I’m worried about this levitating market. And today I’m going to show you why you need to keep a close watch on your nest egg (and your dividends), too.

Here’s what sets my strategy apart: we’ll grow your nest egg and your dividend income while building in the downside protection you’ll need in the months ahead.

(I know that sounds contradictory, but I assure you it’s true. I’ll explain.)

A “Groundhog Day” Market

My worry is rooted in one date: January 26, 2018. That’s when stocks first broached today’s levels.

Here’s what happened next:

If at First You Don’t Succeed …

I know I don’t have to tell you what happened a few months later, the next time the S&P 500 tried to heave itself into all-time-high territory.

Try Again …

Consider also that this was jump (and crash) came with earnings on a sugar high, thanks to the Trump tax cuts.

Today? It’s déjà vu all over again.

… And Again

So are we about to tip over the edge one more time? It’s a strong possibility.

For one, according to FactSet, as of April 23, companies that had reported first-quarter earnings were showing a 3.9% decline in profits. (And you should take many of the positive earnings surprises you read about with a grain of salt; companies and analysts are famous for setting the bar low.)

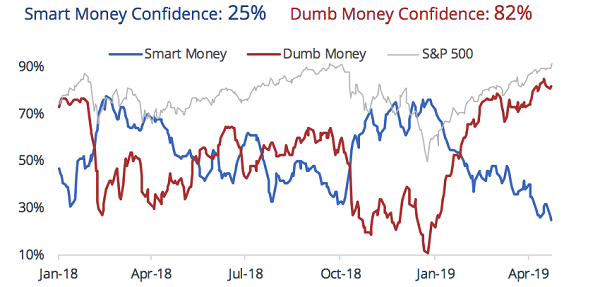

Second, as you can see in the chart below, the “dumb money” hasn’t been this enthusiastic about further market gains since—you guessed it—January 2018! I just showed you what happened then, but you can see the instant replay in this chart.

Source: Sundial Capital

Source: Sundial Capital

By the way, when I say “dumb money,” I’m talking about most individual investors—folks who tend to buy into market highs due to fear of missing out. Savvy contrarians like us, as well as professionals, tend to buy the dips.

Throw in the fact that we’re almost in the May-through-November period, when stocks are known to struggle (hence the phrase “sell-in-May-and-go-away”), and the stars are aligned for a summer pullback.

How I’m Investing Now

With that in mind, you might be surprised by what I’m going to say next: I’m still buying stocks—and you should be, too. Because we need to keep your nest egg growing and your dividend checks coming. So stuffing cash under the mattress is not the answer.

But we’re not going to follow the “buy and hope” crowd—which blindly buys overhyped, low-yielding stocks (I’m looking at you, Dividend Aristocrats), then “hopes” for gains. Instead, we’re going to focus on elite payers throwing off dividends of 7% and up.

Think about that for a moment: at a 7% yield, you’re getting the market’s average historical yearly return (also around 7%) right out of the gate—in cash, no less.

“Sure,” you’re probably thinking, “but that high yield doesn’t help much if the market freaks out and the underlying stock drops 20%.”

Absolutely right. And I’ve got you covered there, too.

A Classic “Pullback-Proof” Play in Action

Consider one of my favorite “pullback-proof” stocks: real estate investment trust (REIT) Omega Healthcare Investors (OHI), payer of a 7.4% dividend and a long-time holding in my Contrarian Income Report service’s portfolio.

With 909 healthcare facilities—mainly senior-housing and skilled-nursing facilities—across America, OHI’s business is so sleepy it makes the most cautious investor’s eyes dry! You can see it in the stock’s beta rating, a measure of volatility: at 0.498, OHI is half as volatile as the market—and its volatility recently fell by 50%:

Boring Is Better

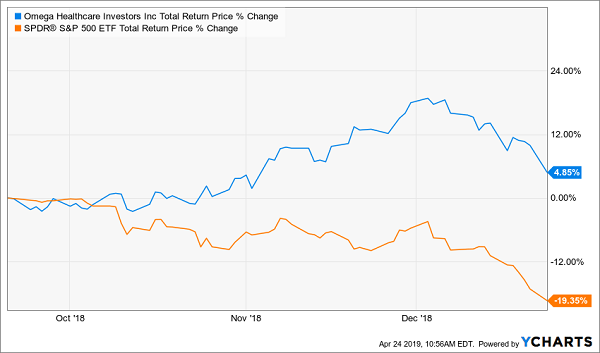

How did OHI hold up in the autumn downturn? On a price basis, shareholders actually made money, while the “buy and hope” crowd took a big hit:

Imagine Holding This Stock Last Fall

When you add the dividend payout OHI investors pocketed during the collapse (and the tiny payout from SPY, not that it makes much difference), things get even better:

Dividends Widen OHI’s Lead

Your “Pullback-Proof” Checklist

The bottom line is that OHI give us our “pullback-proof” blueprint: when it comes to stocks that soar when the market tanks, we want the following:

- High yields, because investors always flee back to dividend payers when markets get rough. With REITs like OHI, I demand safe payouts of 6%+.

- Bargain valuations: when we bought OHI in August 2015, it traded for less than 10-times cash flow.

- Low beta: with a beta of just 0.498 (and bear in mind a beta of 1 means a stock matches the market in volatility), OHI gives us plenty of cushion when markets whipsaw.

— Brett Owens

NEW: The 5 Best “Pullback-Proof” 7.5% Dividends [sponsor]

The 3 steps above are easy for you to use yourself, but you really don’t have to, because I’ve done the legwork for you.

The result: the 5 stocks in my new “Pullback-Proof” income portfolio. My team and I have scoured the market to come up with these 5 safe income plays, which are purpose-built to hold their own in the next market tsunami.

Like OHI, these 5 new picks give us two critical things:

- A rock-solid (and growing) 7.5% average dividend—one of these 5 sturdy income plays even yields an incredible 8.5% today!

- A share price that doesn’t crumble beneath your feet while you’re collecting these massive payouts. In fact, you can bank on 7% to 15% yearly price upside from these 5 “steady Eddie” picks.

One more thing about that 8.5%-payer I just mentioned: look at how it performed on a price basis (not even including that massive 8.5% cash payout) in 2018—a year most folks would rather forget:

A “Pullback-Proof” Superstar in Action

This is the kind of performance all 5 of these high-yield plays are poised to deliver. I’m ready to share the details on each one with you now.

Source: Contrarian Outlook