I’ve been a huge fan of Amazon.com Inc. (NasdaqGS:AMZN) for years.

Now, I’m changing my tune.

Financial heresy?

Quite possibly.

Nor does it change the fact that doing so means entirely new risks for investors who are blindly assuming the stock will go higher as the coronavirus rages on.

Let’s talk about what’s next and which company may be a better buy.

It’s hated, a laggard and, yet, could help you line up some jaw-dropping profit potential.

Here’s what you need to know

Like millions of people around the world and right here in America, my family and I are locked down in Washington State to help prevent the coronavirus from spreading.

We’ve turned to Amazon.com Inc. (NasdaqGS:AMZN) for much of our shopping.

For the most part, we’ve gotten almost everything we’ve needed delivered right to our door. I hate standing in grocery story lines anyway, so this is great as far as I’m concerned, social distancing or not.

My wife, though, has a different take.

She’s noticed that certain items – like toilet paper, sanitizers, and basic pantry items are now made of “unobtainium.” Not only have they been removed from Amazon’s pages, but I’m hearing stories about price gouging, duplicate deliveries, missed dates, order screw ups and more.

Seems to me that Amazon has some serious chinks in its armor.

Team Bezos announced earlier this week that it’s actually closing the doors to new online grocery customers to ensure that the company can meet demand for existing customers. Anybody who wants in has to join a waiting list that’s probably a few weeks long just to be able to shop.

Amazon’s also limited shopping times at some Whole Foods locations so that staff can be diverted to online fulfillment and has reportedly withdrawn next-day delivery for non-essential items in several markets.

France, on a related note, has ordered Amazon to limit French delivery to essential goods only within 24 hours as the coronavirus rages. According to French employees and as reported by CNBC, this means Amazon will have to refrain from packing the video games, craft kits, and – yes – sex toys they were selling.

And, last but not least, the company kyboshed Amazon Shipping while also reportedly delaying Amazon’s Prime Day 2020 until August or later from a more usual July-based event.

I’m also hearing widespread reports that people who have had orders rescinded or duplicates delivered even though they’ve cancelled orders, multiples of the same thing or even totally unrelated products arriving on their doorstep.

I have to believe this is going to pressure Amazon’s bottom line at some point even as it pressures thousands of smaller businesses that rely on Amazon to pick, pack and ship inventory.

It’s officially time to worry.

Amazon’s sharp run higher has been on increasingly thin volume recently. That’s a technical sign the rally is weakening because dang near everybody who wants to buy has already bought.

At the same time, recent economic data is even worse that Wall Street initially feared. March retail sales dropped 8.7% while NY regional manufacturing states dropped a 78.2% to an all time low.

Chris Rupkey, chief financial economist at MUFG Union Bank put it succinctly to CNBC saying that the “economy is clearly in ruins.”

I agree.

That’s why I see Amazon’s retail death grip weakening. Consumer spending has fallen off a cliff and spending habits once associated with vast swathes of our economic engine have vanished.

Both Walmart Inc. (NYSE:WMT) and Target Corp. (NYSE:TGT) have proven they can, in fact, compete – something many long believed to be impossible.

That’s significant because one of the key arguments bullish investors have made when considering Amazon’s stock is that the company can be profitable “whenever it wants” – like good numbers are simply a magic pen away.

Amazon’s cloud services – AWS, for short – has played a huge role when it comes to reinforcing that perception. But I don’t see that holding for long with Microsoft’s Azure in the hunt. Losing the Pentagon “Jedi” contract was a big red warning flag to my way of thinking.

So now what?

I think taking profits is in order if you hold Amazon stock like many investors.

Shares have gone parabolic in recent trading shooting 41.20% from a $1,626.03 to $2,295.90 where it’s trading as I type. The widespread assumption “everybody” has is that it’ll go higher which is practically a guarantee that it won’t.

The easiest way to do that is to sell a few shares on rallies like the present via a Total Wealth Tactic like Trailing Stops. More sophisticated options-savvy investors may also want to consider selling calls to “guarantee” an exit at a predetermined and presumably higher strike price.

Folks with a more speculative edge and nerves of steel could also consider selling calls or even buying put options, both of which are bearish strategies applicable at the moment.

Consider purchasing Alibaba Group Holding Ltd. (NYSE:BABA) with the proceeds.

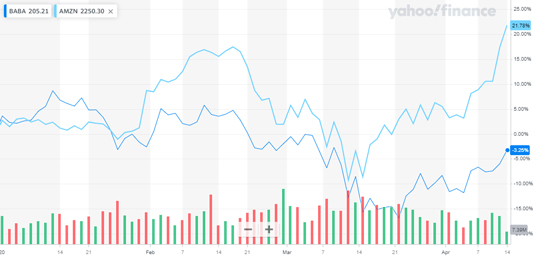

Amazon’s risen 17.37% this year while Alibaba’s dropped -3.19%, which suggests there’s a pure “price play” to be had as China recovers and investors realize that’s the case.

There’s clearly a lot of animosity towards China and, speaking personally, that’s something I share because of the worldwide chaos they’ve caused.

Professionally, however, I don’t have that luxury. My job as Chief Investment Strategist is to help you find great investments and share those opportunities with you when I see ’em.

I think Wall Street is underestimating Alibaba’s resilience at the same time that it’s overestimating Amazon’s ability to continue higher.

The chart supports that clearly.

Psychologically, this makes sense.

Alibaba’s Q1/2020 and Q2/2020 numbers are probably going to stink but those are based largely on coronavirus fears and the expected negative impact within China.

Looking beyond that, however, a different picture emerges.

I think that the stock will pop when savvy investors look beyond currently depressed travel, retail and restaurant data and see unimaginably strong numbers from all things digital including video, streaming, communication and more.

Buying shares while “nobody” thinks the company will recover may just be the perfect coronavirus turnaround.

Until next time,

— Keith

Experts are predicting that in as little as three months, AI as we know it could be totally blown away. And that means as early as October 8, ChatGPT could be replaced by a new AI that's thousands of times more powerful... something that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double - maybe even triple - in price in the months ahead. Click here for all the details.

Source: Total Wealth