Let’s face it: you hardly ever get decent income from commodity stocks. And when you do, these payouts are usually first to get the axe next time, say, oil nosedives.

And with oil doing this…

Oil Falls—Oil Companies’ Profits to Follow

… you may worry that it’s about to get harder to squeeze income out of oil companies.

Still, if you’re worried about inflation or the Federal Reserve distorting markets, or if you just want to hedge your stock portfolio, you’ll likely turn to commodities at some point.

There’s just one problem: gold doesn’t produce anything.

As Warren Buffett said, you could put all the world’s gold in one big cube and it still wouldn’t produce income for you.

That’s usually how it goes—and most gold miners don’t pay dividends because they’re too busy pumping cash into the business to mine more gold.

Fortunately there’s another way to get cash out of gold—and no small amount, either: I’m talking a 13.6% dividend yield.

How? With the GAMCO Global Gold Natural Resources & Income Trust (GGN), an actively managed closed-end fund (CEF) that holds energy and gold stocks, and pivots between them when the time is right.

Current holdings include Barrick Gold (GOLD), Newmont Mining (NEM), Chevron (CVX) and Exxon Mobil (XOM). Plus, as I just mentioned, GGN now yields a whopping 13.6%.

And if you’re worried that GGN’s strategy can’t beat its benchmarks, don’t be. Here’s what the fund has done in 2019:

GGN Tops Gold, Energy—and the Market Itself

Here we see that GGN has easily beaten stocks. Plus it’s also topped the energy sector and physical gold—the latter of which is tracked here by the SPDR Gold Shares (GLD). Both energy and gold are far below stocks in general, due to worries that inflation won’t rise soon, despite the Fed’s hints it may cut rates shortly.

If you’re wondering how a gold/energy fund can crush both gold and energy while also beating the stock market, let me explain.

With its portfolio flexibility, GGN can pivot between the two asset classes and buy what’s undervalued at the time. It can also avoid the worst of a downturn by cutting back on the weaker asset class, whether it’s gold or oil. This is why the supposedly safer energy index fund, the Energy Select Sector SPDR (XLE), fell further than GGN in late 2018—and while XLE still hasn’t recovered, GGN is already in the black:

Flexibility Is GGN’s Strength

What about the dividend?

GGN hasn’t cut distributions since early 2017, when the fund was still picking up the pieces from the 2014 oil crash, which also resulted in a dividend cut for GGN in 2014 (it’s worth noting XLE’s dividends were also cut at the same time, as were those of almost all energy companies). Fortunately, oil has been predictably range-bound since, making it easier for energy-fund managers to maintain their portfolios and payouts:

Oil’s New Normal

And with GGN’s recent solid showing, it looks like the fund has found the perfect strategy for oil’s new normal, while also dipping into gold markets when necessary. If the Fed follows through with rate cuts to inflate the economy, expect inflation to follow, making GGN’s gold holdings, its strategy and its dividend a decent hedge against a Fed-driven stock market.

— Michael Foster

Urgent: Grab This Growing 10.7% Dividend Now—While It’s Cheap [sponsor]

If you want to go beyond volatile commodities, you can bulk up your portfolio’s safety and bag a mammoth 10.7% income stream with my top stock-focused CEF pick now.

I’ve made this top-secret CEF my No. 1 pick in stock-focused funds for 2 reasons:

- It boasts an amazing 10.7% dividend yield.

- Its cash payout is exploding, up an incredible 150% in the last decade!

How does this fund do it?

It’s run by an investment all-star team cherry-picked from 5 of the sharpest management firms on Wall Street.

Together, this crew invests in a “no-gimmicks” portfolio of value and growth stocks, all of which have deep moats protecting their businesses: names like Visa (V), Microsoft (MSFT), Alphabet (GOOGL) and Abbott Laboratories (ABT).

So how has this all-star team performed?

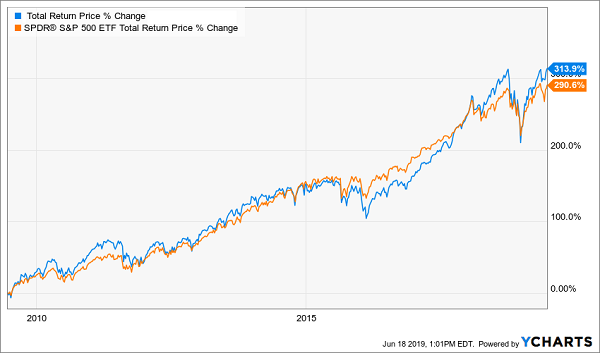

They’ve dominated, with most of my pick’s monstrous total return coming in cash, thanks to that huge dividend payout:

Crushing the Market in Cash

Finally, this fund trades at an unreal 5% discount as I write this. It’s only a matter of time before that shifts to a massive premium, propelling my pick’s market price higher as it does.

So you’ll be looking at a big capital gain here, to go along with that growing 10.7% dividend.

That’s not all! I’ll also give you my 3 other top cash-spinning CEF picks (combined yield: 8.7%; price upside: 20%), too. Don’t miss out. Click here now!

Source: Contrarian Outlook