Walt Disney founded his namesake company in 1923, and since then the business has gone on to become one of the most iconic brands ever created. Today Walt Disney (DIS) is a leading entertainment company with about $60 billion in revenue.

The media conglomerate is highly diversified and vertically integrated, with four major business segments. Here are the company’s sales and profits through the first half of fiscal 2019:

- Media Networks (38% of sales, 47% of profits): TV programming (ABC TV and cable channels like A&E, History, Lifetime and ABC Family, ESPN network), radio (radio Disney, ESPN radio network), eight television stations. In total the company has about 100 Disney-branded television channels, which are broadcast in 34 languages and 162 countries.

- Parks & Resorts (43% of sales, 49% of profits): owns theme parks and resorts around the globe including Walt Disney World In Florida, Disneyland in California, Disney Land Paris, Shanghai, and Hong Kong. Also operates Disney Resort & Spa in Hawaii, the Disney Vacation Club, Adventures by Disney, and the Disney Cruise Line.

- Studio Entertainment (13% of sales, 11% of profits): produces live-action and animated films under the Walt Disney Pictures, Walt Disney Animation, Pixar, Marvel, and Lucasfilm (Star Wars, Indiana Jones) studio banners. This segment’s profitability is volatile and driven by the number of successful releases each year.

- Consumer Products & Interactive Media (6% of sales, -7% of profits): licenses Disney’s trade names, characters, and visual and literary properties, develops and publishes mobile games, and sells its products through its own online stores and various retail outlets around the globe.

In December 2017, Disney announced it was buying Twenty-First Century Fox in a $66 billion deal. As part of a bidding war with Comcast (CMCSA), Disney ultimately raised its offer to $71.3 billion in cash and stock. The Fox acquisition closed on March 20, 2019.

Disney now owns all of Fox’s assets (film and TV studios, cable networks, stakes in Hulu and other key assets) except for the Fox Broadcasting network and stations, Fox News Channel, Fox Business Network, FS1, FS2, and the Big Ten Network. These were assets it had to agree to divest in order to obtain regulatory approval for the merger.

Source: Disney Investor Presentation

Source: Disney Investor Presentation

In 2016 Disney changed from an annual dividend schedule to a semi-annual cadence. The company has grown its dividend each year since 2010 and has paid uninterrupted dividends for more than 25 straight years.

Business Analysis

Disney is arguably the most effective storyteller in the world. People love stories and have been telling them for literally thousands of years.

Not surprisingly, forming a business around this existential human need has worked out very well for Disney over the years – the company is one of the most iconic consumer brands and is routinely named one of the world’s top 15 most valuable brands.

Star Wars, Snow White, Mickey Mouse, Cinderella, Thor, and Frozen are just a few of Disney’s well-loved storytelling assets.

The crux of the company’s success lies in its ability to consistently identify and create high-quality branded content. Thanks to nearly 100 years of developing timeless and beloved films and other forms of intellectual property, Disney has developed a powerful arsenal of brands that it plugs into one of the most impressive marketing and distribution machines ever created.

Disney’s success has also been fueled by well-executed acquisitions made to grow its film franchises, including:

- 2006: Pixar ($7.4 billion deal)

- 2009: Marvel ($4 billion)

- 2012: Lucasfilm ($4 billion)

Disney now owns some of the most successful franchises and studios in the world, including:

- Pirates of the Caribbean

- Star Wars

- Indiana Jones

- The Marvel Cinematic Universe (over $20 billion in global box office sales and counting)

- Pixar (Toy Story, Cars, Finding Nemo, The Incredibles, Monsters Inc)

- Disney Animation (famous for hits such as Frozen)

- Disney Live Action (another serial blockbuster machine)

Now that Disney owns Fox it can add notable movie and TV show franchises such as the X-Men, Avatar, and the Simpsons to its impressive portfolio of content. In fact, of the 39 movies that have ever grossed $1+ billion globally, Disney now owns 22 of them (including four of the five films to every earn $2+ billion). When it comes to blockbuster franchises, no one comes close to Disney.

Once Disney has created a new favorite character, movie, or show, it can leverage that content across almost all of its businesses and technology platforms, reinforcing their recognition with consumers and creating a long, diversified tail of income.

For example, the company’s vertically integrated operations mean that it can produce a great movie, then later show it across its numerous TV channels. It can also merchandise its intellectual property via games, apps, clothing, and toys.

It’s amazing to think how much money a character like Mickey Mouse is still making for Disney after its initial launch in 1928 despite constantly evolving consumer tastes. Disney clearly has a knack for developing timeless content and stories that appeal to our foundational human traits.

Meanwhile, Disney owns seven of the 12 most popular theme parks in the world, where it is continuously incorporating its films and franchises into improvements that help drive strong visitor growth and strong occupancy.

Disney’s ability to continually improve its parks has given the company amazing pricing power over the years. For example, adjusted for inflation, a day pass to the Magic Kingdom at Disney world cost $21 in 1971, according to Travel and Leisure. Today a pass costs $159 (up from $139 in 2018), indicating about 4.5% inflation-adjusted annual ticket price increases for nearly 50 years.

Disney’s latest plans for its parks call for $24 billion in investment from 2019 to 2024, expanding all six of its largest theme parks and possibly opening another one in China. Heavy investment into new parks has been a key driver behind Disney’s impressive ticket pricing power over the decades, so this ambitious long-term investing plan likely bodes well for the future profitability of this segment.

Perhaps most impressively of all, Disney has seemed to crack the code on consistently producing quality movies that avoid genre burnout. For example, its Marvel films, while technically superhero blockbusters, are increasingly branching out into more diverse subgenres that include comedies, heist films, and political thrillers that make them a hit with both critics and global audiences.

Of course, there’s also Disney acquisition of Twenty-First Century Fox. This is by far the largest and most complicated deal in its history. CEO Bob Iger, who’s been leading the company since 2005, has announced that he will remain CEO through June 2021 (he’s frequently said he would retire before that) to oversee the integration of these two media empires.

The potential for the Fox acquisition is substantial for three main reasons. First, Fox brings numerous strong brands under Disney’s umbrella, including Avatar, The Simpsons, Alien, Predator, Die Hard, Kingsman, Planet of the Apes, and X-men.

In other words, Disney is gaining even more ammunition to make its popular film franchises even bigger and intertwined in new ways, setting it up for many more years of billion-dollar blockbusters.

The second strategic reason for the merger is that it will increase Disney’s impressive distribution network, especially in streaming. Disney views streaming as the future of entertainment that will benefit from continued growth in the number of households worldwide that have high-speed internet.

Source: Disney Investor Presentation

Source: Disney Investor Presentation

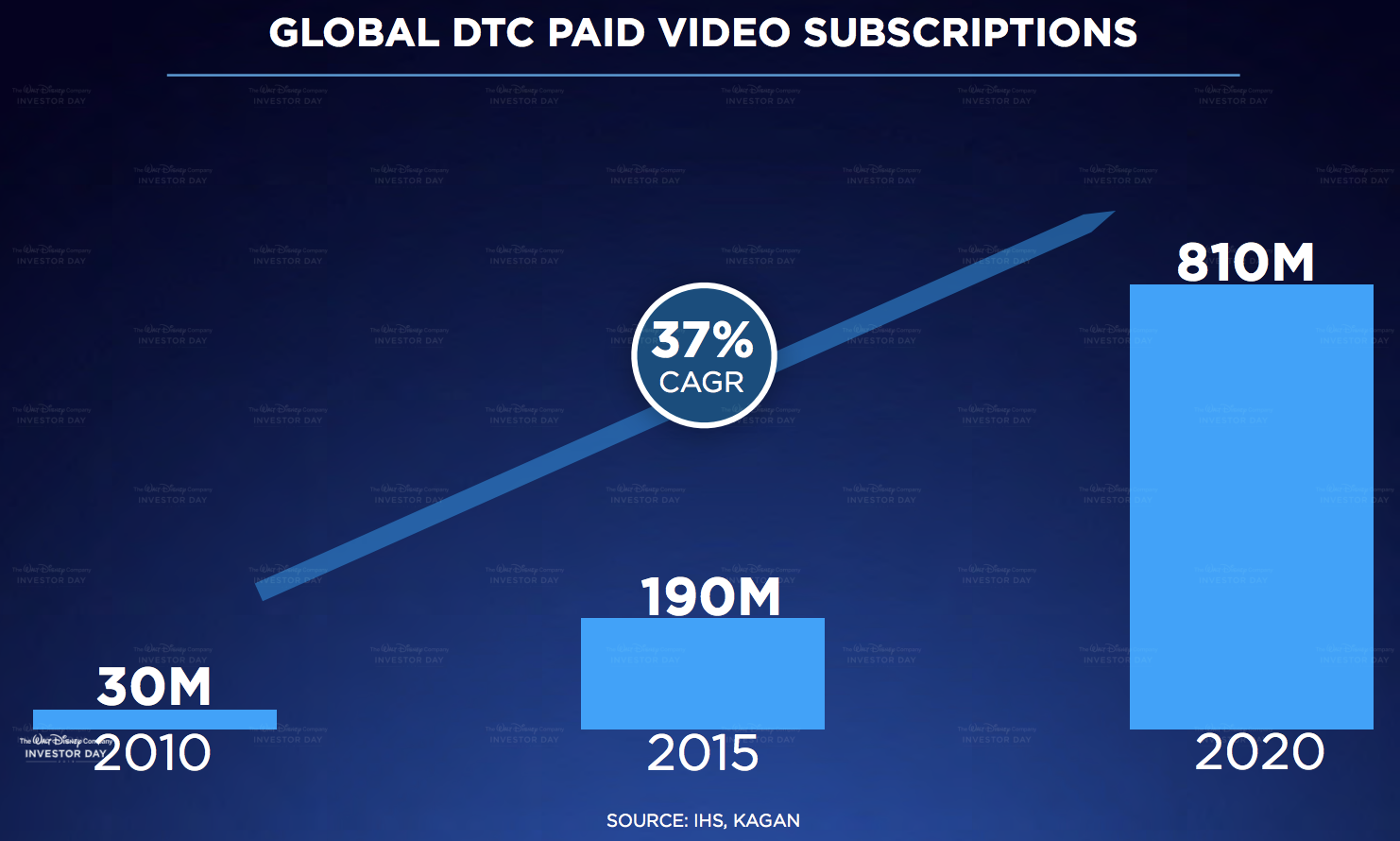

As more households enjoy broadband internet, more entertainment consumption will take place over the web. By 2020 research firms IHS and Kagan estimate that about 80% of broadband users will subscribe to at least one streaming service, a secular trend Disney plans to profit from.

When Disney bought Fox, the acquisition included Fox’s 30% stake in Hulu. Thus, post-merger Disney owned 60% of America’s second-largest (28 million subscribers at the end of April 2019) but fastest-growing streaming provider. For context, at the end of 2018 Comcast was America’s largest pay-TV provider with 21 million subscribers, a figure that Hulu has now surpassed.

In April 2019 Disney also agreed to buy AT&T’s 9.5% stake in Hulu for $1.4 billion, valuing Hulu at just over $14 billion. Disney then gained full control of Hulu in May 2019 when it struck a deal with Comcast (who owned 33% of the streaming service upon AT&T’s buyout) to ultimately acquire its ownership stake as well.

Besides capitalizing on Hulu, Disney made another big move in deciding to end its licensing deal with Netflix in 2019 and launch its own competing streaming service instead.

In April 2019 Disney unveiled the details of its highly anticipated Disney+ streaming platform, which is launching in the U.S. in November 2019. Within two years Disney+ expects to roll out in Asia, Latin America, and Europe.

The service will initially cost $7 per month or $70 per year and include Disney’s treasure trove of content as well as new original series featuring popular hits such as Marvel and Star Wars. By 2024 Disney+ plans to offer over 50 exclusive series, over 10,000 TV show episodes, and more than 500 exclusive Disney movies.

Source: Disney Investor Presentation

Source: Disney Investor Presentation

To make this vision possible, Disney plans to invest around $1 billion per year in exclusive content by 2020, with that figure rising to roughly $2.5 billion annually by 2024.

Outside of Hulu and Disney+ the company’s ESPN+ stream service ($5 per month or $50 per year) surpassed 2 million paying members by April 2019, less than a year after its launch.

Disney says it plans to offer bundled offerings of all three of its streaming services in the future. Given the company’s lead in cranking out quality content, with plans to spend heavily on more exclusive media production, Disney could very well achieve its 2024 goal to have:

- 12 million ESPN+ subscribers

- 40 million Hulu subscribers

- 60 to 90 million Disney+ subscribers

While Disney’s streaming growth guidance wouldn’t surpass industry leader Netflix (139 million global subscribers by the end of 2018), it has a good chance of becoming the world’s second largest direct-to-consumer media provider.

Controlling the media chain from content creation through distribution should help Disney stay relevant with consumers while also keeping a greater amount of profits for itself rather than sharing the wealth with various middlemen.

Overall, Disney enjoys a number of enduring competitive advantages that help ensure it will maintain its world-class entertainment empire in the years ahead, especially now that it’s added Fox’s content to its own and created arguably the most valuable content library on the planet.

Many of the company’s assets are nearly impossible for competitors to replicate because of their dependence on Disney’s trademarked brands (e.g. Disneyworld). As a result, the firm is able to create strong emotional attachment with consumers and command strong pricing power given its scarcity value (where else can you visit the Magic Kingdom?).

With an ability to develop memorable content for practically any demographic, geographic region, and technology medium, Disney appears to have a long runway for profitable growth.

Key Risks

Disney investors have become very excited about Disney’s ambitious growth plans, which explains why shares shot up almost 30% within two weeks of its long-term streaming strategy unveiling. However, it’s important to remember that Disney’s growth plans aren’t necessarily going to drive a substantial increase in revenue or earnings anytime soon.

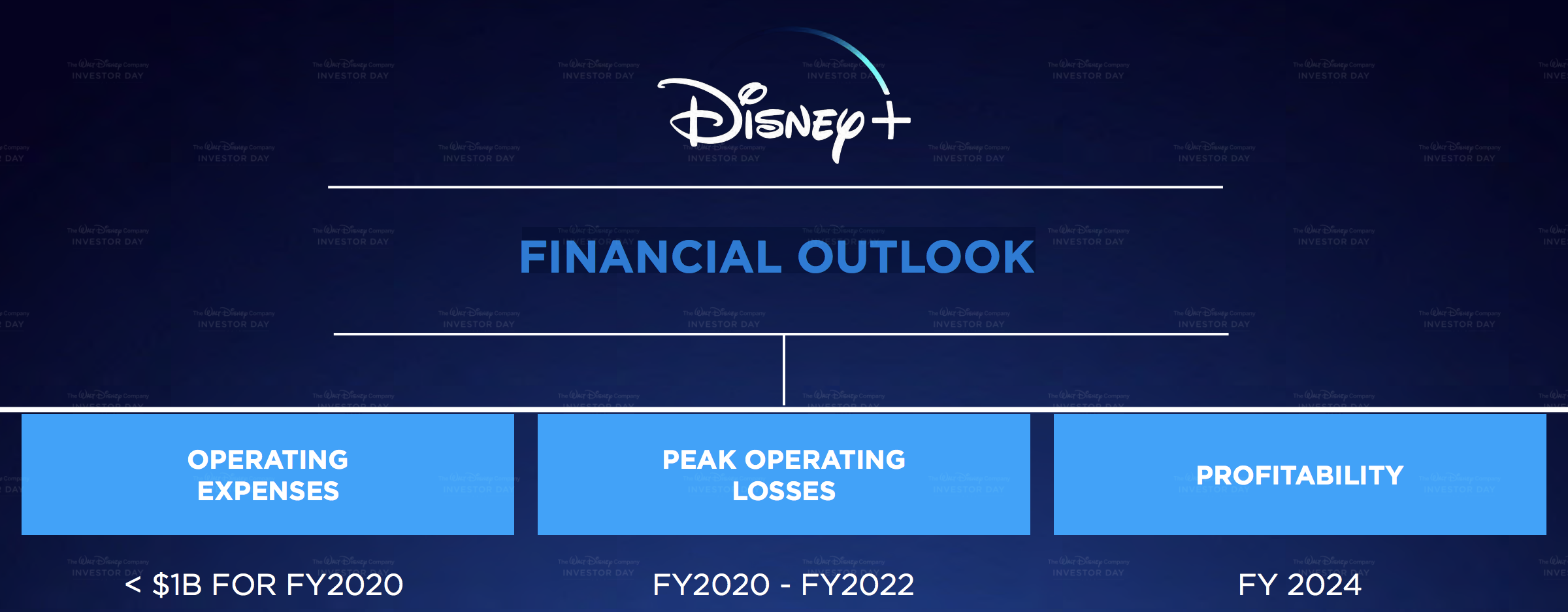

For example, Disney expects Hulu to generate $1.5 billion in operating losses this year and not become profitable until 2023 or 2024. Similarly, Disney+ isn’t expected to start generating positive free cash flow until 2024. ESPN+ is expected to breakeven in 2023.

Source: Disney Investor Presentation

Source: Disney Investor Presentation

CEO Bob Iger has admitted that streaming will require forgoing high-margin licensing revenues such as the roughly $500 million per year it was getting from Netflix (NFLX). Meanwhile, by 2024 total content costs are estimated to rise to about $4.5 billion per year, including third-party licensing.

Comcast’s licensing agreement for its content on Hulu only runs through 2021, meaning that this streaming service could face the same fate as Netflix, losing many of its most popular shows (currently from five major networks). That’s because Comcast plans to launch its own streaming service in 2020 and might want to withhold its own exclusive content to attract paying members.

With numerous media giants rushing to the market with their own streaming services, this is certainly a crowded field with uncertain long-term economics. This might explain why Disney expects Hulu’s subscriber base to eventually reach just 40 million, not much higher than its 28 million today, despite Hulu’s roughly 50% growth rate in recent years.

Should Disney’s streaming efforts fail to generate the type of long-term growth and profitability management expects, investors could wind up disappointed and re-rate Disney’s valuation multiple much lower.

Investors should also note that Disney’s theme parks and studio businesses can have cyclical results. A strong economy results in higher park occupancy levels and an easier ability for Disney to up prices for lodging, tickets, and food. And the studio segment’s movie profits are lumpy and unpredictable, driven by the success of new movies hitting the theaters.

Weakness in either of those businesses is likely to be temporary, but it can be enough to weigh on the stock.

Another risk factor to monitor is Disney’s leverage. The company took on more than $35 billion in debt to buy Fox, resulting in an increase in its leverage ratio from 1.4 to 3.1.

Going forward, the company needs to execute well on integrating the Fox merger, which will likely take at least several years to evaluate, and prioritize repaying debt quickly. In order to retain more cash flow for debt reduction, Disney increased its dividend just 4.8% in 2019, far below its five-year average growth rate of 15%.

Management also suspended share buybacks until Disney’s leverage ratio declines significantly in order to retain its A credit rating from Standard & Poor’s. Fortunately, Disney’s balance sheet still remains strong overall, indicating there isn’t much danger to the payout from the company’s currently elevated debt burden.

However, low- to mid-single digit dividend growth seems likely to continue over the next few years as Disney continues reducing its leverage and ramping up its investments in streaming services and theme parks.

Finally, investors should remember that Bob Iger, who has overseen Disney’s golden age of growth, expects to leave in June 2021. While the company has two potential successors lined up (and could always look externally for a new CEO), Iger will leave some very large shoes to fill when it comes to running what will become the world’s largest and most complex media and entertainment empire.

Closing Thoughts on Walt Disney

Disney has proven itself to be one of the most iconic and dominant entertainment empires in the world. The company’s ever-growing portfolio of beloved brands and fast-expanding distribution network have found success across countless generations, and in nearly every country.

Simply put, Disney possesses one of the strongest portfolios of hard-to-replicate assets in the world. With demand for content continuing to rise over the long run, the company’s ability to monetize its intellectual property should continue to strengthen.

However, Disney is now at an exciting crossroads, attempting to digest its largest-ever acquisition while simultaneously stewarding no fewer than three large streaming platforms and overseeing a substantial expansion of its beloved parks.

Given the company’s higher expenses expected in its future, plus the need to deleverage, Disney investors should expect much slower dividend growth than in recent years. However, for patient investors, Disney seems likely to remain an appealing long-term dividend growth story.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends