Boeing (BA) reported first-quarter earnings this [week], telling investors it was withdrawing its 2019 financial guidance and suspending its share repurchases.

Such an announcement usually spells bad news for a stock and its dividend safety prospects, yet shares of Boeing finished the day higher by 0.4%.

This was the company’s first earnings report following that news, which we previously discussed.

The 737 MAX is a critical business driver for Boeing.

The popular plane series is expected to account for about two-thirds of the company’s future deliveries and approximately 40% of the firm’s total profit, according to analysts estimates.

Let’s review what management had to say and how it could affect Boeing’s dividend safety going forward.

Uncertainty Lingers But Boeing’s Dividend Continues to Look Safe

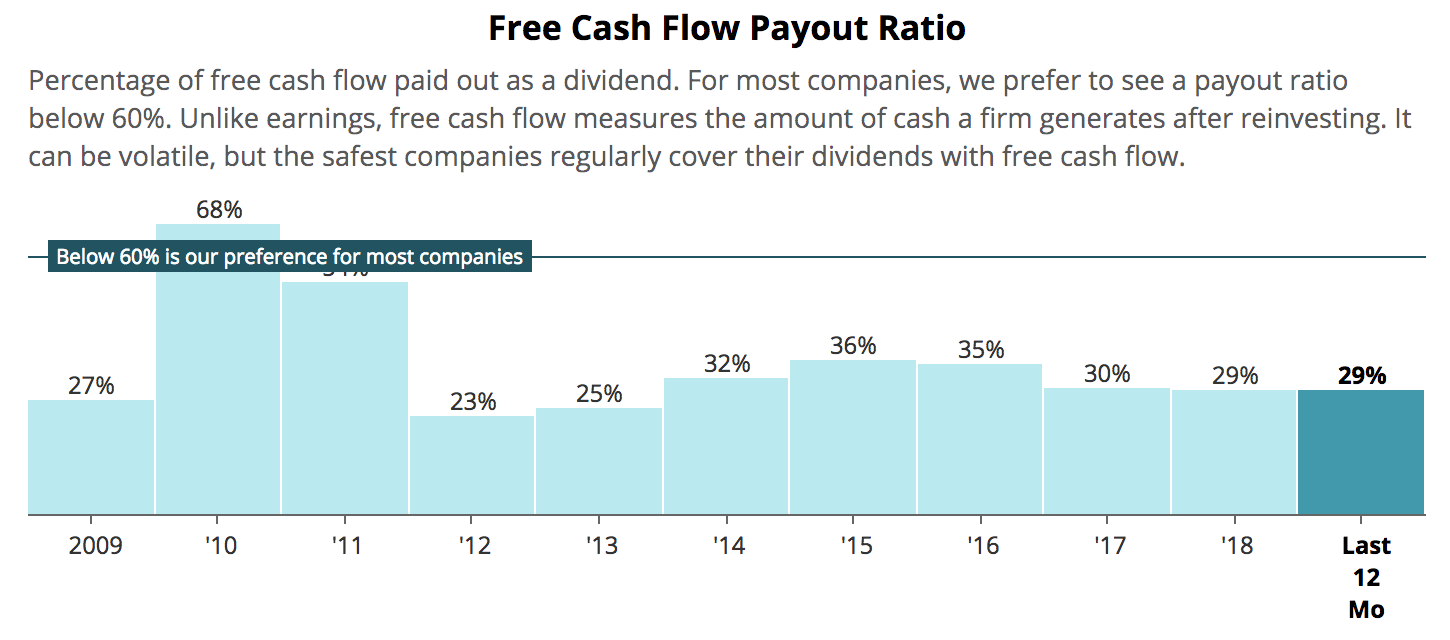

At first glance, it may seem unthinkable that an event like this could ever possibly threaten Boeing’s dividend. After all, the company boasts a low free cash flow payout ratio near 30%, has a massive backlog, and maintains an A credit rating from Standard & Poor’s.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

However, some investors worry that Boeing could face a liquidity crisis. The company’s planes are incredibly costly to manufacture, and with its most important plane model grounded, Boeing can only deliver so many aircraft to its customers.

The risk is that Boeing has to continue investing a substantial amount of money to keep its factories running as it builds out its fleet, but it can’t deliver these planes to customers, resulting in a costly inventory buildup as it burns through cash without being able to collect payments for its finished aircraft.

Due largely to its inability to deliver planes to customers, on April 5, 2019, Boeing announced plans to reduce its 737 production rate from 52 aircraft per month to 42 per month. The resulting impacts have increased its costs to produce aircraft, putting downward pressure on the firm’s profitability and cash flow.

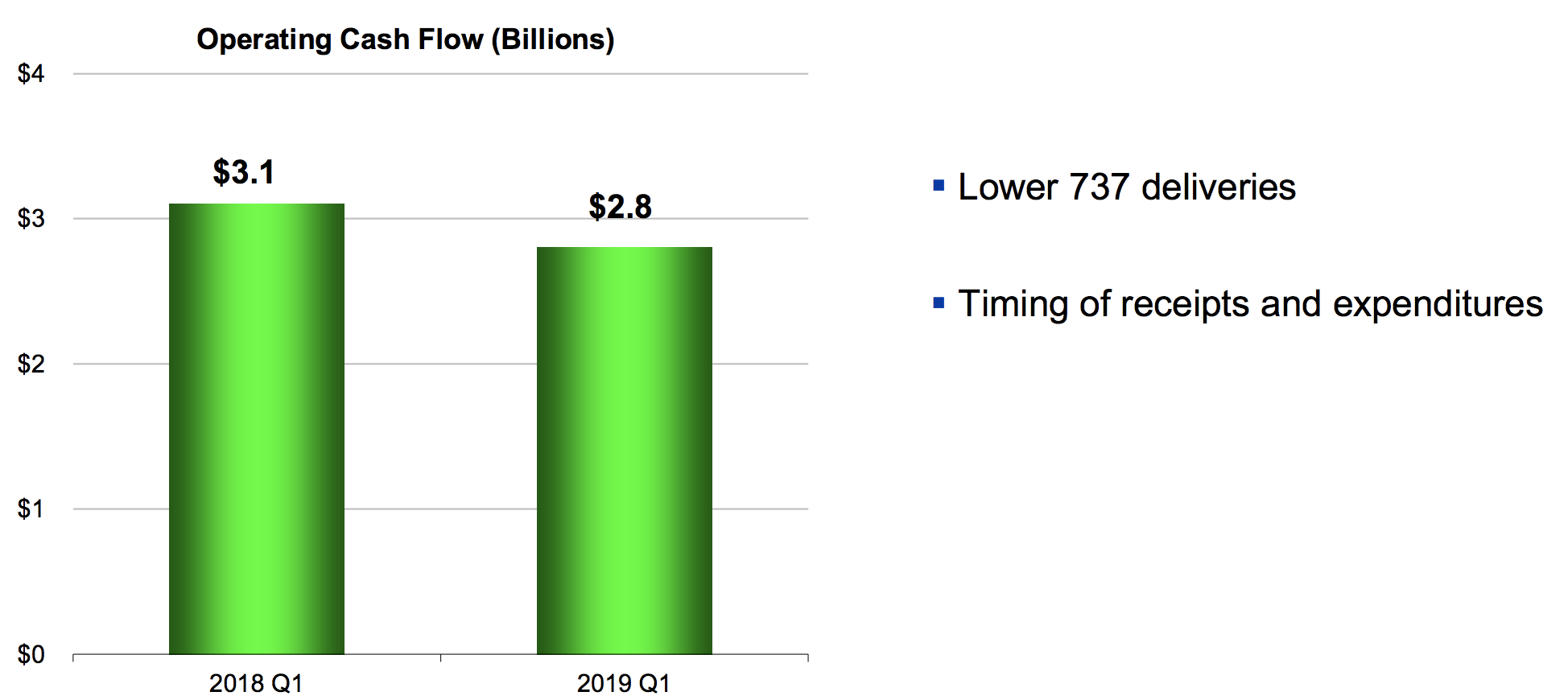

Source: Boeing Earnings Presentation

Source: Boeing Earnings Presentation

The longer Boeing is unable to deliver its 737 planes, the lower its delivery payments and cash flow will trend in the upcoming quarters. The company’s most important driver is the timing of when the 737 will gain regulatory approval to return to service.

From there, Boeing can ramp up deliveries once its airline customers are positioned to accept its planes, and then the company can improve its 737 production rate again.

Those factors will all determine Boeing’s cash expenditures in the quarters ahead. However, with no known timeline regarding when the 737 MAX can safely return to service, management pulled guidance for the year:

“Given the dynamic of 737 MAX return-to-service timeline in activities, we are not in a position today to provide a forecast of the impacts of the 737 MAX grounding on our full year 2019 financials. We will provide you with an update of full year 2019 financial forecast when we have clarity on return to service of the MAX fleet, our production plans, delivery ramp-up profile, and corresponding financial impacts.”

The big question is how quickly the current 737 MAX grounding can be resolved. The longer it drags on, the more financial pressure that will mount.

The good news is the situation could be resolved within the next six months. Boeing said its test pilots have “completed over 135 flights, totaling more than 230 hours of airtime with the software update” that fixes a shared issue which contributed to both fatal crashes.

Boeing completed its technical engineering flight test last week, and the next step is a certification flight under the Federal Aviation Administration’s (FAA) authority. Management said they are working with the FAA “right now to prepare for that in the near term.” Once that’s complete, global regulators will need to come together with the FAA to approve the 737’s worldwide return to service.

Investors were likely encouraged by Boeing’s expectation to hit some of these important milestones in the “near term,” as well as management’s confidence in the anti-stall software update and the 737 fleet’s overall safety profile:

“We know exactly how the airplane was designed. We know exactly how it was certified. We have taken the time to understand that. That has led to the software update that we’ve been implementing and testing, and we’re very confident that when the fleet comes back up, the MAX will be one of the safest airplanes ever to fly.” – CEO Dennis Muilenburg

Even more encouraging, earlier this week Reuters reported that Boeing told some of its customers that it was hopeful the FAA would approve its software as soon as the third week of May, with the grounding being lifted around mid-July. At that point, Boeing could return to producing 52 airplanes per month.

Two of the largest operators of the 737 MAX, Southwest Airlines and American Airlines, have also only pulled the plane from their schedules until August, according to Bloomberg. Supposedly Boeing’s suppliers were informed production would ramp up by September as well, so there are numerous signs suggesting this issue could be behind the company within six months.

In that case, while it’s never easy to ballpark the financial impact of situations like these, Boeing’s health and dividend safety profile should remain solid.

In the first quarter management booked $1 billion of additional costs related to Boeing’s reduced production rate, and unspecified charges were incurred related to the software update and related pilot training. Yet Boeing still generated $2.8 billion in cash flow from operations, compared to its quarterly dividend payment of $1.2 billion.

While the 737 MAX is a critical driver, on the earnings call management noted that the company is larger and more diversified today than it was 10 years ago, helping it work through this challenge.

More specifically, Boeing’s Global Services and Defense, Space & Security segments each grew revenue and expanded margins last quarter. Annualizing their results, these divisions are on pace to generate $6 billion in full-year operating profits, which is more than the cost of Boeing’s $4.8 billion dividend.

Boeing also has $7.7 billion in cash and marketable securities on hand, and its credit facility has unused capacity of $5.1 billion. With the company’s A credit rating recently reaffirmed as well, Boeing should have ample capacity to take on more debt if needed.

In its quarterly report filed with the SEC, Boeing notes that its ability to issue debt and access external capital resources should be “sufficient” to satisfy its short-term and long-term needs:

“In the event we require additional funding to support strategic business opportunities, our commercial aircraft financing commitments, unfavorable resolution of litigation or other loss contingencies, or other business requirements, including impacts related to the 737 MAX grounding, we expect to meet increased funding requirements by issuing commercial paper or term debt.

We believe our ability to access external capital resources should be sufficient to satisfy existing short-term and long-term commitments and plans, and also to provide adequate financial flexibility to take advantage of potential strategic business opportunities should they arise within the next year…When considering debt covenants, we continue to have substantial borrowing capacity.”

Simply put, Boeing’s solid cash flow from other parts of its business, strong balance sheet, and ability to pull additional levers to raise funds appear to be enough for the company to comfortably maintain its dividend as it works through this challenging time, at least for several quarters.

However, Boeing is not out of the woods yet. We should know a lot more over the next three months. If global regulators take longer to sign off on Boeing’s software fix than the company expects, delaying the resumption of 737 MAX deliveries, then Boeing’s cash burn will require further analysis.

For now, the market’s calm reaction to Boeing’s report appears to be reasonable. We will continue monitoring the situation to ensure that the grounding is indeed shaping up to be temporary rather than longer term in nature.

— Brian Bollinger

Marc Lichtenfeld - Author of the best-selling book Get Rich With Dividends – is giving away his Ultimate Dividend Package... Free of charge! Click Here to Get His #1 Dividend Stock... The Safest 8% Dividend in the World... Top Three "Extreme Dividend" Stocks, And Much, Much More.

Source: Simply Safe Dividends