Last week (May 11-15), prices for precious metals spiked higher. In just a week, gold gained 2.7% and silver climbed by 6.5%. But don’t think that you missed your chance. The recent gains are likely to be just the start of a strong run-up in precious metals value. The macro-economic factors now coming to the front will be strong demand drivers for gold and silver.

The uncertainty from economic crises has always triggered investor interest in gold and silver. Here is a rundown of the factors pushing precious metals higher this time around:

Crude oil crashed, the stock markets crashed, interest rates and bonds plummeted towards zero.

When the outlook on these assets becomes more and more uncertain, investors turn to the safe havens of gold and silver.

With people around the world putting their money into precious metal assets, a shortage has developed. A recent article on Yahoo Finance noted that buyers of gold coins were paying an average premium of $135 per ounce. The usual premium is around 2%, or $35.

On Friday, this note was included in the weekly recap from on precious metals dealer: “OneGold is temporarily suspending the future sales of VaultChain Silver. Due to the global pandemic and the shutting down of many mines and refineries, the demand for physical silver is currently exceeding the available supply.” There is a growing imbalance between supply and demand, with demand outpacing the available gold and silver products.

The massive amount of dollar creation by the Fed will be the final push to drive gold higher. The Fed’s asset-buying program and the U.S. government’s CARES Act have added close to $10 trillion of liquidity into the economy. That massive amount of new money sloshing around in the economy should lead to inflation and a devaluation of the U.S. dollar against other currencies. Both of these outcomes are positive for the price of gold.

The case is clear that you need some precious metals exposure in your investment portfolio. There is a strong case that gold and silver investments should be over-weighted, and there are different ways to invest in participating as gold and silver prices move higher. This quote is from a recent issue of Grant’s Interest Rate Observer newsletter:

“As for gold-mining shares, John Hathaway, co-portfolio manager of the $1 billion-plus Sprott Gold Equity Fund, reports that interest is exactly nil. The Sprott bullion business is jumping, but not the mining-stock investment business. Blame previous poor performance, he says, or long memories of mine mismanagement around the time of the 2011 gold-price high, or the inherent risks of digging for a vanishingly scarce metal in inhospitable places.

But for whatever set of reasons, he goes on, gold shares, in relation to bullion, are the cheapest they’ve been in his 20 years in the business: “What astonishes me—I’m an old value investor—is that so many companies are generating free cash flow, and it is not hard to find companies with free cash flow yields of 10% or better.”

Here are three gold-related companies you should consider as potential investments:

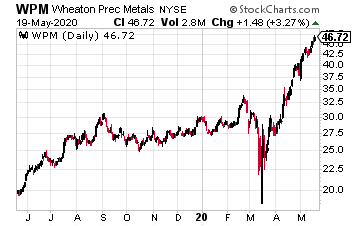

Wheaton Precious Metals Corp (WPM) is one of the world’s largest precious metals streaming companies.

Wheaton Precious Metals Corp (WPM) is one of the world’s largest precious metals streaming companies.

The shares offer investors direct leverage to increasing precious metals prices.

WPM makes agreements to purchase all or a portion of precious metals production from high-quality mines.

The contracts have an upfront payment to help pay mining costs, and then pay a set rate for the metals produced. The purchase prices are set to allow Wheaton to profit from every ounce and leverage increasing metals prices.

WPM pays a current $0.10 per share dividend for a 1.0% current yield.

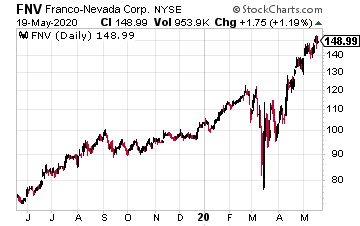

Franco Nevada Corp (FNV) is also a precious metal streaming company. It owns a portfolio of streaming and royalty rights from mines around the world.

Franco Nevada Corp (FNV) is also a precious metal streaming company. It owns a portfolio of streaming and royalty rights from mines around the world.

The current portfolio of assets has a reserve life of 20 years. The FNV dividend has increased for 13 consecutive years.

The current yield is a low 0.67%.

However, investors who purchased FNV shares at the 2007 IPO now have a 6.8% cash yield on their investments.

The share price has climbed tenfold from the $15 IPO price.

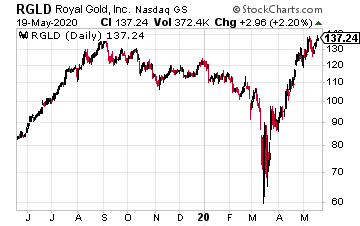

Royal Gold, Inc. (RGLD) is a precious metals company with royalty claims on gold, silver, copper, lead, and zinc at mines in over 20 countries.

Royal Gold, Inc. (RGLD) is a precious metals company with royalty claims on gold, silver, copper, lead, and zinc at mines in over 20 countries.

In 2019 78% of RGLD’s revenue was from gold. The company leverages the price of gold by reinvesting free cash flow into additional royalty contracts.

The RGLD dividend has increased for 19 straight years.

The current yield is 0.85%.

— Tim Plaehn

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Investors Alley