Some investors can live exclusively on dividends in retirement, but most depend on a mix of income sources to make ends meet, including Social Security. In fact, Social Security is by far the most important social program in the U.S., with about 47 million retired beneficiaries in 2018.

The Social Security Administration estimates that two thirds of retirees will get the majority of their income from the program, which has important implications for investors hoping to supplement these payments with dividends.

Let’s take a look at how how dividends can affect Social Security benefits to help you maximize your income in retirement.

How are Social Security Benefits Determined?

How much you’ll receive in monthly Social Security benefits depends on two main factors:

- Your average work-related earnings over time

- The age at which you start taking benefits

The Social Security system uses a formula that looks at your average inflation-adjusted earnings over your 35 highest earning years.

Only your history of work-related earnings is used to determine your primary insurance amount, which represents the benefit you would receive if you start receiving retirement payouts at your normal (full) retirement age.

Your full retirement age is the age at which you are entitled to full Social Security benefits.

In other words, at this age your benefits are not reduced for early retirement, nor are they increased for a delayed retirement.

The full retirement age depends on when you were born:

- 1937 or before: age 65

- 1938 to 1942: age 65 and 2 months to age 65 and 10 months

- 1943 to 1954: age 66

- 1955 to 1959: age 66 and 2 months to age 66 and 10 months

- 1960 or later: age 67

The soonest you can claim Social Security is age 62, but there is up to a 30% benefit penalty for claiming benefits at this early age. The longer you wait to start receiving benefits, the greater your monthly income will be, up to age 70. You can find a Social Security benefit estimator here.

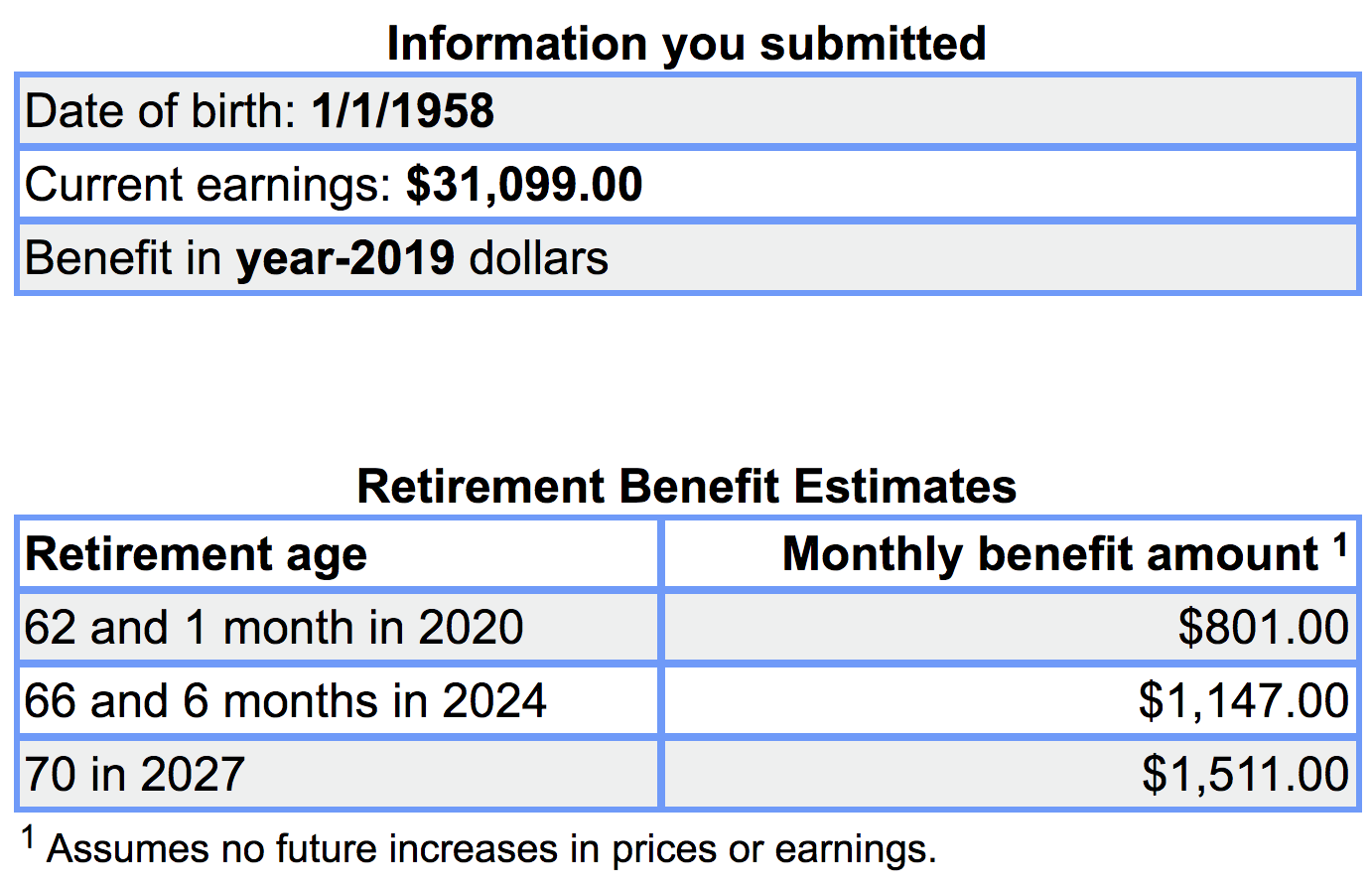

As an example, take a single person who was born on January 1, 1958. Suppose his or her current work-related income was $31,099, which equals the median U.S. income for an individual. If he or she earned this median amount (adjusted for inflation) for 35 years and worked up until full retirement age (66 and 6 months) in 2024, then this person would receive $1,147 per month in benefits.

Source: Social Security Administration – Benefits Calculator

Source: Social Security Administration – Benefits Calculator

While you can begin receiving Social Security retirement benefits as early as age 62, you can see that your monthly payment ($801) would be reduced by 30 percent compared to the full benefit you would collect ($1,147) if you waited to retire until your “normal” retirement age of 66 and 6 months.

It’s also worth noting that you can wait until age 70 to start your Social Security benefits. Then, your benefit increases because you earned “delayed retirement credits.” Waiting beyond age 70 will not reduce your benefits further.

For higher earners, the maximum amount of Social Security benefits you can receive at full retirement age is $2,861 per month for 2019. That assumes your work-related earnings were at or above the maximum cap on Social Security taxes ($132,900 in 2019).

As of December 2018, however, retired workers and their dependents received an average monthly Social Security benefit of $1,461, or about $17,532 per year. Simply put, Social Security payments were not designed to completely replace one’s working income. Even maxing out benefits does not generate princely sums.

In fact, the Social Security Administration notes that “nearly nine out of ten individuals age 65 and older receive Social Security benefits” but such payments only represent “about 33% of the income of the elderly.”

To use another example, the average household run by someone who is at least 65 years old spends $49,542 per year, according the latest data from the U.S. Bureau of Labor Statistics. Even if a couple (with both individuals earning the median U.S. income) maximized benefits by delaying Social Security until age 70, they would still only receive $36,264 per year, or 73% of what the average couple needs to cover retirement expenses.

The gap between what Social Security pays and what typical retirees spend is meant to be filled with other income sources, such as pensions and private savings. Which is where dividends, stocks, and bonds enter the equation.

How Do Dividends Affect Social Security Benefits?

It’s important to understand that you can receive Social Security benefits while continuing to work. However, an earnings limit exists that will kick in to reduce your benefits above certain levels, if you begin taking benefits before your full retirement age.

In 2019 the limit is $17,040 per year. When you hit this earnings limits, then your annual benefit will be reduced by $1 for every $2 of work-related income you make above the limit. One you reach full retirement age the penalty goes away (you can earn all you want and not lose benefits).

Note that these earnings include: “income from wages or net earnings from self-employment.” They also include bonuses, commissions, and severance pay.

Importantly, they do not include: investment income, pensions, capital gains, and inheritances. Thus dividends and capital gains won’t negatively affect your Social Security benefits directly, even if you decide to file earlier than your full retirement age.

However, dividends and capital gains can still affect your ultimate net Social Security benefits due to taxes. At the federal level up to 85% of Social Security benefits are taxable, based on your combined income:

- Combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits

How much of your Social Security is taxable (at your marginal income tax rate) depends on your combined income:

- Single filers with $25,000 to $34,000 combined income: up to 50% of benefits are taxable at federal level

- Married couple filing jointly with $32,000 to $44,000 combined income: up to 50% of benefits are taxable

- Single and married couples with combined incomes above $34,000 and $44,000, respectively: up to 85% of benefits are taxable

Adjusted gross income, or AGI, is your total income minus deductions and certain expenses. Unfortunately, capital gains and dividends are included in your AGI figure, and thus count in your combined income calculation.

No matter how capital gains and dividends are classified, they are still included in your AGI. Long-term capital gains, short-term capital gains, ordinary dividends, and qualified dividends are treated the same in this calculation, even though they can be taxed at different rates.

As a result, dividends can affect the net Social Security benefits you receive by potentially increasing the amount of your benefits that are taxable at the federal level. However, qualified dividends enjoy tax advantages which still make them an appealing source of income for many investors.

Specifically, qualified dividends are taxed at the long-term capital gains rate which is lower than the marginal income tax rate. Following tax reform, the long-term capital gain rates look like this for different filers and taxable income levels:

Source: MarketWatch

Source: MarketWatch

In other words, a married couple could generate up to $78,750 of taxable income and avoid paying federal taxes on all of their qualified dividends. The downside is they could exceed the Social Security benefits combined income limit of $44,000 for couples.

In that case, 85% of their Social Security benefits would be classified as taxable income. However, the couple could claim a standard deduction of $24,400 to help reduce their taxable income. The table below shows the marginal income tax rates this couple would face at the federal level.

Assuming they do not have any other sources of income besides Social Security benefits and dividends, this couple’s overall effective tax rate in retirement (including the 0% tax rate on their qualified dividend income if their taxable income remains below $78,750) would be quite attractive.

Source: MarketWatch

Source: MarketWatch

In other words, while dividends increase your adjusted gross income and therefore have potential to reduce your net Social Security benefits after taxes, their attractive tax treatment and performance qualities still make them an appealing source of income.

Another important tax consideration to keep in mind involves retirement accounts, such as IRAs or 401(k)s. Required Minimum Distributions, or RMDs, from these accounts (after age 70.5) are also included in your AGI and thus combined income calculations.

Additionally, it’s worth noting that 13 states tax Social Security benefits:

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- North Dakota

- Rhode Island

- Utah

- Vermont

- West Virginia

The way these states tax benefits varies wildly. For example, Vermont uses the same rules as the federal government, while Connecticut will only tax benefits for individuals and married couples earning at least $50,000 or $60,000, respectively.

If you live in one of these states make sure you check how your benefits will be taxed and what potential AGI limits should be kept in mind.

Closing Thoughts on Dividends and Social Security Benefits

For most people Social Security represents an essential component of their retirement income. Thus it’s important to understand how your investments, including dividend income, will affect your benefits.

Fortunately, dividends and capital gains won’t reduce your gross benefits. However, both dividends and capital gains can affect how your Social Security benefits get taxed and thus impact your net benefits.

Ultimately, remember that Social Security was not designed to provide sufficient income during retirement, but be supplemented by other sources of income or private savings.

A quality dividend growth portfolio can serve as an attractive foundation from which to generate a steady and growing income stream in retirement. In fact, some investors have built and grown income portfolios that allow them to live entirely off passive income alone and avoid ever having to sell their investments.

Regardless of the path you pursue to make ends meet, remaining aware of how Social Security benefits are calculated and taxed can help you maximize the amount of income made available to you in retirement.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends