In September 2011, the world changed. The acts of terrorism in New York, Washington, and Pennsylvania not only destroyed buildings and lives, but changed both what and how we do a number of activities. The way we travel—with the birth of the TSA and the explosive detectors we pass through before boarding an airplane—is one of the clearest examples.

In February 2020, the world changed again. Since then, the novel coronavirus has not only damaged our economy and destroyed lives, but it already changed how we do a number of activities, and will do so for years to come.

Those of you who know me also know I’m not a doom and gloom investor.

I am continually impressed by how we adjust and adapt to whatever is thrown at us.

While we grumble and complain about long TSA lines, we all know why it takes more time to get on an airplane, and why we can’t go back to the old way of doing things.

In a post-COVID-19 world there will be inconveniences that we’ll adjust to, just as we always do. And as investors, there will be opportunities in companies that are called upon to be the new, more visible front lines in our battle against infectious disease.

Many of these companies are being highlighted now as we seek treatments and a vaccine for coronavirus. They are the pharmaceutical, biotechnology, and diagnostic companies that are developing faster and innovative ways to develop a solution for our current crisis.

I believe these companies will have a more visible presence in our daily lives for years to come. And I also believe the government and commercial businesses alike will invest substantially in them.

Here are a few of the companies we are all becoming familiar with, as COVID-19 reshapes our daily lives. These may be the best growth stocks to buy now in our fight against the disease.

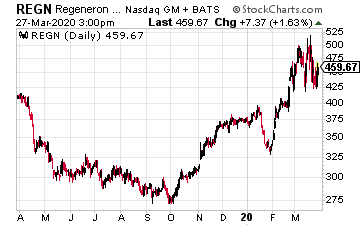

Regeneron Pharmaceuticals (REGN) has been front and center in the fight against the novel coronavirus. The pharmaceutical company, led by CEO Leonard Schleifer, has even been mentioned several times by President Trump as one of the companies working to develop a vaccine.

Regeneron has been in the fight against dangerous diseases for more than 30 years.

Regeneron has been in the fight against dangerous diseases for more than 30 years.

The company famously developed a treatment for Ebola, following an outbreak of the disease in 2014.

Perhaps the most impressive part of Regeneron’s Ebola treatment development, and what many are hoping is a similar outcome with COVID-19, was the speed with which the company developed its treatment.

Speed, and the proprietary process by which the company identifies and develops vaccines, is a major advantage for Regeneron.

The company earned $7.50 per share in the latest quarter, which was a year-over-year increase of almost 9%. Revenue totaled $2.17 billion, a 13% year-over-year increase. The stock has traded higher in light of its coronavirus work, but still sports a PE of just over 24.

Gilead Sciences (GILD) is another drug development biotechnology company that has been developing successful drugs for deadly diseases for years.

Gilead Sciences (GILD) is another drug development biotechnology company that has been developing successful drugs for deadly diseases for years.

The company previously focused on drugs for HIV, hepatitis, and influenza.

Giliead has ratcheted up both studies and production of its experimental drug remdesivir, which has been touted as a potential treatment for coronavirus.

“The speed with which remdesivir has moved into clinical development for this coronavirus reflects the pressing need for treatment options…” Merdad Parsey, MD, PhD, Gilead Chief Medical Officer, recently stated.

Gilead earned $5.9 billion in its latest quarter, an increase of $0.1 billion year-over-year. HIV product sales made up $4.6 billion of that revenue, with hepatitis C treatments comprising another $630 million.

If the company’s remdesivir proves out as a viable treatment for coronavirus, it could add a significant new revenue stream for Gilead.

One of the tools in the fight against infectious diseases that has now become ingrained in our everyday nomenclature is “testing.”

One of the tools in the fight against infectious diseases that has now become ingrained in our everyday nomenclature is “testing.”

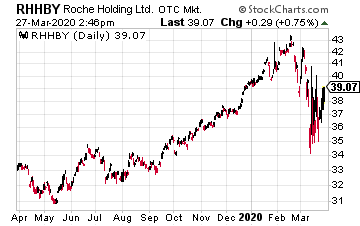

Roche Holdings (RHHBY) has been working closely with the FDA to develop faster tests for coronavirus.

Just last week before the floor was closed, traders at the New York Stock Exchange were greeted by healthcare workers taking their temperature before they could enter their workplace.

In the same way that post-9/11 rules had us all removing our shoes before boarding an airplane, it is not inconceivable that post coronavirus lockdown, we could find ourselves being tested before entering work or paid events. The company that develops the best and fastest test will surely profit greatly.

Not only is Roche developing new tests for COVID-19, but it is also testing some of its already developed drugs, such as one for arthritis, which may be beneficial in the treatment of coronavirus.

Roche revenue increased 9% in full year 2019 versus 2018. The company grew its diagnostic (testing) business 3% and its pharmaceuticals business 11%. If my assumptions are correct, diagnostics may become a much larger driver of revenue going forward.

I have no doubt we’ll get through COVID-19. We are a resilient, innovative, and adaptable country. But, as with our experiences post-9/11, I also know the world is changing. And, with that change comes new challenges, and new opportunities.

— Eddy Elfenbein

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Investors Alley