If this wobbly market has you parked on the sidelines, worrying the big 2019 rally might evaporate at any second, I have good news: this is still a great time to buy.

But you need to buy carefully if we want to maximize our upside (and protect ourselves from a 2008-style meltdown).

Top-quality closed-end funds (CEFs) handing you dividend cash that more than doubles (and in many cases more than triples) what your typical S&P 500 stock pays.

I’ll give you three solid CEF picks (selling at fire-sale prices up to 23% off) at the end of this article.

These three bargain funds give you a great setup, no matter what happens with this trade-obsessed market: if stocks do pull a 2008 repeat, these CEFs’ huge discounts will limit their downside.

And if stocks rip higher, investors will pile into these three absurdly cheap deals, lighting a fire under their share prices.

Either way, you’ll still collect these CEFs’ outsized dividend payouts, with yields up to 6.9%!

And despite the worrying headlines we’re seeing these days, I still see plenty more upside in this market. Let’s dive into why.

Earnings Are Down—and That’s Good News

Here’s the strange thing about the first-quarter earnings season (which, behind all the breathless headlines about tariffs and interest rates, is still rolling along): earnings are down 0.8%.

Let me explain why this small piece of (seemingly bad) news is actually a win in disguise.

Analysts went into the quarter expecting S&P 500 profits to fall 3.9%. But then those expectations were upgraded again (and again), until they narrowed to 0.8%. With about 20% of S&P 500 companies yet to report, we could actually wind up with profits higher than a year ago.

If you want to see why earnings were expected to fall at all, just look back to 2018.

In the first quarter of that year, corporate profits surged 25%. That’s obviously unsustainable, yet 25% growth continued in the second quarter and was nearly as high in the second half of 2018.

In short, 2018 was one of the strongest earnings years in history—and it was also the year that stocks saw their first bear market in a decade.

I spotted this “earnings-up, stocks-down” disconnect in late 2018, when I recommended that investors move into the then-oversold market. Here’s how stocks have performed since 2019 kicked off:

Stocks Catch Up to Profits

Now let’s move on to what’s driving this economy now (hint: it’s not trade) to see why I’m still bullish on stocks for 2019.

Businesses Start Spending

Besides strong profit growth, there are other factors pointing to further market gains. For one, the US saw 3.2% annualized GDP growth in the first quarter of 2019, smashing expectations of 2%. Some economists were even whispering of negative GDP growth at the start of this year, so the 3.2% number was a big shocker for the bears.

Now it is true that some details in the GDP growth showed weakness, like consumer spending growth of just 1.2%. So let’s take a closer look at that.

One thing to bear in mind here is that first-quarter consumer spending is largely dependent on tax refunds, which were delayed this year due to the government shutdown. What’s more, other things, like a late Easter and low inflation (a 1.6% rate in the first quarter, down sharply from 2.5% in 2018), resulted in lower consumer spending.

In other words, seasonal noise means it’s hard to take the consumer-spending figure as too significant a warning sign.

And here’s another overlooked detail: rising investment and business spending, which is offsetting lower consumer spending and, more importantly, setting the table for stronger consumer spending as companies hire more, pay employees more and so on.

Finally, S&P 500 companies notched outsized 5.2% sales growth in the first quarter, again beating of expectations. As long as sales growth continues (and keeps flowing through to higher profits) there are fewer arguments the permabears can use to make investors scared.

3 “Profit Either Way” Funds Yielding Up to 6.9%

Unfortunately, the 2019 market runup means there are fewer deals for us to buy to profit from the bears’ misguided fears about the economy (even with last week’s pullback). With the SPDR S&P 500 ETF (SPY) already up 15%, where can we go?

The answer is simple: CEFs.

Unlike ETFs, CEFs can—and often do—trade at a discount to net asset value (NAV, or what their underlying stock portfolios are worth).

We don’t have to get into the fine details on that—these discounts basically mean that when you buy through a CEF, you can get, for example, shares of Apple (AAPL), Microsoft (MSFT), Johnson & Johnson (JNJ) and Berkshire Hathaway (BKR.A, BRK.B) for less than you could buy these stocks individually.

That makes CEFs a perfect place to bargain-hunt after a market surge like we’ve seen this year. And as I said earlier, there are three particularly cheap high-yield CEFs that are more than deserving of your attention now.

CEF Pick No. 1: A 6.7% Dividend for 23% Off

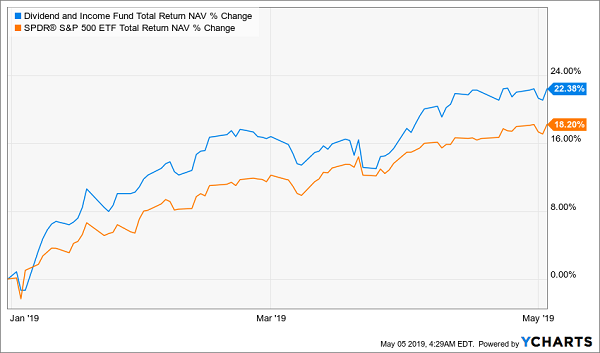

The first is the 6.7%-yielding Dividend and Income Fund (DNI), which trades at a huge 23.2% discount to NAV, despite holding a lot of strong mid-cap and large-cap companies like Broadcom (AVGO), Intel (INTC), Tyson Foods (TSN) and Walt Disney Co. (DIS). One thing I like about DNI is how its portfolio has outperformed the index fund in 2019:

DNI: A (Still-Cheap) Market Dominator

Yet despite that outperformance, you can still buy DNI for much less than its “true” value. This is the beauty of investing in CEFs—especially in times like these.

CEF Pick No. 2: Last Chance for This Outrageous 16.7% Discount

Another heavily discounted option is the Boulder Growth & Income Fund (BIF), a 3.6% income payer whose focus on bargain-priced large caps has helped it post strong returns in the long run. But BIF’s biggest holding, Warren Buffett’s Berkshire Hathaway, is up less than the broader market this year, and that’s kept BIF trading at a wide 16.7% discount to NAV.

Berkshire Gives Us Our In

Don’t let this seeming underperformance fool you. As you can see above, the reason why Berkshire is up less than the S&P 500 for 2019 is because it fell less than the market in late 2018. That’s left he stock with less “snap-back” upside to deliver, though Berkshire has topped the market many times in the last 16 months. This temporary lag in BIF’s top holding is keeping the fund’s “discount window” open (for now).

CEF Pick No. 3: A 7% Dividend Set to Rise

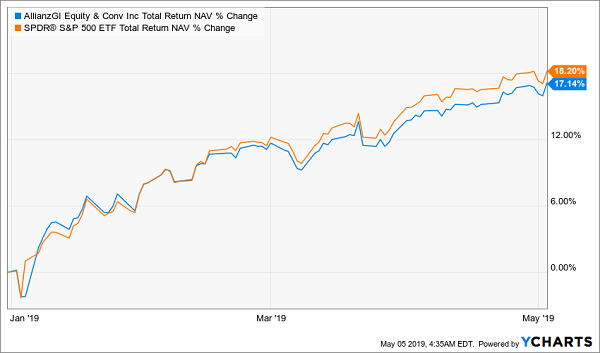

Finally, another absurdly cheap fund is the AGIC Equity & Convertible Income Fund (NIE), which trades at an 8.1% discount, despite holding top-notch firms like Visa (V), Amazon (AMZN) and Adobe (ADBE). NIE’s carefully diversified portfolio has helped it closely match the broader market’s returns in 2019:

Solid, Steady Gains

But what’s even better is the income stream. NIE yields an outsized 6.9%, thanks to its combination of convertible bonds and stocks.

Let me leave you with this: NIE’s huge dividend has held steady for a decade—and actually went up in 2014. With the high returns the fund has seen lately, don’t be surprised if its already-massive payout takes another step up in the coming months.

— Michael Foster

Forget a 6.8% Yield: Grab This Life-Changing 8.4% Payout Now [sponsor]

Here’s something else you should know about CEFs: a 6.9% yield is actually on the low end of these funds’ dividend payouts!

Consider the 4 ideal retirement plays I’ve discovered, and will share with you when you click right here.

These 4 incredible funds give you something truly unique in these income-starved times: a safe 8.7% dividend yield!

And this is just the average payout you’ll get from these 4 stout income plays. One of them even yields an amazing 10.7%. So if you were to drop $100K into this one fund, you’d get $10,700 back, every year, in CASH.

Less than 10 years from now, you’ve recouped your entire investment in dividends alone! That’s right: once you’ve covered off your initial buy in dividends, every gain (and dividend) check) you clock from that day onward is pure profit.

I can’t think of a safer scenario than that!

I can’t wait to show you this 10.7%-paying income play and the three other funds in this powerful “4-buy” retirement portfolio. Thanks to these 4 CEFs’ outsized 8.7% average yield, you’d pull in $43,500 in dividends alone on, say, a $500K investment.

That could very well let you retire early—and not have to sell a single stock in your portfolio during your golden years!

Now is the perfect time to buy these 4 dynamic funds, while they’re still going at bargain prices. Click here to get these 4 funds’ names, tickers, current yields and everything else you need to know before you buy.

Source: Contrarian Outlook