With coronavirus spreading and China’s economy being shut off from the rest of the world, you’re right to ask one (or both) of the following questions:

Is this rally justifiable? Is it still a good time to buy in?

Profits (and Dividends), Not Fear

Here’s the good news: this market is rising on fundamentals, and ignoring overwrought media headlines that will eventually be forgotten.

Those payouts are in a corner of the market too many people never think to check.

Don’t get me wrong: coronavirus is a risk. But, as terrible as it is that thousands of people have been infected, the reality is that this isn’t a significant factor for American companies.

It still could be (and the impact to supply chains is worth watching), but there’s another story that’s having a bigger, and more positive, long-term impact.

I’m talking about earnings.

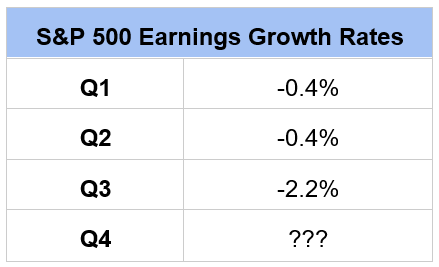

Earnings are a big deal for U.S. stocks because they were poor throughout 2019. For three quarters in a row, profits declined year over year, with the decline worsening in the third quarter.

This was officially an earnings recession, which is why expectations going into the fourth quarter were glum, with analysts expecting earnings to fall 1.5% at the start of the earnings season. Then companies started reporting.

So far, about two-thirds of S&P 500 companies have reported earnings, and the data looks encouraging. Overall, 71% of firms that have reported surprised with better-than-expected bottom lines. Most importantly, they’ve reported earnings growth of 0.7%.

That’s crucial because it means all signs point to us escaping the earnings death spiral analysts worried about in 2019. And although it’s 2020 now, there’s a reason why last year’s earnings results matter a lot. It has to do with history and timing.

The Forward-Looking Machine

Usually we don’t pay much attention to last year’s earnings when thinking about the stock market. But right now, putting 2019’s results in historical context matters a lot, because it explains why the current rally is justified.

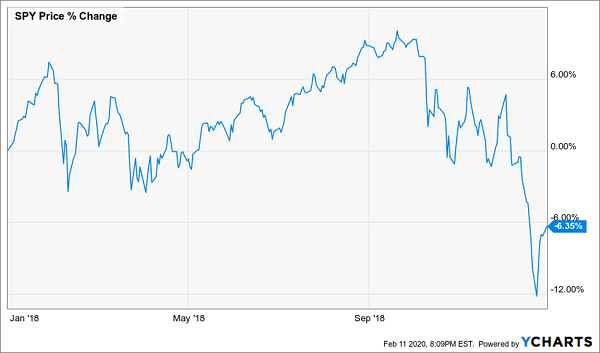

First, let’s look at 2018.

2018 Cost Investors Dearly

As you can see, stocks fell hard in 2018, which was the first year of declines since the Great Recession. What’s more, if you measure from top to trough, stocks technically fell into a bear market.

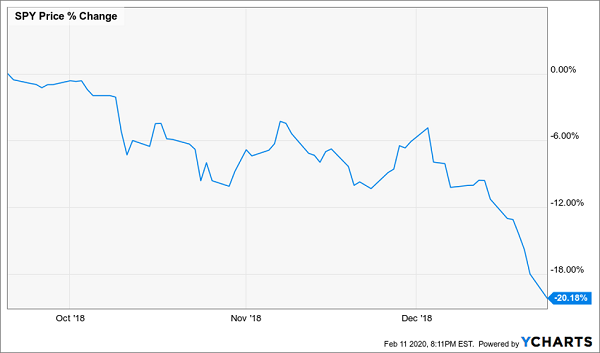

The Bears Come Out of Hibernation

This 20% drop in three months was obviously frightening to many, but now we know it was justified: it was responding to the earnings decline in 2019. That may sound like it’s in reverse, but remember that stocks are forward looking: they don’t price in the earnings of yesterday, but the earnings potential of tomorrow.

From late-2018’s perspective, tomorrow’s earnings potential was poor, so stocks had to fall. And the market was right.

Fast-forward to today and the market is pricing in strong earnings growth that runs counter to the low expectations set by 2019. And fourth-quarter numbers, at least so far, are proving that these stronger profits should be priced in, which is causing the market to rise even further.

The bottom line: this is a healthy bull market, even if few people are willing to say as much.

3 Dividends (7.8%+) That Love a Bull Market

One way to benefit from the market’s surge on high earnings is to get a low-cost index fund, like the Vanguard 500 ETF (VOO). But if you want an income stream, this isn’t the place to find it: VOO yields a puny 1.3%.

But there are alternatives. Like closed-end funds (CEFs), many of which throw off massive yields of 7% and up and hold growing mid-cap and large-cap companies. One that’s worth your attention: the Gabelli Equity Trust (GAB), with its 9.7% yield. GAB holds Mastercard (MA), Rollins (ROL), Berkshire Hathaway (BRK.A) and PepsiCo (PEP), all companies with strong profit growth.

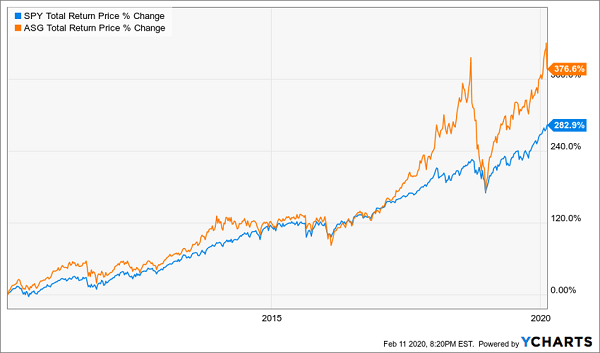

Or you can go with the Liberty All-Star Growth Fund (ASG), which focuses on high-growth firms in tech, like Salesforce.com (CRM) and Equinix (EQIX), and out of tech, like Nike (NKE) and Paylocity (PCTY). ASG is one of the best performers out there, beating the S&P 500 for years and paying a generous 7.8% dividend.

ASG Crushes the Index

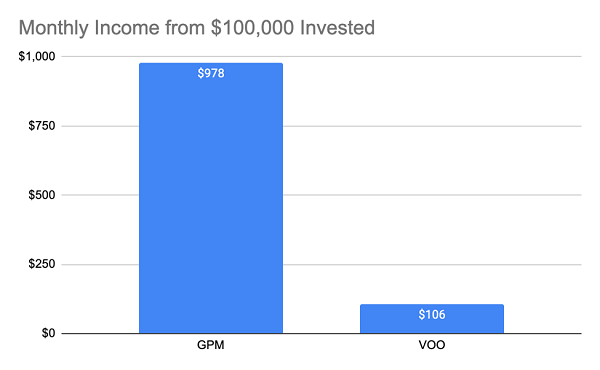

Finally, if you want a truly outsized income stream, the Guggenheim Enhanced Equity Fund (GPM) is a great option. With an 11.7% yield, every $100,000 invested in GPM earns a whopping nine times more monthly income than VOO gives you.

Source: CEF Insider

Source: CEF Insider

Plus, GPM holds strong American companies, like Nike, Equinix, AbbVie (ABBV) and Edison International (EIX), which is how its big returns can fund its big payouts.

These three CEFs are just the start. There are plenty more you can use to get into this bull market and grab a huge dividend stream, too.

— Michael Foster

5 “Bear-Proof” Dividends Paying 8%+ Now [sponsor]

A 7.8%+ dividend is great. Trouble is, these 3 funds are all missing the one critical element.

I’m talking about an underappreciated number called the discount to net asset value (NAV).

Don’t let the jargon trip you up. Suffice it to say, all CEFs trade at either a premium to their NAV—or what their portfolios are worth—or at a discount.

And we always want to buy at a discount—something we won’t get with GPM, GAB or ASG. With those three, we have to rely solely on their portfolios to hand us gains. But when we buy funds trading at a discount, we have another, reliable way to get paid: a narrowing discount, which lifts the share price higher as it vanishes!

That’s why the above 3 funds are worth putting on your watch list now. But for your CEF buy list, you’ll want the 5 other CEFs I want to show you today. They yield 8%, on average, and all 5 trade at big discounts to NAV—so much so that I’m expecting 20%+ price upside from each of them in the next 12 months!

The best thing about these 5 CEFs is that, even if the market tumbles, their wide discounts act like shock absorbers, supporting their prices the entire time. And we’ll still collect their solid 8+ dividends!

Don’t look back a year from now and regret not “kicking the tires” on these 5 cash machines. Click here and I’ll share all the vital details on each one: names, tickers, dividend histories (some even pay you every month!) and my complete research.

Source: Contrarian Outlook