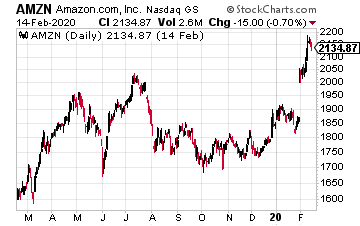

I don’t know how you could have missed it, but in case you did, Amazon (AMZN) blew earnings out of the water recently, with the stock busting through all-time highs.

While cloud services revenues, the ones you see commercials for constantly as “AWS,” were stellar, so were Amazon’s e-commerce numbers.

But, what if you want to participate in the booming e-commerce sector, but don’t want to buy a $2,000 stock and push Mr. Bezos’ net worth even higher?

I think there is a better way.

And, it captures not only e-commerce but any transaction that can be done in digital form.

According to a recent McKinsey and Company report, global revenue from payments, combining retail and corporate, stands right at $2 trillion.

And, while revenue growth is somewhat lumpy, depending on the country you’re in, the global average is 6% annually.

FinTech and large financial institutions have been transforming the payments landscape, providing faster, more secure, and increasingly mobile payment options. And as the services get better, that means more and more digital payments and a lot of money for payment companies.

Here are a few of the ones I see benefitting from the payments boom.

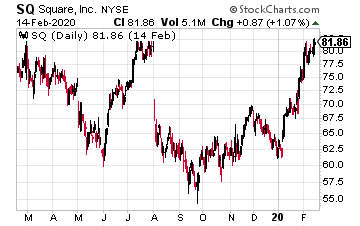

Square (SQ) has been around for several years and is becoming pretty commonplace in the restaurants and retail establishments I frequent. They have a touch screen cash register that lets you sign right on the screen used by the cashier.

The stock has pulled back from the $100 level, which it grazed briefly in 2018, and trades around $80 today.

Square took in $1.27 billion in revenue in Q3, a 44% quarter-over-quarter increase while increasing year-over-year payment volume by 25%.

One of the most exciting things going on at Square is the Cash App. This is an app that lets individuals send and spend money. But, they have just added functionality for the app to let investors buy fractional shares of stock, another booming investment area. For Q3, Cash App revenue was up 115% year-over-year.

The Cash App shows me that Square is not just resting on its laurels with its retail payment system and that the company continues to be at the forefront of innovation.

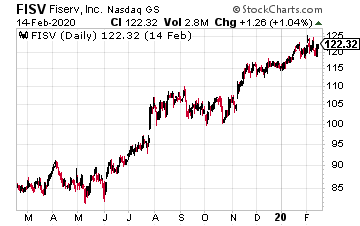

Another company that has been a long time favorite that has added a digital payment service to its wide range of offerings is Fiserv (FISV).

The company has been executing its business plan for years now and has introduced its new Digital Payments SDK offering, which allows businesses to customize the user experience to their needs.

We’re talking about a company that reported last year they moved over $75 trillion in digital payments.

We’re talking about a company that reported last year they moved over $75 trillion in digital payments.

So, I think they have a handle on the payments market.

In the latest quarter, Fiserv reported a 5% growth in their Payment segment, even as their Financial segment business declined slightly. The company is projecting an organic revenue growth of 6% to 8% for 2020.

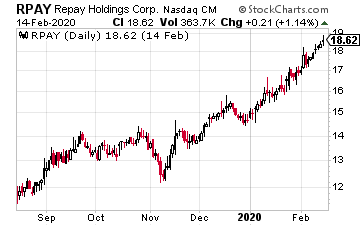

Switching gears from a large company with years of growth, let’s look at a much smaller company that came public just last year. Repay Holdings (RPAY) came public in July 2019 and has seen its stock on an upward trajectory ever since.

Repay has solid digital payment offerings in the consumer finance sector.

I find it interesting that they have chosen to target independent automobile dealers.

I like the strategy of going after very defined markets.

This should allow them to tailor their offerings and compete with larger rivals.

In Q3, Repay reported an increase in payment volume of 40% to $2.6 billion over Q3 2018. This was combined with a revenue increase of 27% and an earnings increase of 29%, to $11.9 million.

The company has made three quick acquisitions, with the most recent being a just-announced purchase of Ventanex. Ventanex operates in consumer finance, a segment Repay is already in, and the B2B healthcare sector.

Again, the company appears to be focusing on a very specific sector, which should allow them to create a specifically crafted offering that will be compelling to that customer.

I think you could consider any one of these three growth companies as nice portfolio additions.

— Eddy Elfenbein

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Investors Alley