Dividend growth stocks have historically been one of the best ways to grow income and wealth over time. In fact, over many decades of saving and compounding, a well-designed dividend portfolio can grow into millions or even tens of millions of dollars.

But that creates the potential for complexities when it comes to estate planning, including tax issues for any heirs inheriting stocks and investment accounts.

Let’s take a look at what you need to know about the estate tax on stock and dividends, including who needs to worry about this issue and what strategies can be utilized to minimize the tax bill.

General Estate Tax Rules

The estate tax is “a tax on your right to transfer property at your death,” according to the Internal Revenue Service. When you pass on your assets to someone, the government wants to potentially take a cut of the value of your estate.

The fair market value of each item is used to calculate an estate’s gross value.

Fortunately, very few people have to pay federal estate taxes thanks to the lifetime exclusion rule.

This rule allows every individual and married couple to inherit a certain amount that is not subject to the 40% federal estate tax.

Before tax reform this exclusion amount was $5.6 million per person or $11.2 million per couple.

However, tax reform significantly increased this amount. Between 2019 and 2025, individuals and couples will be able to inherit up to $11.4 million and $22.8 million, respectively, tax free.

The exclusion amount is adjusted for inflation each year, so it generally rises about 2% annually. Once the Trump tax cuts expire at the end of 2025, the exclusion amount will decline back to about $5.7 million per individual and $11.4 million per couple, though it will be somewhat higher due to inflation adjustments.

What does the generous size of the lifetime exclusion rule mean for most people?

Before tax reform passed, the total number of estates affected by federal inheritance taxes was just 5,500 (0.2% of all estates). Through 2025 under the doubled exclusion limits, the Tax Policy Center estimates that just 1,700 estates (0.06%) will be affected.

However, even if you expect to be well under the federal exclusion limit, you may still need to give some thought to estate tax planning. Certain states have their own very different estate tax laws.

State Inheritance Taxes

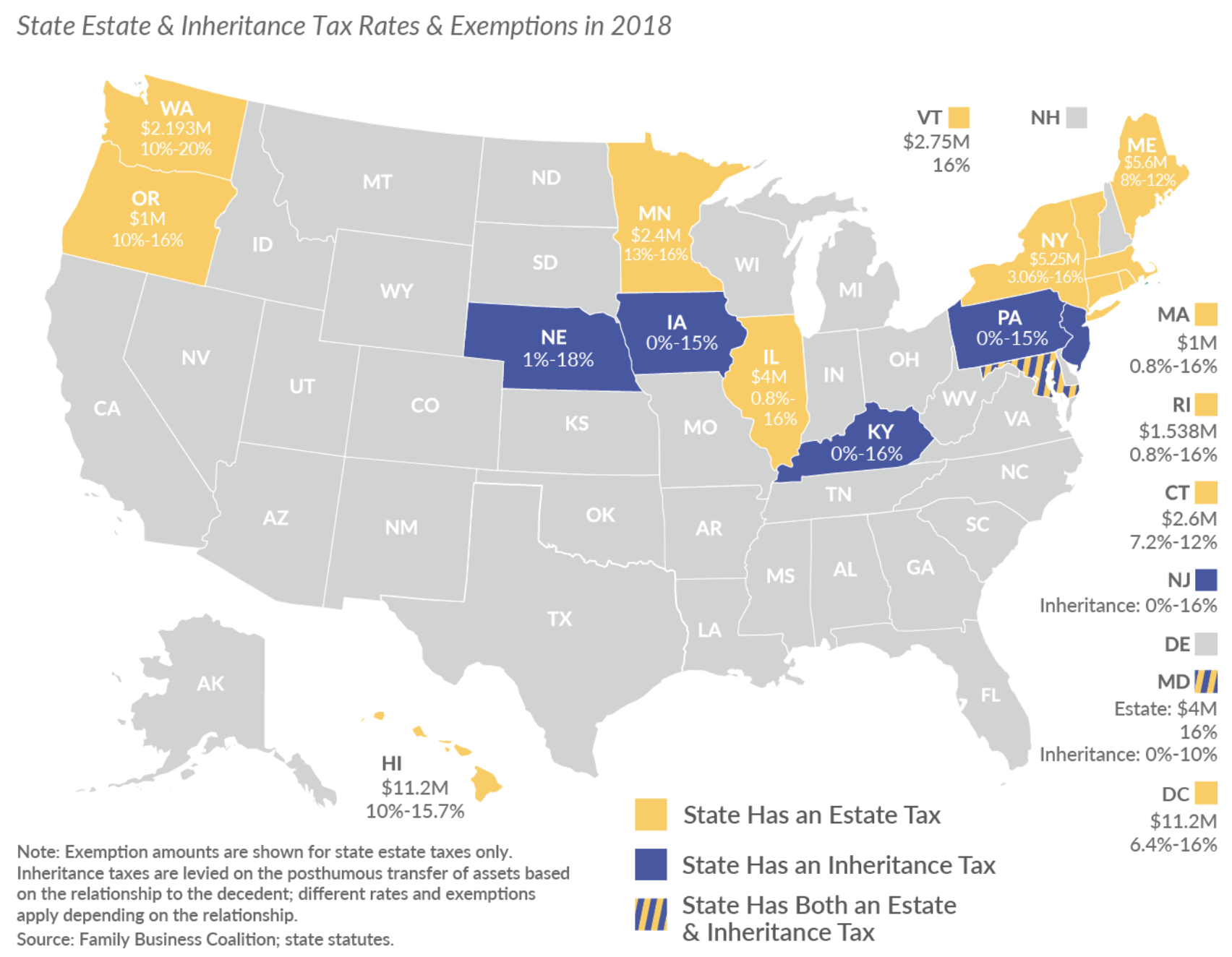

Currently 17 states and the District of Columbia have some form of estate or inheritance tax. Like with the federal government, you only pay taxes on estate values above each state’s exclusion limit.

Source: Tax Foundation

Source: Tax Foundation

Fortunately, most estate and inheritance taxes at the state level are much lower than the maximum 40% federal rate. The bad news is that almost all states have far smaller exclusions than the federal exclusion limit.

Some states, such as Nebraska and Iowa, even tax all inheritances from the first dollar. This means that if you are likely to leave behind a large estate you will want to sit down with a fee-based fiduciary financial planner to determine the best course of action when it comes to minimizing estate or inheritance taxes.

Estate Tax on Dividends and Income

Many people may not know that an estate actually owes two types of taxes. While we have covered the the estate tax on the transfer of assets from the decedent to their beneficiaries and heirs, the dividend and investment income an estate generates can also result in a tax liability.

When someone dies, their assets immediately become property of their estate. If your estate includes investments such as dividend stocks, bonds, CDs, and rental property, which all generate income, then the estate may need to file an estate income tax return.

This issue arises when an estate earns income after its owner dies but before its assets are distributed to its beneficiaries. If the estate earns at least $600 in annual income during this period, then it must obtain a tax ID number from the IRS and file Form 1041, an income tax return. Estates in this situation generally need to make quarterly estimated income tax payments as well.

Importantly, a decedent’s estate can claim an income distribution deduction for distributions it makes to the estate’s beneficiaries. If an estate paid out all of the dividends it earned to its beneficiaries, for example, the beneficiaries would receive a K-1 stating their share of the income that they must include on their personal tax returns.

Once the beneficiaries receive the estate’s assets, the estate is terminated and the beneficiaries are responsible for any taxes on income the assets generate.

The bottom line is that dividends can trigger an estate income tax that you need to be aware of, even if your gross estate value is otherwise under the federal exclusion limit. Distributing any estate income earned to beneficiaries passes on the tax liability and could be a more convenient approach, but every situation is different. Once again, you may want to seek advice from a financial planner.

Now that we have a broad idea of how estate taxes work, let’s take a look at the most important things most people need to know about how inherited stocks and dividend-paying investments work.

Inherited Investments and the Step Up Rule

The good news is that when it comes to inheriting investments, including stocks, bonds, and mutual funds, there is something called the “step up” rule that helps reduce the tax burden on long-term investments.

Note that this discussion applies to capital gains taxes and not estate taxes, which are treated as a separate tax by the IRS. Even if you do not face estate taxes, the step up rule can affect you if the estate has investments.

The step up rule basically means that you only pay capital gains taxes on the increase in value of an investment (stocks, bonds, mutual funds, property, capital assets owned by businesses, etc.) since the date of death of the person leaving you the investment. Following tax reform, 2019 long-term capital gain rates look like this:

Source: MarketWatch

Source: MarketWatch

Note that the long-term capital gains tax rate is usually much lower than either marginal income tax rates, or federal estate taxes. Here’s an example to see how investment inheritance works under the step up rule.

Suppose a family member bought $10,000 worth of stock 20 years ago and you inherit it. When they died the stock was worth $40,000 and since then has appreciated further and is now worth $45,000.

Under current tax law your cost basis on these inherited shares would have “stepped up” from $10,000 to $40,000 because that was their fair market value on the date the person died.

Most Americans are either in the 0% or 15% long-term capital gains tax bracket. So if you then sell these inherited shares, your capital gains tax bill will be either 0% or 15%, but only on $5,000 of increased value since the person died.

Note that for people with very large estate there is a tax rule that allows the cost basis step up to be pushed back up to six months after the date of the person’s death. If the investment appreciates significantly over this time, then the tax savings become greater.

Income derived from dividend stocks, mutual funds, or bonds you inherit will still face their usual tax treatment. This article provides an in-depth guide to dividend taxes under the current tax code.

The step up rule was created by Congress to make paying taxes after inheritance easier. That’s because calculating the adjusted cost basis of shares bought decades ago, and potentially affected by dividend reinvestment plans, can be extremely difficult or even impossible if the data isn’t available. While the step up rule is a great benefit for most inheritors, there are two important issues to keep in mind.

First, the step up rule only applies to investments held in taxable accounts. The good news is that while retirement accounts like 401(k)s can be inherited tax free, any distributions from these accounts (money taken out) will be considered taxable income and taxed at the marginal income tax rates below (for 2019).

Source: MarketWatch

Source: MarketWatch

Heirs can hold off on withdrawing from retirement accounts for a while, but eventually required minimum distributions will kick in and create a tax bill.

Second, the rule only applies to assets (stocks, bonds, mutual funds, property) that was legally part of an estate. It doesn’t cover investments that were gifted to you or held in a grantor retained annuity trust that hadn’t expired by the time of the person’s death. For investments that you receive as gifts, your cost basis will match the cost basis of the person who originally bought them.

Why would someone gift you investments or set up a grantor retained annuity trust if it could potentially minimize the effectiveness of the step up provision? Because these are two of the most popular ways to minimize estate taxes.

Strategies for Reducing Estate Taxes

There are several ways that wealthy individuals can minimize the estate taxes their heirs will pay. Under current tax law, individuals and couples can give away $15,000 and $30,000 per year, respectively, to as many individuals as they want, tax free.

This lowers the value of your estate by the gifted amount. For example, a couple could give $30,000 to 10 individuals per year for 10 years and thus reduce their estate value by $3 million. Their future heirs could thus benefit from these gifts (including cash) and then face a potentially much lower tax bill.

Besides gifts, you can reduce the value of your estate and avoid taxes on any money you pay for an individual’s qualified expenses for tuition or medical bills. The catch is that you must make these payments directly to the educational institution or medical provider, not to the individual receiving the benefit.

There’s also something called a grantor retained annuity trust, or GRAT. This is an irrevocable trust that allows wealthy individuals to pass on potentially large amounts of money to future heirs above the annual tax free gift contribution limits.

The way it works is that you contribute certain assets to a GRAT that is locked up for a fixed amount of years. You retain the right to receive the original value of the asset back, plus a certain rate of return based on the IRS’s Rule 7520 (typically about 3% per year). When the GRAT expires you get back your original asset value plus allowed returns, and the remainder then goes to your beneficiaries tax free.

The key benefit to GRATs is that it can freeze the value of your estate and minimize the tax burden of your heirs. For example, say you have an estate worth $25 million that you expect to appreciate by $5 million over the next three years. You can set up a GRAT (using a certified financial planner) to transfer this $25 million into that trust. After three years you can get the $25 million back and the vast majority of the excess $5 million growth in value can be go to your future beneficiaries tax free.

Concluding Thoughts on Estate Taxes

Estate planning is challenging, especially thanks to the complexity of our tax code. Fortunately most people’s estates won’t be affected by federal estate taxes due to incredibly high exclusion limits.

At the state level whether or not your heirs will face a tax bill depends on the state you live in since over a dozen of them have their own unique estate and inheritance tax laws. Meanwhile, dividend and other investment income an estate generates can result in an estate income tax filing requirement, depending on when the assets are transferred to their designated beneficiaries.

If you are concerned about your heirs facing large inheritance taxes, then it’s well worth sitting down with a fee-based fiduciary financial advisor to go over your estate’s potential tax bill. They can help you map out a plan to potentially minimize estate taxes and account for the current higher federal exclusion limit that runs through 2025 by making annual gifts to future beneficiaries, covering qualified education and medical expenses for others, setting up a grantor retained annuity trust, and considering charitable donations.

— Brian Bollinger

The best way to earn monthly income is NOT a stock, bond or option... Rather, it's this little-known alternative investment. CLICK HERE TO FIND OUT MORE.

Source: Simply Safe Dividends