Amgen (AMGN) was founded in 1980 and is one of the world’s leading biotechnology companies with operations in more than 100 countries. The business develops and manufactures treatments for oncology/hematology, cardiovascular, inflammation, bone health, nephrology, and neurological diseases.

About 77% of the firm’s sales are derived from the U.S., and Amgen’s product portfolio is concentrated in a handful of drugs (top 5 = 69% of revenue). In the first quarter of 2019, the company’s most important drugs included:

- Enbrel (treats rheumatoid arthritis): 22% of sales (grew 4%)

- Neulasta (bone marrow stimulant used in cancer patients) 19% of sales (-12% growth)

- Prolia (treats osteoporosis in postmenopausal women) : 11% of sales (grew 20%)

- Xgeva (protects bones of cancer patients): 9% of sales (grew 6%)

- Aranesp (bone marrow stimulant used during chemotherapy or kidney failure): 8% of sales (declined 9%)

- Sensipar/Mimpara (calcium reducer used to treat kidney disease): 4% of sales (-57% growth due to heavy biosimilar competition)

In the past few quarters, the company has released new or expanded indications for Prolia, cholesterol drug Repatha, and cancer drug Kyprolis.

These new launches are helping to partially offset declines in older drugs, including those that have lost patent protection and face increased generic and biosimilar competition including Enbrel, Neulasta, Aranesp, and Epogen (about 10% annual sales declines for these last three).

Amgen is counting on its development pipeline to help it offset the natural sales declines that result from patent expirations via potential blockbusters like:

- Expanded indications for osteoporosis drugs Prolia and Xgeva

- New migraine medication Aimovig

- Cancer drug Blincyto

- Cancer drug Krypolis

- Cholesterol drug Repatha

Amgen is also a leading developer of biosimilar drugs (generic versions of biological drugs which are higher margin) and launched a biosimilar version of immunology drug Humira (the best-selling drug in the world for many years) in Europe in late 2018.

The company is currently working on biosimilar versions of other top drugs including immunology drug Remicade, cancer drug Rituxan, and blood disease drug Soliris. In total, Amgen’s 10 planned biosimilars are meant to compete with existing drugs that recorded over $68 billion in 2018 sales.

Overall, the firm’s development program is expected to result in substantial increases in key drug sales. The two largest opportunities (Prolioa / Xgeva and Repatha) have potential to reach $4 billion to $5 billion in peak sales, according to analysts. For context, each of these programs would represent around 20% of 2018 sales.

Despite its success in certain new medicines and a promising drug pipeline, Amgen’s management is guiding for a weak 2019 including $22.5 billion in sales (-5%) and adjusted EPS of about $13.78 (-5%).

Amgen only began paying a dividend in late 2011 but has raised its payout for eight consecutive years at a double-digit rate.

Business Analysis

Amgen was one of the earliest biotech companies and specialized in biologically-derived medications. These can be more effective and have better safety profiles compared to chemical-based pharmaceuticals.

The company has historically been strongest in cancer drugs and those treating renal (kidney) conditions. Over time Amgen has diversified its product lines and now targets 13 different conditions, including more common (and thus larger market) conditions such as high cholesterol, migraines, and arthritis.

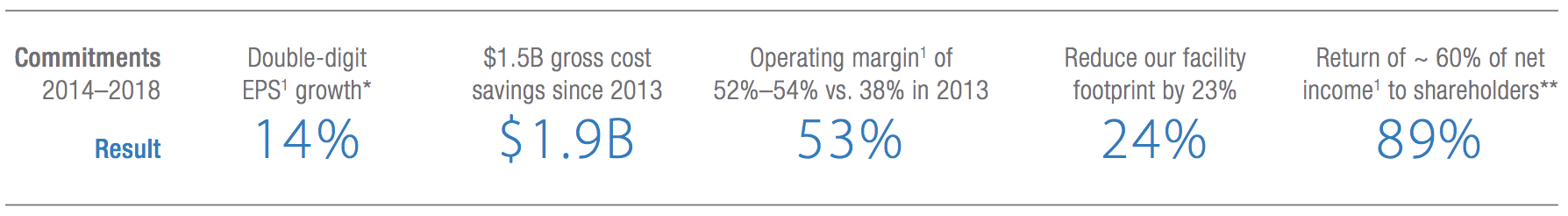

As the business has grown, Amgen has leveraged its large scale and low-cost manufacturing to great effect, resulting in strong profitability. For example, in 2018 Amgen’s adjusted operating margin exceeded 50% (up from 38% in 2013).

Amgen’s higher margins were also made possible by the firm’s five-year cost-cutting initiative. This reduced total gross costs by $1.9 billion and helped achieve superior R&D efficiency (the company is generating similar results investing 16% of sales in R&D as it was at 19% in 2013 by reducing average drug development time by three years).

As a result, management has delivered or exceeded most of its previous five-year guidance, which called for double-digit EPS growth, ambitious cost savings, and a meaningful return of profits to shareholders.

Source: Amgen Annual Report

Source: Amgen Annual Report

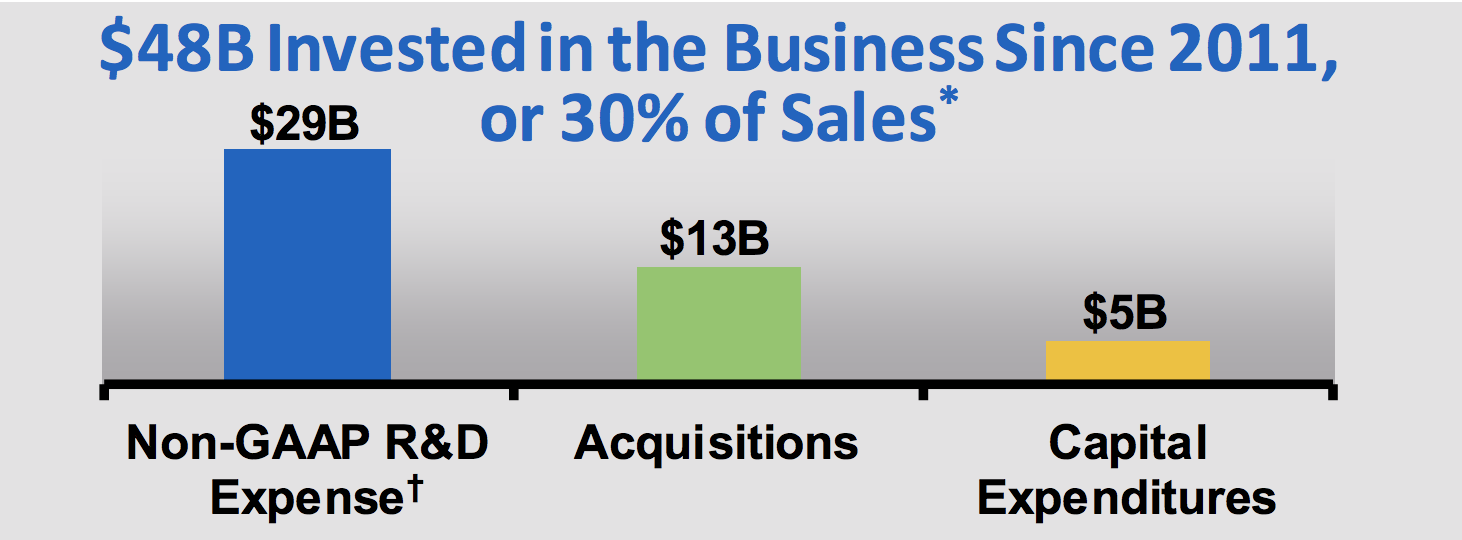

Like all biotechs, Amgen has to spend a lot on R&D and acquisitions in order to continually develop new drugs to replace ones which have expiring patents or face sales pressure from biosimilar drugs created by competitors (these drugs treat the same condition but via slightly different biochemical pathways).

Over the past 12 months, Amgen spent $3.9 billion, or 16% of sales, on new drug development. Since 2011 the company has invested $29 billion in R&D, a level of development spending that only a handful of large rivals can match.

Source: Amgen Investor Presentation

Source: Amgen Investor Presentation

Simply put, the cost of bringing a new drug through the FDA’s three-stage testing procedure is extremely expensive and time-consuming.

According to the Tufts Center for the Study of Drug Development, the 10-plus year approval process costs on average more than $2.5 billion per drug when factoring in all post-trial monitoring.

As if the process wasn’t challenging enough, only two out of every 10 marketed drugs generates enough in sales to at least cover its R&D costs, per the Pharmaceutical Research and Manufacturers of America organization. Increased safety concerns and government regulations add further challenge to competing successfully in this industry.

Amgen has plenty of experience dealing with these challenges, and about 75% of its drug pipeline is also based on genetic research, up from 15% in 2013. Amgen believes its lead in using human genetic data to design new drugs is a key driver to sustaining its competitive advantage, including bringing drugs to market faster and at reduced costs.

Another advantage Amgen enjoys is the relatively diversified nature of its sales. For example, many biotechs end up highly concentrated in just one or two key blockbuster drugs which can result in over 50% of their earnings coming from a single product. AbbVie is a key example of this with Humira generating about 70% of its earnings.

This can lead to substantial volatility in a biotech’s financial results and long-term growth prospects when increased competition arrives and forces a drug maker to reduce its price in an effort to maintain market share. It also puts even greater pressure on a firm’s drug pipeline to deliver big results.

While Amgen derived 22% of its sales from its top drug Enbrel in 2018 (down from 27% in 2017), the company’s concentration is expected to decline over the coming decade.

For example, by 2026 high cholesterol treatment Repatha is expected to be the company’s biggest seller, with $3 billion to $4 billion in sales, but account for just 14% to 19% of total revenue. Increased diversification should help to smooth out cash flows over time and provide enhanced dividend safety and long-term growth potential.

Better diversification is likely to come from Amgen’s development pipeline of 32 drugs. The pipeline (nine drug launches in the past five years) also contains versions of biological drugs (called biosimilars), including Amgen’s own versions of blockbuster such as Humira ($20 billion in peak sales), Rituxan ($7.3 billion), Avastin ($7 billion), Herceptin ($6.8 billion), and Remicade ($5.8 billion).

While Amgen isn’t going to be able to take all of these global sales away from their established blockbusters, it should be able to win partial market share which will help to replace declines in older drugs.

Overall, Amgen plans to increasingly target markets that benefit from the long-term aging of the global population (cancer, inflammation, heart disease, and osteoporosis) and will rely on volume-driven growth rather than price increases (management expects a mid-single-digit decline in 2019 net selling prices).

Analysts expect Amgen’s earnings to grow at about 5% annually over the next five years. Forecasts are especially challenging in this industry given the high-risk nature of drug development and future peak sales uncertainties. However, mid-single-digit earnings growth would be solid for a large drug maker like Amgen.

With the company’s payout ratio sitting just below 40% in 2018, investors can likely expect Amgen’s future dividend growth to continue at a mid-single-digit pace as well.

However, like all biotechs and pharmaceutical firms, Amgen faces numerous complex risks that could affect its long-term growth and profitability, potentially making the stock unsuitable for the most conservative income investors.

Key Risks

Amgen’s sales have struggled to grow in recent years (up just 3% from 2016 through 2018) for several reasons, including an aging portfolio of products. While Amgen was the early leader in biological drugs (harder to produce and thus more expensive and profitable), other drug makers have been able to catch up in recent years.

For example, anemia drug Epogen (4% of sales) was approved in 1989, and its patents expired long ago. The same is true for Aranesp (8% of sales) and Neulasta (19%), which were launched in 2001 and 2002, respectively. Steadily rising biosimilar competition for these two drugs is is why their sales are expected to decline for the foreseeable future.

Enbrel, which was approved in the late 1990s, shows that management is very good at defending market share from biosimilar rivals, with that drug expected by management to deliver $4 billion in sales this year (18% of total).

But eventually, all older drugs experience sales declines as rivals come in with alternative or biosimilar versions. Basically, biosimilar competition is a relatively larger threat to Amgen compared to some of its rivals, who have newer biological drug portfolios.

An example of this is anemia drugs Epogen and Aranesp, which are both over 12 years old, have faced some medical safety concerns, and which Pfizer’s (PFE) biosimilar, Retacrit, is expected to steal market share from starting in 2019.

Neulasta (19% of sales), a long-lasting Neutropenia (low white blood cells) drug, is also facing recent biosimilar competition that helped drive sales declines of 12% in the past year, and that’s expected to get worse going forward due to two new biosimilar rivals launching in 2019.

Even drugs that continue to enjoy patent protection, such as Amgen’s largest drug, Enbrel (whose patents don’t expire until 2028 and 2029), can suffer because rival drug makers can make medications targeting the same conditions, but through alternative pathways.

For example, Enbrel not only competes with market leader Humira in the U.S. and elsewhere, but is expected to see large competition when a handful of Humira biosimilars hit the U.S. market in 2023.

In fact, here are the number of major product rivals that Amgen lists in its annual report (a non-exhaustive list):

- Enbrel: 4 major rivals

- Neulasta: 3 major rivals

- Prolia: 3 major rivals plus various upcoming biosimilars

- Aranesp: two major rivals plus biosimilars

- Krypolis: four major rivals

Another issue for Amgen is that management has been unable to deliver a major blockbuster since Prolio/Xgeva won approval in 2012. This was the last major success under former CEO Kevin Sharer, who led the company’s golden age of peak sales and earnings growth (from 2000 to 2012).

The current CEO, Robert Bradway, joined the company in 2006 and after working as a managing director and health care investment banker at Morgan Stanley. Given his background, as the drug industry continues consolidating, driven by increased regulatory scrutiny and a more challenging environment to put through price increases, Mr. Bradway could feel pressure to strike a large deal.

After all, Amgen’s balance sheet is in great shape with $26.3 billion in cash at the end of the first quarter of 2019, an A credit rating, and just $6 billion in net debt.

Amgen’s last large acquisition was the $10.4 billion purchase of Onyx Pharma in 2013, which gave it cancer drug and potential future blockbuster drug Krypolis. However, while the latest drug trial data increases the likelihood that Krypolis will receive regulatory approval in the EU (it’s already approved in the U.S.), increased competition is expected to limit its use as a first-line treatment.

This highlights the risks inherent in the drug industry, where the average drug can take a decade to get approved and potentially cost over a billion dollars to develop and market. It also illustrates why big acquisitions, which are a key component of the drug maker business model (buying other companies’ development pipelines can potentially save time and money) can be so hard.

Whether or not the Onyx acquisition ends up proving a good deal for investors will depend on how Kyrpolis does over time, which is based on uncertain drug trials and how much market share it can achieve. The same will likely be true of any other deal Amgen decides to make in the future, so investors considering the stock must place a lot of trust in management’s capital allocation skill.

In the meantime, Amgen has been aggressively driving cost savings from its supply chain and production facilities. However, there is only so much cost cutting that can be done before it starts to risk affecting the quality of R&D or product safety.

To achieve sustainable long-term growth, Amgen will ultimately need to execute on its R&D pipeline, including its biosimilar efforts. That’s particularly true since numerous rivals have poured billions of dollars into developing biosimilar versions of some of Amgen’s most important products, including Neulasta (19% of sales) and Enbrel (22%).

Source: Financial Times

Source: Financial Times

While Amgen has its own biosimilars in development, as you can see it’s a very crowded field. For example, arthritis drug Remicade, for which Amgen is working on a biosimilar version, will have to deal with at least 20 other products that are being developed by rivals.

As a result, the amount of market share Amgen might steal from well-established blockbusters might be smaller than anticipated and therefore result in slower sales and earnings growth than hoped for.

In fact, even with its large pipeline of biosimilars, analysts estimate that Amgen will only generate low-single digit annual sales growth over the long term. Earnings are expected to grow somewhat faster thanks to continued share buybacks.

While that modest amount of bottom line growth is better than nothing, especially in the pharma industry, it’s not likely to allow Amgen to deliver double-digit dividend growth for much longer given the firm’s payout ratio near 40%.

The company faces several other challenges as well, including potential regulatory and reimbursement changes from Medicare that can negatively affect some of its drugs. Medicare and Medicaid, which cover about 50% of the U.S. population, don’t currently have the ability to negotiate for lower drug prices for bulk purchases. However, with the state of Federal healthcare policy constantly in flux, this could change.

Current Medicare Part B reimbursement change proposals could reduce effective drug prices, and Amgen has relatively high exposure to Medicare for its sales. This is likely why Amgen cut its Repatha prices by 60% for Medicare patients in 2018, and why that drug’s sales rose 72% (to $550 million) despite volumes rising 90% in the U.S.

This highlights the risk that even if drug volumes are strong, future margins on such medications are far from guaranteed should regulators change the current drug reimbursement rules. In its 2018 annual report, the company warns that “CMS has indicated interest in testing new models for drug payment in Medicare Part B and Part D” which could negatively affect its future earnings power.

The FDA is also attempting to accelerate the process for bringing biosimilars to market. While Amgen has set itself up to potentially benefit from this trend, there is no telling how successful its own biosimilar versions of other drugs will be. What’s more certain is that the company’s aging portfolio of biological drugs is likely to see significant sales declines should the pace of biosimilar competition continue to accelerate.

Basically, the drug industry, while blessed with the ability to generate substantial cash flow (patent protection on wildly profitable drugs), is also a byzantine world of uncertainty and unpredictable challenges in actually bringing drugs to market (e.g. drug trial failures) or maintaining market share once they get there.

As a result, the drug industry tends to be characterized by highly volatile earnings and is generally not necessarily a great place for conservative income investors to consider. Our preference is to focus on the select few companies that have very diversified portfolios, excellent financial health, and a track record of conservative capital allocation. Johnson & Johnson (JNJ) and Pfizer (PFE) are two examples.

Closing Thoughts on Amgen

The biotech industry is one that many investors put firmly in the “too hard” box, which is understandable. Even for industry leaders with long track records of solid growth and innovation, such as Amgen, there are numerous risks that are hard to quantify (patent losses, regulatory changes, biosimilar competition, etc.). Amgen’s drug concentration is difficult to get comfortable with as well, despite being smaller than some major rivals (like AbbVie’s).

With that said, Amgen appears to be one of the best and most profitable biotechs in the industry. The company’s strong cash flow, substantial cash position, and large development pipeline should continue to allow it to reward dividend investors with secure and growing payouts.

However, it’s worth repeating that these types of companies are just too complex and risky for most conservative income investors who value capital preservation, even if their dividends look quite safe.

Investors who have a higher risk tolerance and are willing to deal with the volatile nature of the biotech sector should also be sure to size their positions accordingly and only buy at valuations that provide compensation for the risks associated with the industry’s challenging business model.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends