Let’s be honest: it’s hard not to be rattled by last week’s double-digit drop in the S&P 500.

And it’s true that if the coronavirus continues to spread, we could see more people holed up in their homes, meaning less spending and less economic activity.

But let’s not forget that American economic data looks very good right now.

The Federal Reserve sees GDP rising a healthy 2.6% in the first quarter of 2020, even accounting for the coronavirus’s impacts.

Personal incomes and spending are also rising at healthy levels, so there’s no reason to panic.

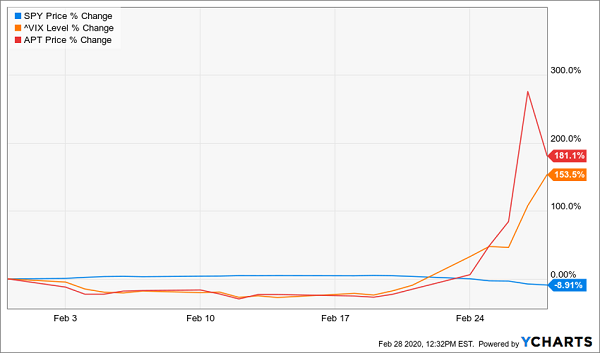

Even so, this is what the markets were doing as of the end of February.

Markets Lose Their Minds

With the S&P 500 (in blue) down 9% from the start of February to the end, the volatility index (VIX), in orange, soared over 153% in the same period. Since the VIX, usually called the “fear indicator,” measures how much downward pressure the market expects, this is significant. And the 181% surge in shares of face-mask maker Alpha Pro Tech (APT), in red above, tells us all we need to know: this market movement is about one thing.

History Gives a Hint of What to Expect

This sell-off is largely due to uncertainty. Simply put, no one knows how long this outbreak will last or what its effects will be. As a result, markets are pricing in the absolute worst.

But history tells us that the likelihood of this being the absolute worst is low; odds are, we’ll see something like the SARS outbreak, which caused markets to dip in March 2003, shortly after the virus began to spread. Look what happened then:

Markets Bounced Back From the Last Outbreak

This is most likely the future we’re looking at when it comes to this virus-driven selloff.

The Income Option

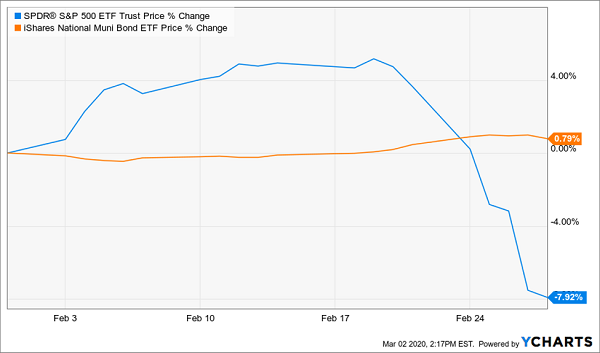

Still, more volatility is likely the order of the day, and that’s why holding several asset classes is key. As you can tell from the chart below, investing in municipal bonds, issued by states and cities to fund infrastructure projects, can ease the pain of facing unrealized losses in stocks during a panic like we’re in now. (Municipal bonds, or “munis,” are tracked by the iShares National Muni Bond ETF (MUB), in orange below.)

Diversifying to Avoid Big Losses

While SPY was down for February due to the virus, MUB was actually up slightly. This makes sense, because there’s little connection between the Chinese supply chain and the creditworthiness of municipal bonds in the US.

Plus, there’s an argument that a “flight to safety” move is driving investors to munis during this selloff. That also makes sense, because munis tend to be less volatile (note the smooth orange line versus the roller-coaster blue above) than stocks, and also because they pay better dividends: MUB’s 2.2% yield is a touch better than SPY’s 1.9%.

But 2.4% is still pretty crummy. Closed-end funds (CEFs) can do better. Much better.

Right now, for example, there are 83 muni CEFs trading at discounts of 5% or more, and 39 of them yield more than 4%. And better still, these funds’ dividends are tax-free for most Americans.

One fund to put on your list is the Putnam Municipal Opportunities Fund (PMO), which pays a 4.9% yield (over double that of MUB), which could translate into a lot more for you, depending on what tax bracket you’re in. In addition, PMO trades at a 7.6% discount to net asset value (NAV), versus zero discount with MUB. PMO holds the same kind of muni bonds MUB does, but with one big difference: the CEF makes investors more money.

Crushing the Index

With over double the return since its inception, PMO is easily beating MUB while giving investors a bigger income stream. Yet it still trades for less than its assets are worth!

The bottom line? If you’re looking for stability in this coronavirus panic, consider adding muni CEFs, like PMO, that give you a big, often tax-free, yield and reduce your portfolio’s volatility, too.

— Michael Foster

4 “Buffett-Friendly” 8.4% Dividends to Buy in the Coronavirus Panic [sponsor]

“Be fearful when others are greedy and greedy when others are fearful.”

It’s a timeless quote from the best investor of all time: Warren Buffett.

Here’s the problem, though: it’s tough for the average person to do. When the market is in full collapse, you and I both know it takes a very strong stomach to run against the herd and hit the “buy” button.

Luckily, there’s a way we can make this proven contrarian move a lot easier. It comes in the form of 4 other closed-end funds I want to show you now. They give us two critical reassurances as our mouse hovers over that “buy” button in our brokerage accounts:

- Massive 8.4% dividends. That’s more than the stock market has historically returned on an annualized basis, coming our way in dividends alone! And the more of our return we get in safe cash, the better protected we are from a collapse—and the better we can sleep at night.

- Huge (and totally unusual) discounts. It only makes sense: if a fund is dirt cheap now, it’s hard for it to get a lot cheaper in a meltdown! That gives you more reassurance that these funds won’t fall as far as the market in a crash, and are perfectly positioned to bounce back faster in the inevitable rebound.

Full details on these 4 “Buffett-friendly” CEFs are waiting for you now—and this is the perfect time to buy them. Click here for full details on these funds: names, tickers, complete dividend histories and everything else I have on them—all condensed into a single, quick-to-read report.

Source: Contrarian Outlook