AbbVie (ABBV) announced plans to acquire Allergan (ANG) in a deal valued at more than $80 billion, including assumed debt.

As a result of this planned transaction, we are downgrading AbbVie’s Dividend Safety Score from a rating of Safe to Borderline Safe.

A dividend cut still seems unlikely, but the deal will cause AbbVie’s leverage to rise significantly, driving the downgrade.

Management reaffirmed its commitment to the current dividend and plans to deleverage aggressively in the years ahead.

As the company’s balance sheet improves and it demonstrates continued traction with its larger growth platform of drugs to offset future Humira declines, AbbVie’s Dividend Safety Score would likely return to a Safe rating.

Let’s take a closer look at the merits of this deal and how it affects AbbVie’s dividend safety and growth profile.

Why AbbVie Wants to Buy Allergan

Both AbbVie and Allergan had seen their stock prices languish in recent years as investors worried about each firm’s future growth potential.

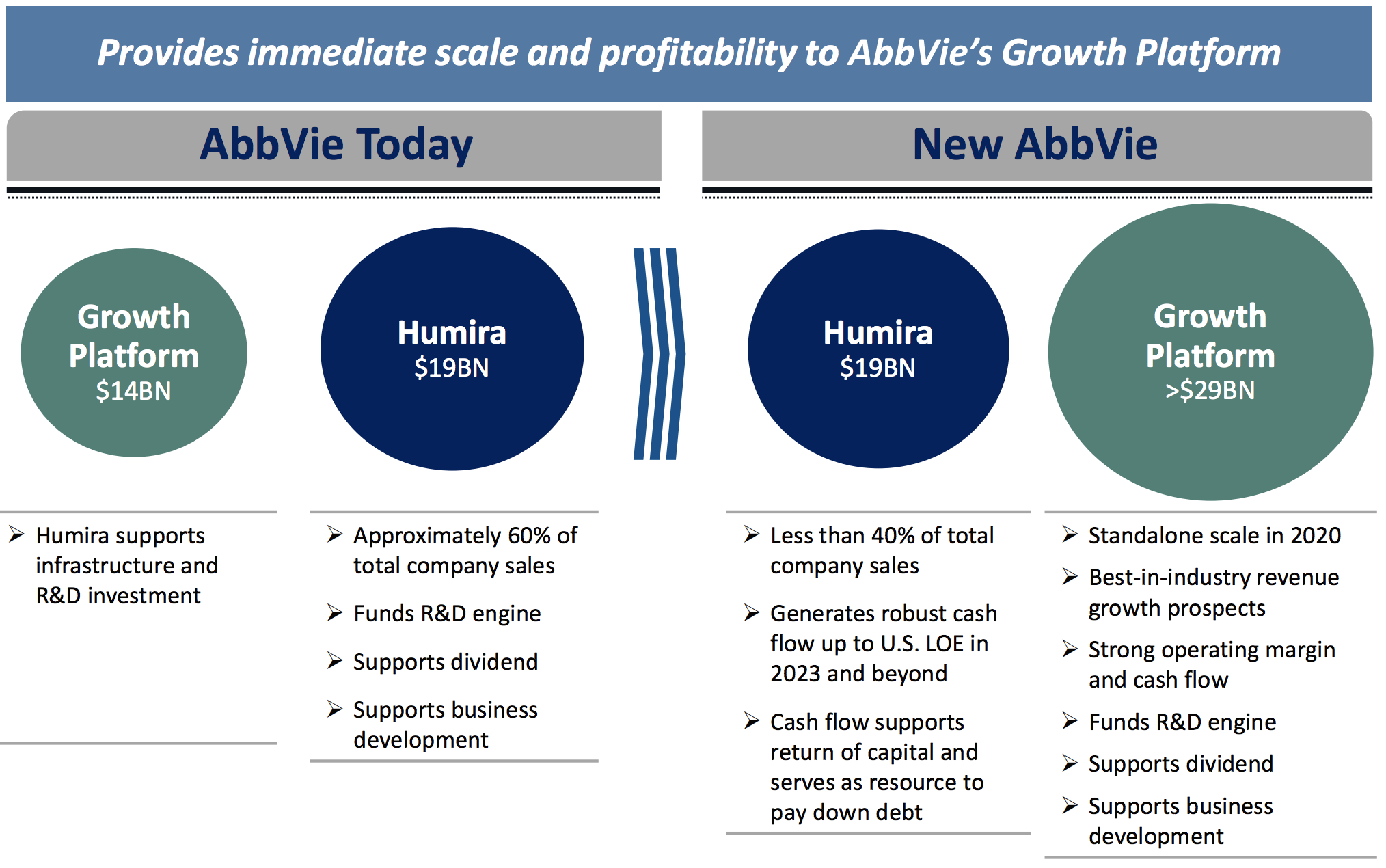

In AbbVie’s case, its concentration in rheumatoid arthritis drug Humira, which accounts for approximately 60% of total company sales and faces loss of exclusivity in the U.S. in 2023, served as an overhang on its stock price.

Meanwhile, Allergan’s reported sales edged lower by 1% in 2018 as divestitures and revenue declines in products losing patent protection offset growth in its medical aesthetics and eye care businesses.

Combining forces has potential to create a larger, more diversified biopharma business that can alleviate investors’ product concentration concerns while also building a more solid foundation for long-term growth.

Hammering this point home, AbbVie labeled its investor presentation, “Creating a New Diversified Biopharmaceutical Company.” As you can see, Humira would fall from 60% of sales today to around 30% to 40% of company-wide sales.

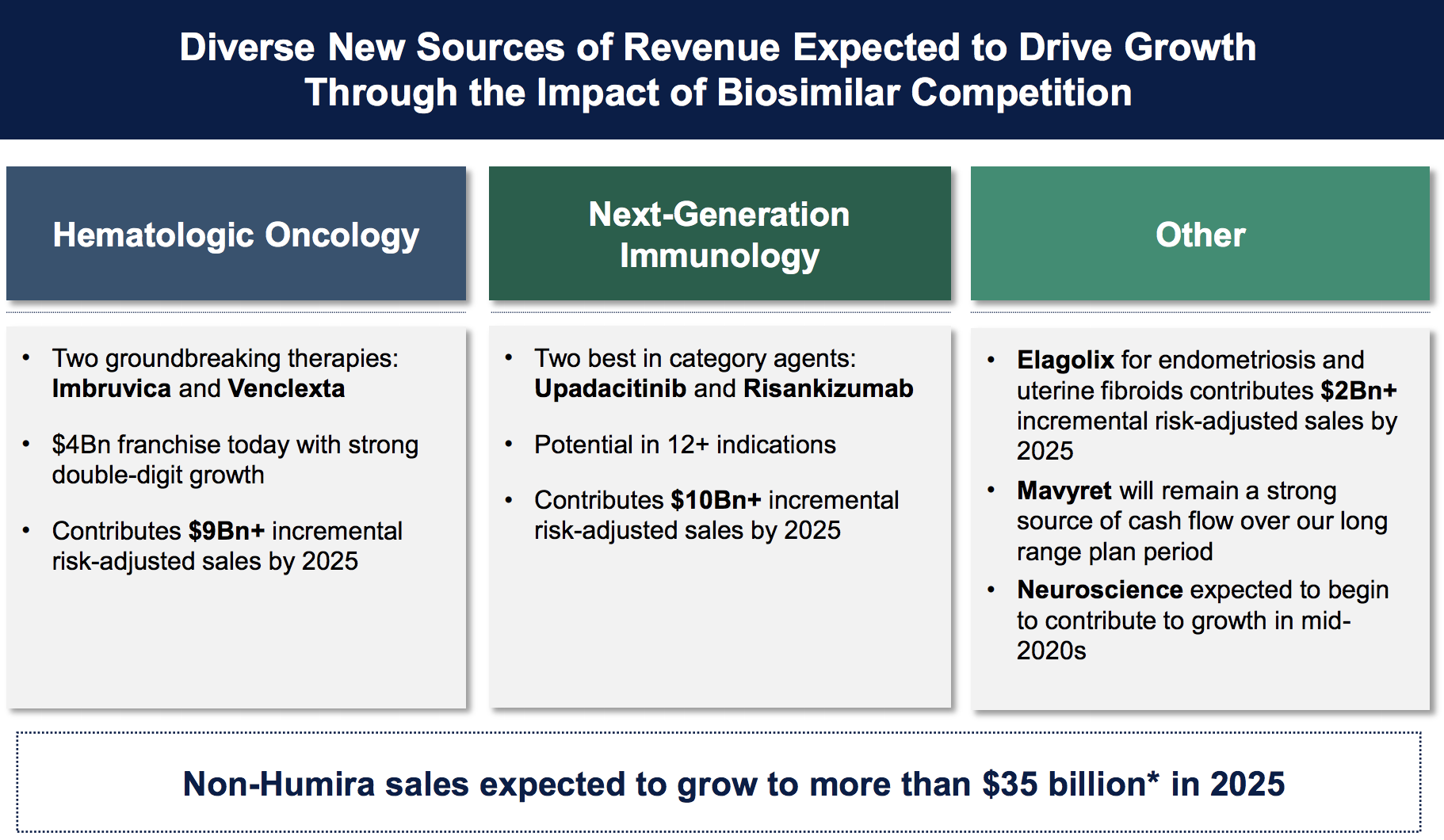

The remainder of the business, called the Growth Platform, would have “standalone scale” with more than $29 billion in annual revenue. AbbVie believes its new growth platform can deliver high-single digit annual revenue growth for the foreseeable future, securing “attractive growth prospects through the next decade under any U.S. Humira erosion scenario.”

Source: AbbVie Investor Presentation

Source: AbbVie Investor Presentation

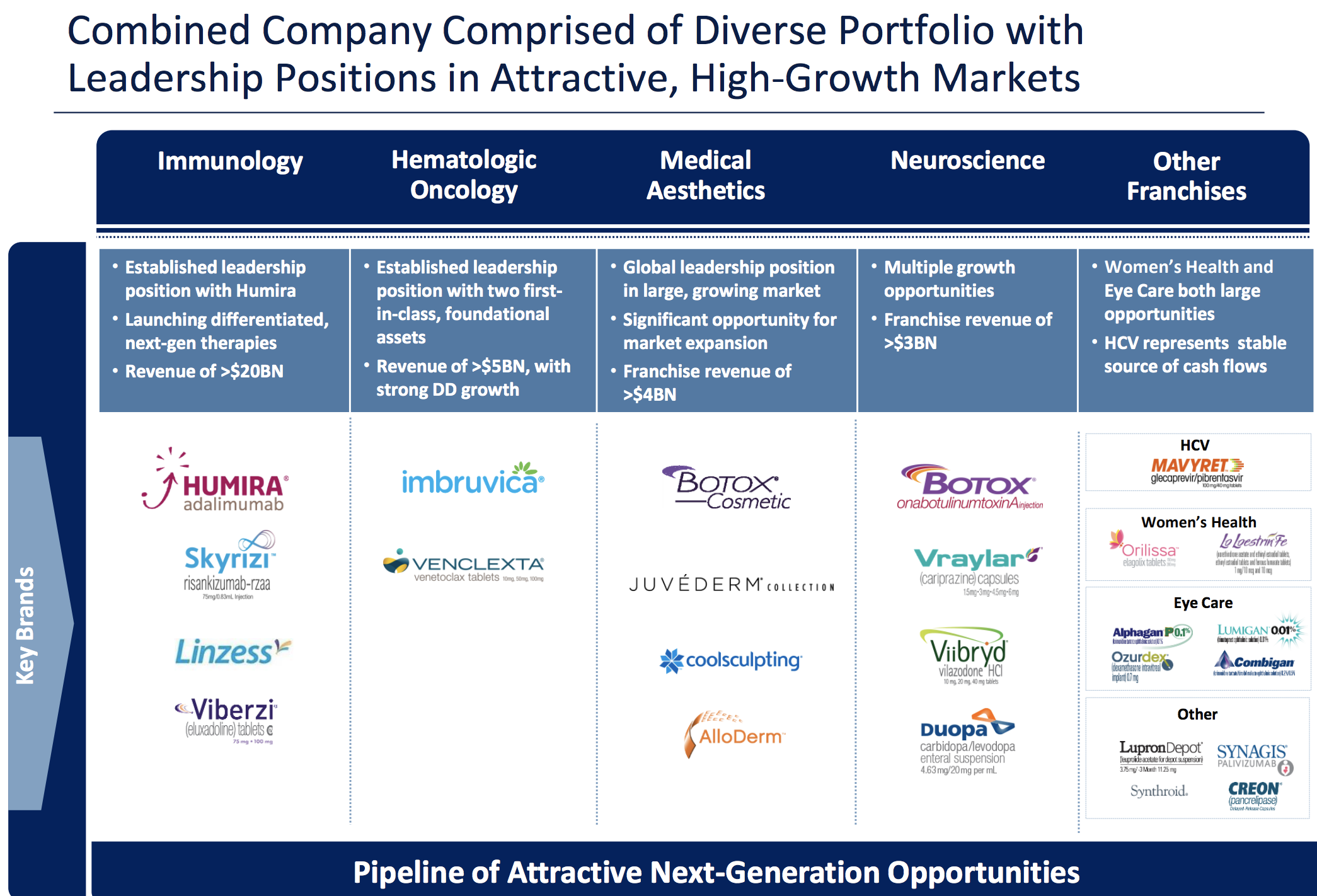

Following the combination, the new AbbVie will generate about $49 billion in annual revenue, making it the fourth largest pharma company by sales. The drugmaker will have No. 1 or No. 2 market positions in immunology, hematologic oncology, medical aesthetics, and global HCV, along with leadership positions in women’s health and eye care.

Source: AbbVie Investor Presentation

Source: AbbVie Investor Presentation

As Standard & Poor’s notes, the new AbbVie’s top three products will account for 56% of pro forma 2018 revenue, down from 82% in 2018 for AbbVie alone. In other words, management is taking a step forward to reduce the firm’s dependence on Humira through the rapid expansion of non-Humira businesses.

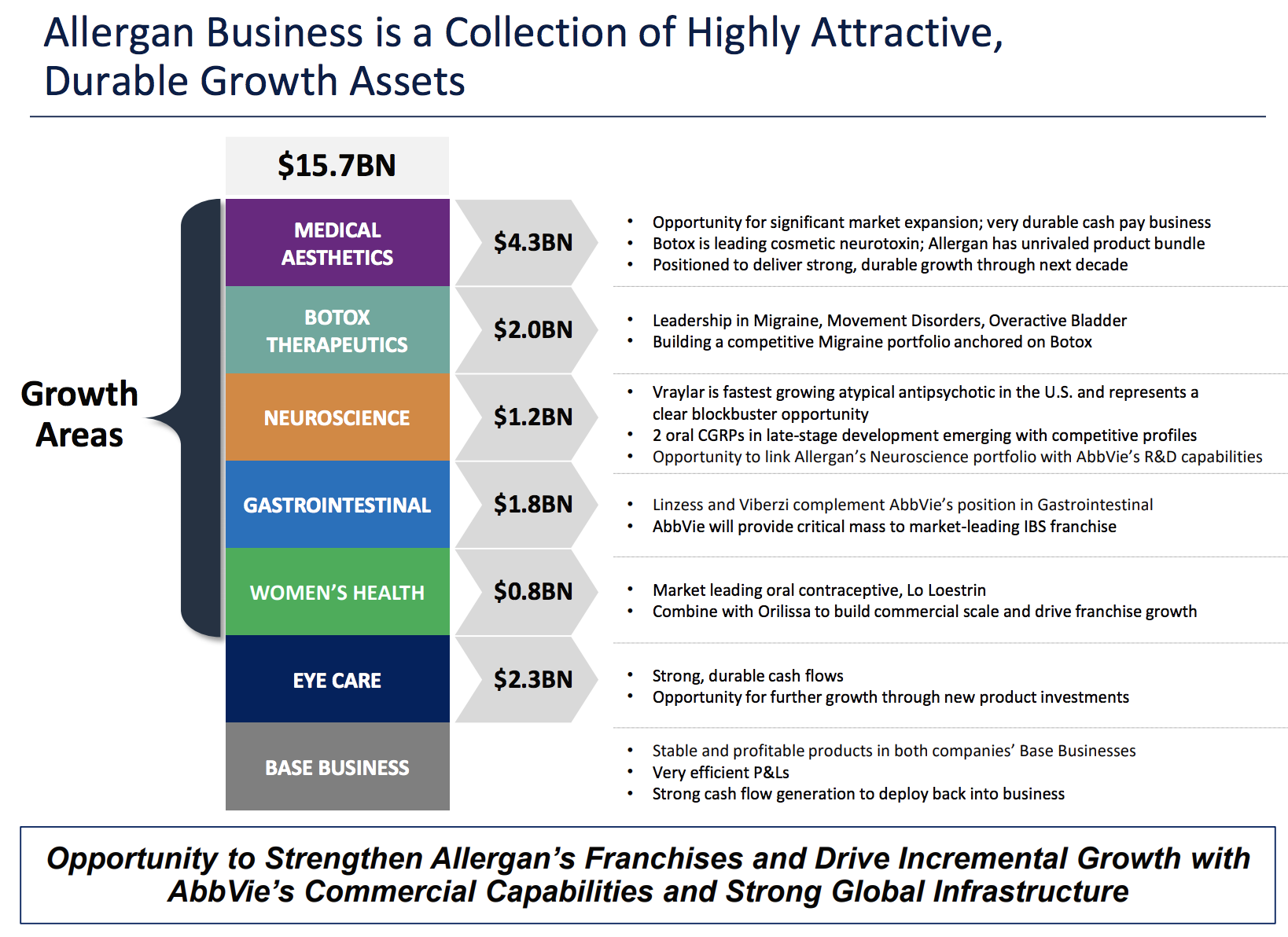

Allergan’s business is spread across a number of new businesses for AbbVie, including leading beauty franchises such as Botox. The medical aesthetics space is an attractive market growing at a high-single digit pace, and it’s also a cash pay business, helping diversify AbbVie’s payer mix.

Allergan also has a meaningful collection of neuroscience assets, a key area of focus for AbbVie. Unlike many acquisitions in this space, buying Allergan is not a speculative bet on a pipeline either.

Source: AbbVie Investor Presentation

Source: AbbVie Investor Presentation

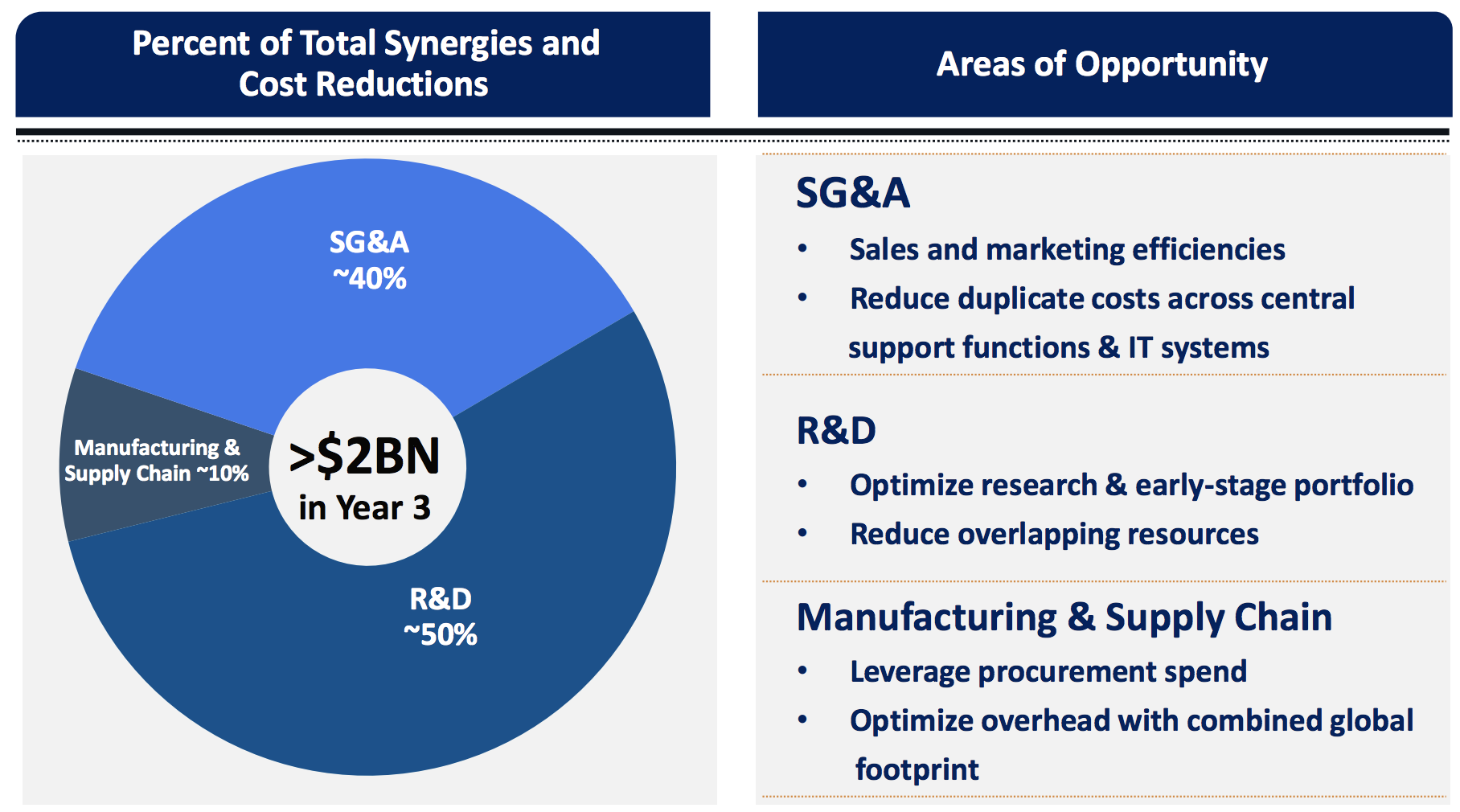

Thanks to the substantial scale of the combined company, management expects to deliver at least $2 billion of annual pre-tax synergies (about 4% of revenue) and other cost reductions within three years. Eliminating redundant infrastructure will drive most of the savings, and management emphasized the company will leave investments in key growth franchises untouched.

Source: AbbVie Investor Presentation

Source: AbbVie Investor Presentation

From a financial perspective, both of these businesses enjoy high margins and generate substantial free cash flow. AbbVie believes the deal will be immediately accretive (i.e. grow earnings per share) upon closing and result in 10% accretion in the first full year and peak accretion of 20%.

Let’s take a closer look at how this deal affects AbbVie’s dividend profile.

AbbVie’s Dividend Safety Score Downgraded to Borderline Safe

The good news is the new AbbVie’s dividend will remain comfortably covered by the firm’s free cash flow. After issuing shares to help finance the cash-and-stock deal, AbbVie’s annual dividend commitment, using its current payout of $4.28 per share, will rise to about $7.5 billion.

The combined company generated $19 billion in operating cash flow last year and invested about $900 million in capital expenditures, resulting in free cash flow of roughly $18 billion.

In other words, before potential cost synergies, the new AbbVie’s free cash flow payout ratio will likely sit around 40% (versus 48% today), at least through Humira’s loss of exclusivity in early 2023. That’s a reasonably safe level.

During this period, AbbVie should have around $10 billion in annual retained cash flow it can use to invest in growth (likely by acquiring more pipeline assets) and improve its balance sheet, which will need to be a top priority.

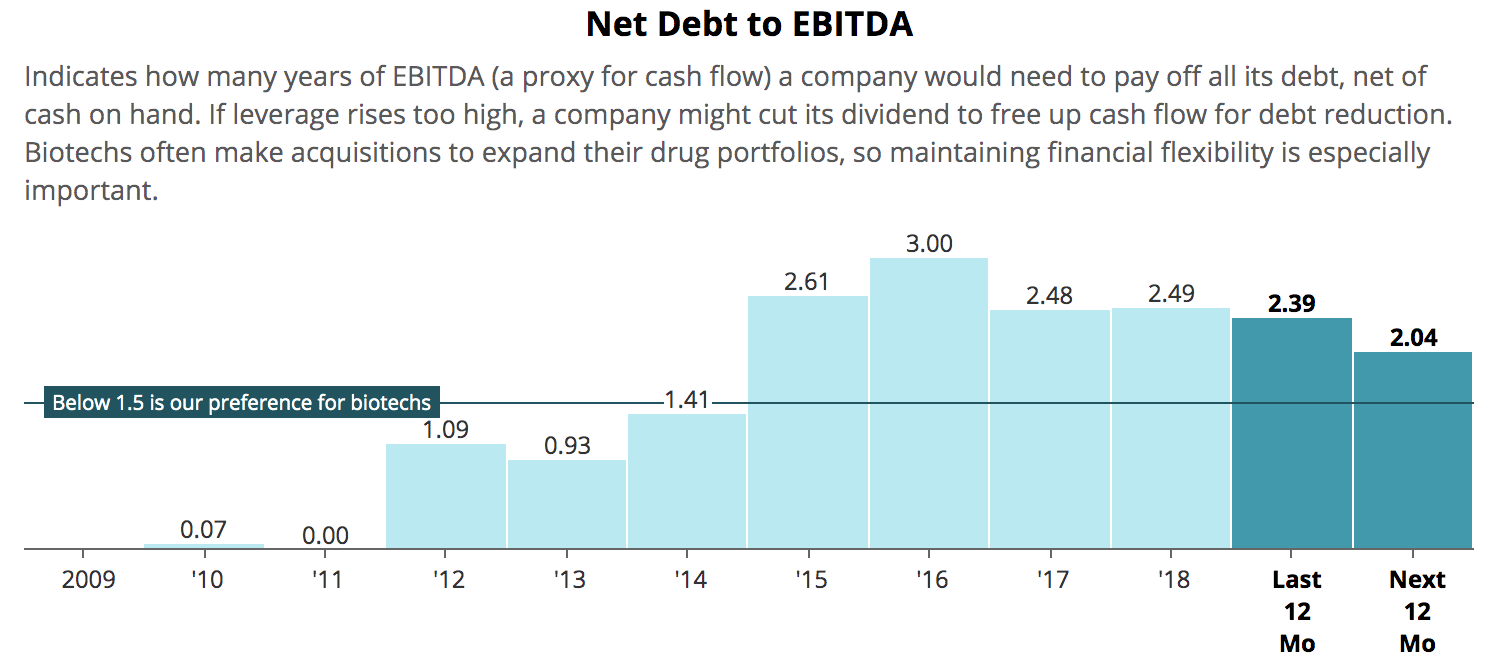

Higher leverage is a key concern with this deal. The firm’s net debt will increase by nearly $40 billion to finance the deal, and Allergan brings an additional $22.4 billion in adjusted net debt with it.

As a result, AbbVie’s total adjusted net debt will increase from $33.7 billion to approximately $95.5 billion, according to our estimates. Meanwhile, prior to the deal’s announcement, analysts estimated AbbVie and Allergan would generate combined EBITDA of $23.6 billion in the year ahead.

Therefore, once the deal closes, AbbVie’s net debt to EBITDA leverage ratio will likely double from about 2.0 today to approximately 4.0. That’s a risky level for most types of businesses, including biopharmaceuticals which must contend with patent losses, drug pipeline volatility, and the occasional need to acquire new medicines to support their long-term growth.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

AbbVie said it was committed to maintaining at least a BBB investment grade credit rating and plans to reduce debt by $15 billion to $18 billion by 2021 with further de-leveraging through 2023.

Since the company seems likely to generate around $10 billion in annual retained free cash flow over at least the next few years, management’s debt reduction goals seem reasonable.

If successful, according to our estimates AbbVie’s adjusted net debt to leverage ratio would fall to between 3.3 and 3.4 by 2021, even assuming no growth in EBITDA. That’s still a high level, demonstrating the importance of AbbVie’s new Growth Platform performing well as its U.S. Humira franchise braces for lower-priced biosimilar competition in early 2023.

Management expects Humira’s cash flow over the next few years to exceed the incremental debt AbbVie is taking on for this deal. In other words, Humira’s remaining cash flow will be utilized to pay off the acquisition’s financing as the blockbuster drug essentially buys the assets intended to replace it over the long term.

On the call discussing the transaction, management said this deal “assures we can continue to drive a strong and growing dividend. We are absolutely committed to a growing dividend, and nothing has changed.”

So management’s desire to maintain AbbVie’s status as a dividend aristocrat is clearly in place, though investors probably shouldn’t expect more than low-single digit dividend growth until the balance sheet is strengthened and Humira’s outlook beyond 2023 becomes clearer.

Moody’s also maintained AbbVie’s investment grade credit rating and reiterated its stable outlook. Standard & Poor’s expects to lower AbbVie’s credit rating one notch to BBB+ due to its higher leverage, but that rating is still above management’s minimum BBB rating target.

Essentially, if everything goes according to plan, AbbVie can deleverage, reduce its risk of a major revenue decline following Humira’s eventual loss of exclusivity in the U.S., continue growing (albeit slowly) its dividend, and provide investors with more predictable long-term results.

As the company makes progress on these goals and pays down its debt, AbbVie’s Dividend Safety Score has potential to improve back to a Safe rating.

However, the stakes are still high for now, and there’s a reason why investors are punishing AbbVie’s stock, sending it down about 15% on this news.

A deal of this size is a transformative transaction and marks a major change of strategy. Management previously said by 2025 the company expects to have reduced Humira sales concentration to about 25% of total revenue (compared to 95% in 2013), with non-Humira sales expected to exceed $35 billion.

Source: AbbVie Investor Presentation

Source: AbbVie Investor Presentation

If everything was going well, why buy Allergan? Management insists the firm’s existing growth platform is still tracking how they thought it would and notes AbbVie has done deals in the past to build out its pipeline.

AbbVie says the purpose of buying Allergan is to get its growth platform to critical mass – $25 billion to $30 billion in annual revenue – with solid profitability that allows that part of the business to be standalone. Management explained that assets like Allergan are not always available, and certainly not at this value.

However, reading between the lines, a move like this feels a little forced. Management could have growing concerns about the speed of Humira’s eventual demise, or perhaps the team isn’t as confident about AbbVie’s pipeline assets delivering a large enough base of revenue fast enough to offset Humira.

During the call management commented, “There are a whole range of outcomes that can occur in 2023…we have a responsibility to cover that full range of outcomes.”

A comment like that doesn’t do much to help confidence. Investors are now left digesting a major capital allocation bet that reduces some risks (Humira exposure) while introducing others.

On the call, analysts questioned the risk of biosimilar competition harming Allergan’s large Botox business, the potential affect of litigation since Allergan previously sold some branded opioids, and why management no longer stated AbbVie’s 2025 targets in the latest presentation.

A shakeup this large suggests something might not be going according to plan, but management isn’t willing to come out and say it. Throw in AbbVie’s still large exposure to Humira (30% to 40% of revenue), high financial leverage to pay for this deal, and mounting political pressure to lower drug prices, and it’s not so hard to see why the market is losing more confidence in the company.

Investors will need to keep a close eye on the success of AbbVie’s growth drivers. If Humira’s long-term outlook is indeed weakening (management previously expected Humira to be a $12 billion business in 2025), drugs such as Skyrizi, Orilissa, and Upadacitinib will become all the more important, and continuing to defend existing cash cows such as Botox will be critical as well.

AbbVie is also left with little financial flexibility should the firm need to buy more mid-to-late stage pipeline assets without risking its credit rating. There’s not much margin for error, and yesterday’s news didn’t do much to help investors feel better about AbbVie’s growth potential beyond 2023 when Humira loses exclusivity in the U.S.

Overall, the acquisition of Allergan will be a game-changer for AbbVie, for better or worse. The deal provides potential to make AbbVie a somewhat more predictable cash cow, but it also introduces signifiant integration risk by bringing in several new businesses, and there is always risk of overpaying due to the uncertainties involved with developing and marketing prescription drugs.

While AbbVie’s dividend appears likely to remain safe for now, investors probably won’t regain confidence in the firm’s story until the long-term trajectories of Allergan’s business, AbbVie’s existing pipeline, and Humira become clearer. Progress on de-leveraging is critical, too, with Humira set to fade perhaps faster than expected. There are a lot of moving parts to get comfortable with.

These aren’t necessarily reasons to sell the stock if you own it, but investors should remain aware of the higher operational, financial, and political risks facing the company. Otherwise, most of the concluding remarks I made in our May 2019 note reviewing AbbVie’s underperformance remain true following the Allergan acquisition:

Investors will need to closely monitor the pace of Humira’s erosion as competition ramps up in the coming years, as well as any developments with healthcare reform. Politicians on both sides of the aisle desire to make medicine more affordable, which could result in proposals that increase the amount of biosimilar competition Humira faces in the U.S. sooner than expected and reduce the long-term profitability of AbbVie’s drug pipeline…

And thanks to the long and costly drug approval process, it’s not always easy to know how quickly a pharmaceutical company’s profits will grow in the future, or even if they’ll grow at all. AbbVie’s major dependence on Humira makes that statement even more true and reduces management’s margin for error with bringing new medicines to the market.

Therefore, it’s generally best for conservative income investors who are interested in this space to stick to the more diversified blue chips whose businesses are less likely to be disrupted if something goes wrong with any single drug.

Johnson & Johnson (JNJ), Merck (MRK), and Pfizer (PFE) are three examples of pharma companies who have strong balance sheets, balanced drug portfolios, and good potential to deliver safe and growing dividends for the foreseeable future. While they still face the same regulatory risks as AbbVie, they require less monitoring due to the diversified nature of their cash flow streams.

There’s nothing necessarily wrong with investing in AbbVie, especially with its shares appearing beat up and its dividend remaining safe as long as management delivers on its long-term diversification plans.

However, investors must be comfortable with the firm’s Humira concentration and prepared for heightened volatility as the market continues adjusting its long-term growth expectations for Humira and AbbVie’s blossoming drug pipeline. As always, make sure to maintain a well-diversified portfolio and size your positions appropriately to manage risk.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends