We talk a lot about exciting tech trends, like artificial intelligence (AI), cybersecurity, and 5G, where there’s a lot of investment opportunity. However, if you want to be a disciplined investor, you need the “boring” sectors, too. This way, during bad market selloffs, your overall portfolio is protected.

This is where utilities come in.

You sure aren’t going to hear much about utilities in the media for their ground-breaking products that are going to change the world. But sometimes boring is best, especially given the chaotic start to August.

Case in point: The Technology Select Sector SPDR Fund (XLK), which tracks tech stocks, is down 2.3% since August 1, while the Utilities Select Sector SPDR Fund (XLU), is up 1.2% since August 1. That’s a pretty big difference! And if we look at Friday’s broader market action, while tech stocks (along with the three major indices) sold off, utilities closed up again.

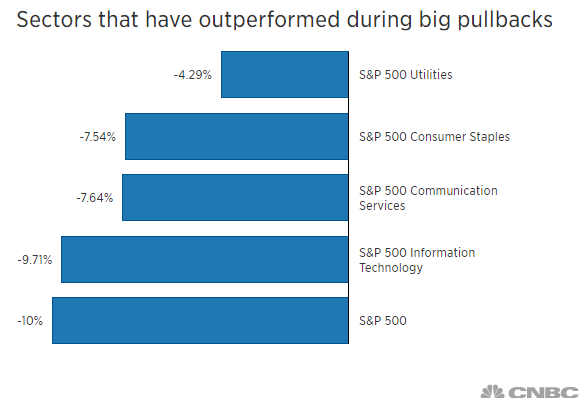

Clearly, there’s a lot of demand for utilities right now. Just take a look at the graph below.

According to CNBC, at times when the S&P 500 Index fell at least 10% in one month during the market’s 11-year bull run, the best-performing sector was the utilities sector.

Better performance and great dividends. Utility stocks aren’t looking so boring now, are they?

The truth of the matter is that not only do utilities provide safe havens during bouts of market volatility, but the ultra-low interest rate environment is great for them, too. Borrowing costs are lower, and they can retire higher cost debt and replace it with lower cost debt. This means any more debt they take on is at a lower cost, which can help boost operating margins.

But not all utilities are created equal, so you need to be careful when you decide to invest in one. As you know, I scour the stock market for the crème de la crème of stocks — and in the utility sector, the one I like is NextEra Energy, Inc. (NYSE:NEE).

NextEra Energy is currently the largest utility company in the world. Through its two electric companies in Florida, a renewable energy business and several subsidiaries, NextEra Energy provides electricity, wind and sun energy, battery storage and nuclear power. The company began operations back in 1925 as the Florida Power & Light Company and operated gas plants, power plants and water facilities, as well as laundry and ice cream businesses.

Its subsidiary, NextEra Energy Resources (NEER), operates on the unregulated side. NEER primarily focuses on the wholesale value of wind and solar energy.

Because Florida is an ideal place to generate wind and solar power, power generation from solar and wind farms is much cheaper to sustain in the long term.

The service area is in the southern half of the state, which happens to be where the population is densest. This will allow for better distribution efficiencies, giving transmission and distribution operations more value.

On July 24, NextEra Energy reported second-quarter earnings of $1.33 billion, or $2.35 per share, which represented 14.6% annual earnings growth. The analyst community was expecting earnings of $2.31 per share, so NEE posted a 1.7% earnings surprise.

A Strong Second-Quarter Report

Looking forward, company management expects full-year fiscal 2019 earnings per share of $8 to $8.50 and 2020 earnings of $8.70 to $9.20. It also maintained its 2021 earnings forecast of $9.40 to $9.95. So, NEE should continue to grow nicely.

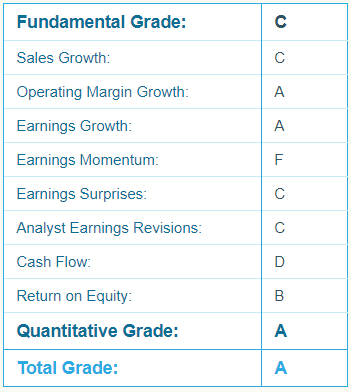

This being the case, it’s no surprise that NEE receives an A-rating in Portfolio Grader. As you can see below, NextEra Energy is achieving excellent earnings growth, as well as operating margin growth. Return on equity is also quite good.

Though its Fundamentals hold a C-rating, what’s really important is that its Quantitative Grade is an “A.” It’s the most powerful variable in my grading stock formula, as it indicates the current level of buying pressure. And based on this week’s past action, folks are still buying. Not only did the stock end the week up 4.1%, but it closed higher despite broader market’s selling on Friday.

This is what I consider a “Bulletproof” stock. It will do well no matter which way the market turns, thanks to its strong Fundamentals, earnings and sales growth. That’s why I recommended it to my Growth Investor subscribers a few years ago, and why it’s sitting pretty with over a 40% return right now. I’m such a fan of it that I’ve made it Top Five Stocks on my Growth Investor Buy List. It also doesn’t hurt that it offers a 2.3% dividend yield. NEE has an ex-dividend date on August 28. The company will pay a quarterly dividend of $1.25 per share on September 16 to all shareholders of record on August 29.

— Louis Navellier

The analyst who was ranked as America's #1 Stock Picker in 2020 by TipRanks details the 40X opportunity behind Apple's "Project Titan." Click Here To Learn More.

Source: Investor Place