Which Stocks Are Fighting the Bear?

Last week was the second-best week for the Dow Jones Industrial Average in the last 80 years. What makes this fact more impressive is that the best week of the last 80 years was the two weeks prior that!

The stock market is rallying on hopes that the spread of COVID-19 is starting to fade. It appears in some states that the curve is finally flattening. I don’t want us to get ahead of ourselves. We know there’s a long way to go and President Trump has acknowledged right now will be a painful time.

The social distancing recommendations and restrictions are certainly difficult, but proving to be effective.

The President has even suggested the economy could reopen by May 1, although many experts believe that might be too optimistic.

It’s odd to see the market jump even when the economic news appears to be so dire. Millions have lost their jobs. But hopefully, the economy can reopen soon, and these Americans can get back to work.

Eight Stocks Performing Well Through the National Lockdown

The stock market has experienced a massive selloff. In one month, the S&P 500 lost one-third of its value. The index saw some of its heaviest selling in decades. However, that’s looking at the index as a whole.

Beneath the surface, some stocks have been doing just fine. This week, I’m going to highlight eight stocks for you that, if not exactly beating the bear, have been at least resisting it quite well. Many of these eight are due to report their first-quarter earnings soon.

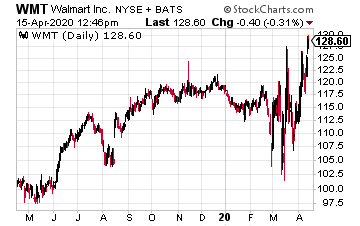

Let’s start with Walmart (WMT), the largest retailer in the world.

Let’s start with Walmart (WMT), the largest retailer in the world.

Walmart has been an invaluable resource for consumers during the shutdown.

The stores have reduced hours and implemented rules on how many shoppers can be in a store.

Still, customers are lining up each morning to get in.

Fans of WMT know that the stock is less a retail company than a massive inventory management operation. Few businesses (or even governments) have the reach and influence of Walmart.

As a result, WMT’s stock has held up much better than the rest of the market. In fact, shares of Walmart came close to breaking out to a new 52-week high last week. Look for another impressive earnings report in early May.

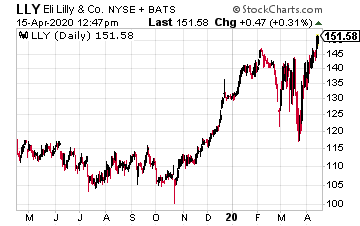

Next up is Eli Lilly (LLY). Lilly is another stock that’s been leading the charge against COVID-19.

Next up is Eli Lilly (LLY). Lilly is another stock that’s been leading the charge against COVID-19.

The drug maker has already started clinical testing for therapies to treat COVID-19, and wants to start testing a cure by this summer.

LLY also capped the out-of-pocket costs for Insulin at $35 per share in order to help diabetes patients who are suffering financial strains.

That’s smart business. Earnings are due out on April 23. Wall Street expects earnings of $1.06 per share.

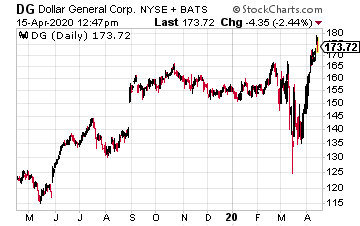

Dollar General (DG) has been very popular in socially distant America.

Dollar General (DG) has been very popular in socially distant America.

The company has limited its hours and, like Walmart, has instituted a seniors-only shopping period.

Business is booming.

The store recently said it will hire 50,000 employees by the end of April, and shares recently hit a new 52- week high.

Recently, DG reported its thirtieth year in a row of same-store sales growth. Crucially, many DG stores are in rural America, and 75% of Americans live within seven miles of a Dollar General. This is a great example of a store that’s helping vulnerable Americans get through a difficult time. Look for the next earnings report sometime around Memorial Day.

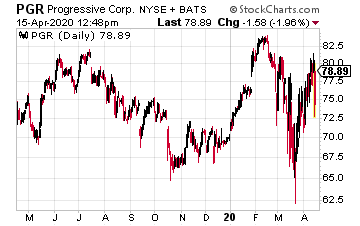

The ever-perky Flo at Progressive (PGR) is also chipping in.

The ever-perky Flo at Progressive (PGR) is also chipping in.

The auto insurance stock said active personal auto policies will get a 20% discount for April and May.

The company will also waive its late fees through May 15.

This not only helps PGR’s customers but it’s good business and it helps brand loyalty. Consumers will remember this. Not even a global pandemic can muss Flo’s hair. Shares of PGR are up nicely this year. Earnings are due out on April 15.

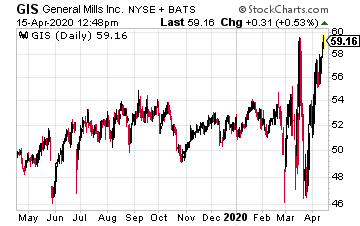

Thanks to the global shutdown, lots of industries have been devastated, but it appears that Betty Crocker is surviving the quarantine just fine, thank you very much.

Thanks to the global shutdown, lots of industries have been devastated, but it appears that Betty Crocker is surviving the quarantine just fine, thank you very much.

The same came be said for Cheerios, Yoplait, Lucky Charms and Haagen-Dazs, all General Mills (GIS) brands.

GIS which is holding up very well, is a great example of a defensive stock, meaning its business isn’t heavily tied to the business cycle.

Folks will buy Cheerios in good times and bad. If anything, some consumers ave steered toward comfort food. General Mills won’t report until late June, but Wall Street expects earnings to rise from 83 cents per share to 96 cents per share.

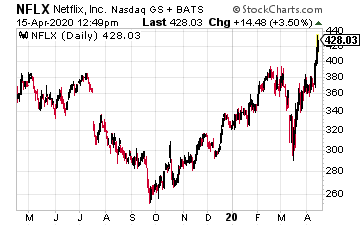

With so many people at home, the phrase Netflix (NFLX) has a new meaning.

With so many people at home, the phrase Netflix (NFLX) has a new meaning.

When folks can’t go to the movies anymore, the streaming service offers a great escape.

Plus, the company has an impressive array of content.

In two weeks, from March 2 to March 16, shares of NLFX plunged 22%.

Since then, the stock has snapped back nicely. In fact, Netflix is another stock that’s closing in on a new high. If we’re all going to be stuck inside, we might as well watch Tiger King. The company’s first-quarter earnings report is due out on April 21.

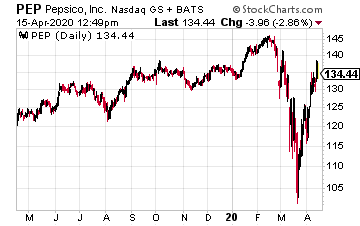

Pepsi (PEP) is another good example of a defensive stock that won’t merely survive but thrive in these difficult times.

Pepsi (PEP) is another good example of a defensive stock that won’t merely survive but thrive in these difficult times.

Remember that Pepsi is a lot more than soda: the company also owns Frito-Lay, Gatorade, and Tropicana.

Pepsi recently said it will hire 6,000 full-time workers and provide enhanced benefits to U.S. workers.

I also like that PEP is moving to stay ahead of its competition. Last month, the company announced it is buying Rockstar Energy for $3.85 billion. I’m expecting another strong earnings report on April 28.

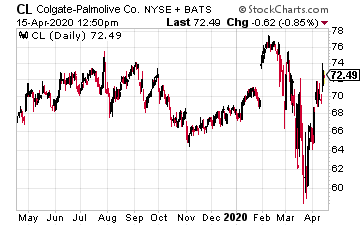

Colgate-Palmolive (CL): My #1 Pick of the Eight

Last but not least is my #1 pick of the bunch, Colgate-Palmolive (CL).

Last but not least is my #1 pick of the bunch, Colgate-Palmolive (CL).

Many investors are too quick to dismiss “boring” investments.

I admit that a toothpaste company may not sound like a big winner, but the facts say otherwise.

Of course, CL is a lot more than toothpaste.

The company owns an impressive stable of household brands.

Since the stock’s low 45 years ago, the shares have gained an amazing 240-fold. If you include dividends, then Colgate is up more than 840-fold, an average annualized gain of 16%.

In response to the COVID-19, CL said it’s going to give 25 million bars of soap to health organizations, plus $25 million worth of other hygiene products.

Colgate-Palmolive has also increased its dividend ever year for 58 straight years. Plus, the current yield is just over 2.5%—is a pretty good deal, especially in an era of 0% interest rates. Look for earnings on Friday, April 17.

— Eddy Elfenbein

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Investors Alley