Tax-deferred retirement accounts like IRAs and 401(k)s serve as an essential part of most people’s long-term savings plans. While these are powerful tools, they also come with some tax complications after investors reach a certain age due to required minimum distributions, or RMDs.

Let’s take a closer look at the complications posed by RMDs, as well as the suitability of using dividend stocks to meet these requirements. We’ll also examine some other RMD funding options that may appeal to investors.

Brief Overview of RMDs

IRAs and 401(k)s were set up by Congress to make it easier for people to save for retirement. These accounts incentivize higher savings rates since contributions made to them are tax deductible.

Starting the year after you turn 70½ years old, each year you’re required to withdraw a certain minimum amount from your retirement accounts (doesn’t matter which ones). The withdrawal amount is based on the IRS’s uniform lifetime table pictured below, which is an actuarial table designed to balance annual withdrawals with your remaining life expectancy by age.

The way the formula works is that you take the value of all your applicable retirement accounts each year, and then divide that by the distribution period, which falls steadily with each passing year.

Source: IRS

Source: IRS

For example, the first RMD, at age 70½, is for 3.6% (1 / 27.4) of your total retirement savings in IRAs and 401(k)s (not Roth IRAs). By age 115 and up, the RMD grows to 52.6% (1 / 1.9) of your applicable retirement account values.

RMDs are taxed at your top marginal income tax rate which looks like this for 2019:

Source: MarketWatch

Source: MarketWatch

Note that RMDs are added to your adjusted gross income for tax purposes each year, and thus can push you into a higher tax bracket. As a result, accounting for RMDs is an important part of tax preparation and overall budgeting during retirement.

If your retirement accounts are large enough, your RMDs can eventually become substantial and thus result in surprisingly large tax bills due each April if you haven’t planned for them correctly.

Now that we have a general idea of the dilemma RMDs pose to retirees, let’s take a look at the pros and cons of using dividends to cover RMDs.

The Pros and Cons of Using Dividends to Fund RMDs

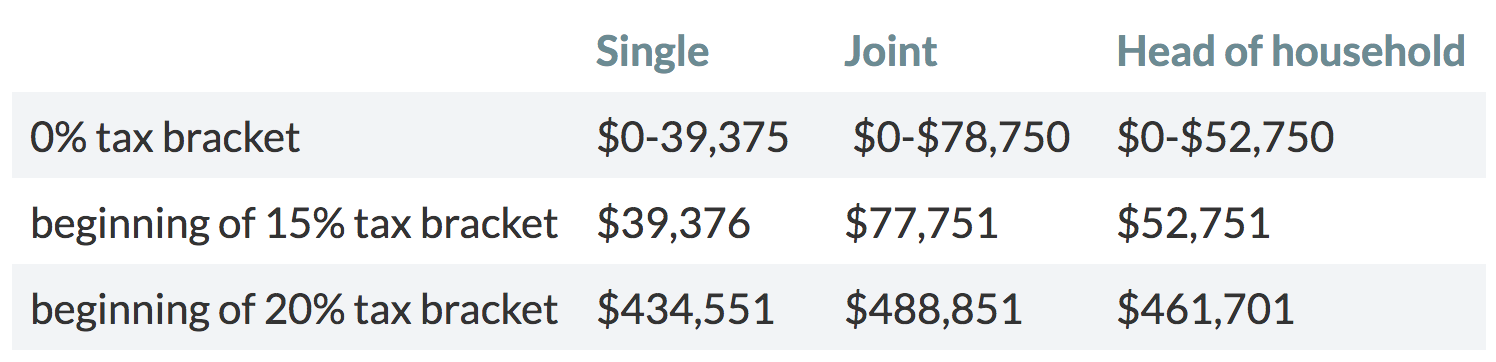

Normally most dividend payments are taxed at long-term capital gains rates, which are lower than income tax rates. In 2019 here’s how qualified dividends are taxed, based on your filing status and taxable income range.

Source: MarketWatch

Source: MarketWatch

Most Americans fall into the 0% or 15% tax bracket, and even wealthy individuals enjoy a relatively low tax rate on dividends received in taxable accounts ( the top marginal tax rate is otherwise 37% for ordinary income).

Note that for pass-through stocks, such as REITs and MLPs, the tax treatment is different. This article provides an in-depth guide to taxes for various kinds of income stocks.

With retirement accounts like IRAs and 401(k)s all of your profits, whether interest, capital gains, or dividends, are treated the same and taxed at ordinary income tax rates.

In other words, investing in dividend stocks in tax-deferred accounts results in losing the lower tax rates dividends enjoy in taxable accounts. However, owning dividend stocks in retirement accounts provides several benefits, too.

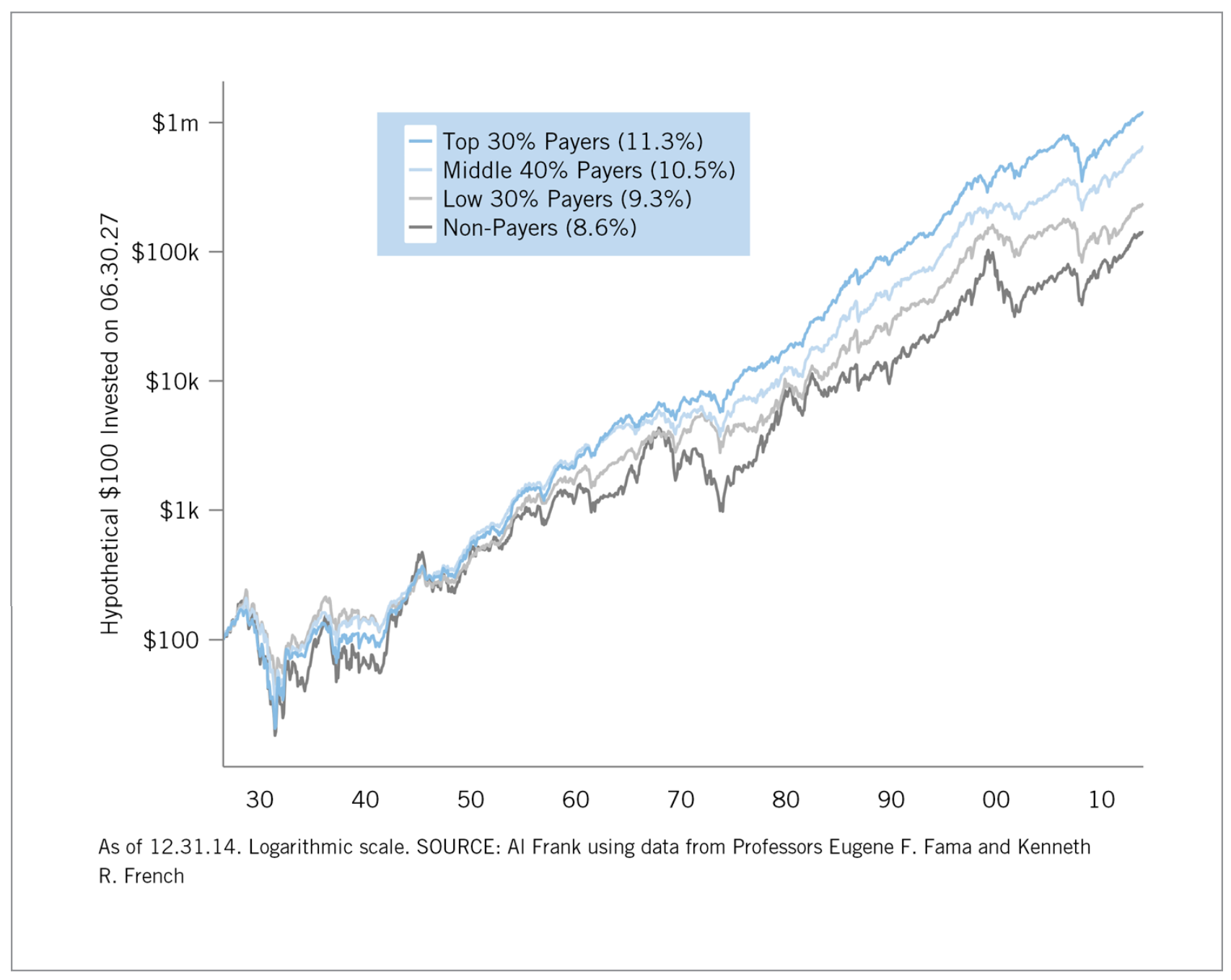

First, no one wants to run out of money in retirement, and dividend stocks have historically proven to be one of the best ways to preserve and grow one’s wealth over time.

For example, from 1930 through 2017 dividends accounted for about 42% of the S&P 500 Index’s total return, according to Hartford Funds. From the mid-1920s through 2014, dividend-paying stocks with low, average, or high yields also generated annual total returns between 9.3% and 11.3%, ahead of the 8.6% return earned by non-payers.

Source: Al Frank Asset Management

Source: Al Frank Asset Management

Besides helping your retirement accounts grow over time, dividend stocks can also help you worry less during the market’s inevitable downturns. While stock prices are unpredictable and often quite volatile over any short period of time, dividends have been much steadier.

The table below shows the S&P 500’s peak decline and the change in dividends paid by S&P 500 companies for each recession and bear market since World War II.

If we take a smoothed out average, by excluding the outliers (events not likely to be repeated in the future – World War II and the financial crisis), then the S&P 500’s average dividend reduction during recessions was about 2%. That compares to an average peak stock market decline of 32%.

Even if we include both the World War II recession and the financial crisis outliers, we can see from the table above that average dividend cuts during recessions represented a pullback of just 0.5%.

Simply put, U.S. companies try to avoid cutting dividends unless it’s absolutely necessary. As a result, S&P 500 dividends tend to be much less volatile than stock prices, and our Dividend Safety Scores can help investors generate an even safer income stream.

That income stability brings us to the concept of using dividends to fund RMDs. While it’s true that eventually RMDs will be large enough to likely force you to sell shares, dividends can be a reasonable way to cover your RMDs in the first few years of retirement.

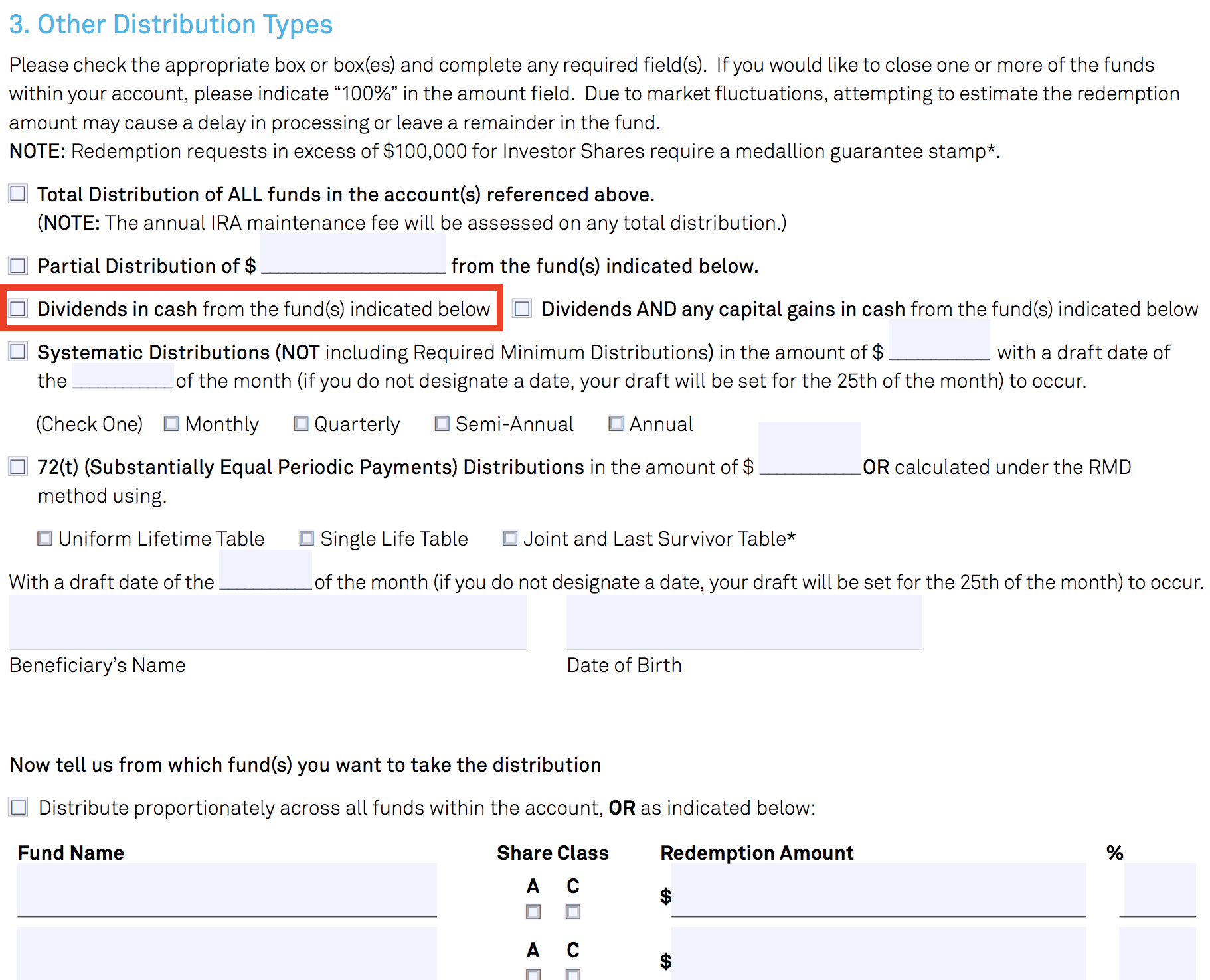

Each year your retirement account custodian (companies such as Fidelity or BlackRock) will send you a 1099-R form. This is where you choose which accounts you’ll be paying RMDs out of, and how you wish to fund them.

Source: BlackRock

Source: BlackRock

A conservative dividend portfolio yielding 4% to 5% (with a mid-single-digit dividend growth rate) can potentially cover the first five or so years of RMDs with dividends alone, and thus help you avoid having to sell shares at all.

That might not sound like much, but if those early years coincide with a bear market, then the ability to avoid selling investments at much lower prices can improve your long-term retirement savings and provide more peace of mind.

And even later in life, when RMDs rise high enough that dividends alone can’t cover them, you’ll still be selling less income producing assets (which gain in value over time) and reducing your dependence on prevailing stock prices.

Therefore, dividends can serve as a reasonable way to not only fund initial RMDs but also help maximize your overall nest egg’s size over the long term. However, in addition to dividends, there are other alternatives to RMDs that you can consider.

Other Alternatives to Funding RMDs

There are two popular ways to minimize the potential pain of RMDs and avoid the risk of selling shares during a down market. The first is with an “in kind” transfer. Again, this is done via the 1099-R form your custodian will send you each year.

“In kind” withdrawals allow you to transfer an amount of securities equal to your RMD to a taxable account. This is an option because RMDs do not have to be taken in cash. However, you will still owe taxes on an “in kind” withdrawal, and the investments you transferred will now owe taxes on the profits (interest, dividends, and capital gains) they generate.

However, the benefit of an “in kind” transfer is that if you don’t need the income to live off, you can meet your RMD requirement via this approach without having to sell shares, potentially at the bottom of a bear market.

But as with all things in finance, there are some other factors to consider regarding “in kind” withdrawals. The first is the risk that falling share prices could cause the amount you attempt to transfer to fall below your RMD for that year while the transfer request is processing. You should build in some margin of safety with the amount you transfer to account for price volatility.

The other issue to remember is that an “in kind” transfer will reset your cost basis on the assets you transfer. For example, if you bought stocks for $10,000 years ago and they are worth $30,000 today, when you transfer them to cover your RMD you’ll pay income taxes on that $20,000 gain.

What if you want to avoid RMD taxes entirely?

If you don’t need RMDs to fund your living expenses, you can choose to have your custodian transfer your annual RMD amount to a qualified charity, converting your RMD into a Qualified Charitable Distribution (QCD). See the IRS’s FAQ section on QCDs for important qualifiers for this option.

There are several benefits to the QCD approach. The first is that you can often avoid paying income taxes on RMDs entirely. In addition, QCD contributions do not raise your adjusted gross income, which means a lower overall tax bill for that year.

Another benefit to lowering your adjusted gross income is that you may be able to avoid the Medicare High-Income Surcharge on Medicare Part B and D premiums. This applies to single and joint filers with adjusted gross incomes of $85,000 and $170,000 or above, respectively.

Closing Thoughts on Using Dividends to Fund RMDs

Tax-deferred investment accounts can help you achieve a comfortable retirement. However, just as there are strong benefits to these accounts, there are also some downsides and complications. RMDs are one of the biggest, because of added tax preparation work and forced higher taxes during retirement.

Fortunately there are ways to reduce some of the burdens and risks associated with RMDs, including the potential need to sell shares during a market downturn.

A low risk, diversified dividend growth portfolio can be constructed that yields 3% to 5% and achieves mid-single-digit annual dividend growth. Those dividends can be used to fund at least the first few years of RMDs, or help cover the tax liability created by an “in kind” transfer. Either way, dividends can take some of the stress out from having to choose which assets to sell.

Ultimately, dividends, “in kind” transfers, and Qualified Charitable Distributions are solid RMD funding approaches that you should discuss with your certified financial planner when constructing or updating your long-term retirement plan.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends