We’ll always keep you up to date on the best stocks to buy now. But sometimes the stocks we recommend are the best stocks to buy and hold forever – or at least hold for a very long time.

With that in mind, we’re bringing you our Money Morning all-stars: picks we’ve brought you in the past that have already performed well and still have a lot of gains on the way.

Here’s a peek:

- A company that brings technology to fleet management has delivered 100% gains for our readers, but is still making savvy moves to deliver more profits.

- Perhaps our experts’ favorite tech giant isn’t the one you’d expect, but it has jumped in front of the pack and is still growing its biggest business at a staggering rate.

- One of our experts called for our next pick to double in a year. It’s halfway there now, so you can still grab it for the rest of the ride.

- We’ve also got a pick that is far from glamorous, but absolutely essential. Plus, it’s been consistently trouncing the S&P 500 for half a decade.

- We’ll close with a cannabis pick of ours that has soared – and then offer not one, not two, but three that are positioned to repeat the feat.

And now our latest list of best stocks to buy now…

Best Stocks to Buy Now, No. 5: This Company Brings Cutting-Edge Technology to Our Highways and 100% Profits to Your Portfolio

Since then, the share price has more than doubled. But not before Michael doubled down on his recommendation in December 2017, handing newer readers a 20% gain in a little over a year.

We’re talking about FleetCor Technologies Inc. (NYSE: FLT), an enterprise that proves every company is a tech company.

FleetCor has become one of the leading providers of fleet and fuel management for the trucking industry, as well as for all kinds of vehicles used in business and government agencies.

Those drivers spend millions of dollars on gas every day. Thanks to FleetCor, all those transactions are monitored efficiently, and the drivers can leave their wallets in the cab.

Whether it’s filling up the tank or getting brakes fixed, FleetCor offers a virtual card service that will take care of the payments automatically.

That service is the result of the 2014 acquisition of Comdata for $3.45 billion, which brought in 20,000 new customers for FleetCor. Since then, the company has landed big contracts with Uber Technologies Inc. and BP Plc. (NYSE: BP). And it made a key acquisition in 2017 to enable business-to-business cross-border payments.

More recently, the company just acquired Oregon-based Nvoicepay for an undisclosed sum. That deal gives FleetCor a platform to automate accounts payable processing for its clients. Given its favorable cash flow – free cash flow was up 35% in 2018 – it’s likely that we’ll see more strategic acquisitions like this from FleetCor in the near future as it builds its competitive edge.

Speaking of that edge, FleetCor beat earnings estimates in its most recent quarter, finishing the year with 23% growth in earnings per share (EPS).

The bottom line: This has already been a top performer for a lot of our readers. But there’s still lots of room to run if you get in now.

Best Stocks to Buy Now, No. 4: Surprise! This Unheralded Tech Giant Is a Top Performer and the Leader of the Pack

Here’s another that has proven a winner for Money Morning readers over and over again. It’s been a favorite not just of Michael Robinson’s, but of Chief Investment Strategist Keith Fitz-Gerald and Capital Wave Strategist Shah Gilani.

We’re talking about a tech conglomerate that’s benefiting from some of the biggest investing trends in recent history, from cloud computing to legal cannabis.

In March of last year, Keith came out and said this pick could be the first American tech giant to be worth $1 trillion.

Well, Apple Inc. (NASDAQ: AAPL) reached that mark last summer – but it didn’t last long. So it still remains to be seen which company can reach the trillion-dollar mark and stay there.

And don’t look now, but Keith’s pick has taken over the lead…

That would be Microsoft Corp. (NASDAQ: MSFT), which at $845 billion is now valued higher than Apple, Amazon.com Inc. (NASDAQ: AMZN), and Alphabet Inc. (NASDAQ: GOOGL).

But that’s not surprising if you’ve been following along with us.

We’ve told you before this is the company to watch when it comes to cloud computing. Sales for its Azure cloud platform have been outpacing the market leader Amazon Web Services for several years now. And in the most recent quarter, Azure revenue grew 76%, compared to 45% for AWS.

In other words, in one of the most lucrative and fastest-growing tech sectors on the planet, Microsoft has Amazon looking in its rearview mirror.

That alone is a good reason to buy MSFT, but it also comes with a bonus reason: It’s a great pick-and-shovel play on legal cannabis.

Because cannabis is such a young and politically complicated industry, it’s incredibly important that cannabis companies keep their affairs in good order and in compliance with regulations. Increasingly, Microsoft’s Azure cloud computing service has been the tool they turn to.

“Ever since June 2016,” Michael writes, “Microsoft has used its ultra-powerful software and cloud services to become the go-to source for the cannabis industry.”

So while the market gets flooded with cannabis companies that may or may not be reliable bets in the long term, Microsoft gives you a piece of that explosive industry while providing the benefits of a stable organization with a long track record of growth.

Readers who followed Michael’s advice and picked this one up in 2012 have enjoyed gains of more than 250%, not counting dividends. But if you’re late to the party, there’s still time. Microsoft beat earnings estimates in the most recent quarter, with 15% growth in EPS from the year before. You can expect a lot more success in the years to come.

Best Stocks to Buy, No. 3: This Company’s Business May Be Boring, but the Profits It Delivers Aren’t

While the rest of the market is busy speculating on the next mobile app or wearable device, our next pick keeps delivering steady gains by providing essential services that never go out of fashion.

After all, you’re not going to stop throwing out your trash anytime soon. And neither is anybody else.

For Waste Management Inc. (NYSE: WM), your trash is its treasure.

With more than 21 million customers, WM is the largest provider of waste management and residential recycling services in North America.

According to CSIMarket, Waste Management holds the largest market share in the United States for every major segment of environmental services – and a 37% share overall. That’s compared with a 22% share for its top competitor.

But the moneymaking opportunities don’t stop when the trash is picked up. WM is also a leader in converting trash to LNG fuel that can go into its truck fleet or even into natural pipelines or local electric grids.

In other words, Waste Management is not just a trash company. It’s also an energy company. It’s solving one of humanity’s more pressing problems – how to deal with a growing population using the same amount of space – by turning it into a new resource for communities and more profits for shareholders.

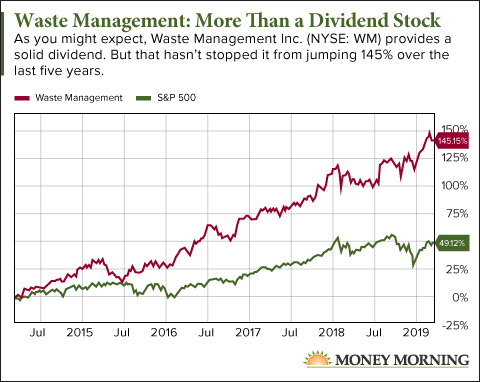

WM’s dividend has increased in 15 consecutive years and currently yields a solid 2.1%. But that stable income generation hasn’t kept WM from being a growth stock. The stock has risen 145.2% over the last five years, compared to 49.1% for the S&P 500.

And since we last brought this one to you in August 2018, it’s gained 11.2%, while the S&P 500 has fallen 2.4%.

Back in November 2017, subscribers to Keith Fitz-Gerald’s High Velocity Profits service saw how to get even bigger gains from WM.

That’s when Keith recommended a Jan. 19 call option on WM. He recognized that it was a great stock, and an option trade allowed subscribers to put up a relatively small amount of money and enjoy big, fast gains if it did well.

That’s exactly what happened. By the time the options expired, about two and a half months after the initial recommendation, they had gained 275% in value.

Don’t worry. There’s plenty more fuel to propel this stock upward in the coming months and years. And if you want to go for truly quick profits, a call option may be the way to go.

But if you’d rather have a stock you can hold onto forever – or as long as people keep producing trash – Waste Management is exactly that.

Best Stocks to Buy, No. 2: This Tech Company Is Poised for 181% Growth in Four Years

FleetCor isn’t our only pick capitalizing on the fact that every company is a tech company. Our next profit play is a Silicon Valley company that has moved the IT department to the cloud.

The result is a low-cost, low-maintenance service platform that has become the go-to option for many of the world’s biggest companies.

We’re talking about ServiceNow Inc. (NASDAQ: NOW), which counts among its clients more than 800 companies from the Fortune Global 2000.

In addition to major corporations like The Hershey Co. (NYSE: HSY) and Diageo Plc. (NYSE: DEO), ServiceNow clients include giant institutions such as CERN, the European physics lab that employs 12,000 scientists, and New York City’s 6,000-employee Department of Health.

Michael Robinson calls ServiceNow a “profit powerhouse.” That’s a well-earned title, considering its 255% growth in earnings per share (EPS) between 2016 and 2018. The company beat earnings expectations handily in its most recent quarter, posting EPS of $0.77 compared to an expected $0.64.

That also represents 120% growth from the same quarter a year before. And according to FactSet, analysts currently project another 71% of EPS growth in the next two years and 181% by 2022.

ServiceNow has gained more than 90% since Michael first recommended it to Money Morning readers in October 2017.

But when he doubled down on it last year, he said he expected the share price to rise 100% over the next 12 months. In spite of market volatility in late 2018, the stock is now a little more than halfway there, at 51% growth.

So there’s still time to hop on this train if you haven’t already.

Best Stocks to Buy, No. 1: Our Weed Pick Handed You 278% Gains – Here Are the Next Winners

This list wouldn’t be complete without a look at the state of legal cannabis investing.

Money Morning readers who followed Michael Robinson’s advice to buy Canadian firm Canopy Growth Corp. (NYSE: CGC) back in June have enjoyed a 40% growth spurt since then.

And if you bought your shares back when Keith Fitz-Gerald recommended it in November 2017, you’ve gotten blockbuster returns of nearly 280% – about 324 times better than the S&P 500’s performance in that time.

But the explosive growth in the industry is far from over. Arcview Market Research projects that the global legal cannabis market will more than double from $12.2 billion in 2018 to $31.3 billion in 2022. By that time the industry, could employ nearly a half-million Americans full time.

So the million-dollar question, then, is where is the next Canopy-like success story going to come from.

We’ve got two great candidates for you: Aurora Cannabis Inc. (NYSE: ACB) and Tilray Inc. (NASDAQ: TLRY).

Both of these Canadian companies have primarily been involved in medical cannabis until recently. But you can expect some major expansion in the age of legalization.

In September, it was reported that Aurora was in preliminary discussions with The Coca-Cola Co. (NYSE: KO) to develop cannabis-infused beverages. Those talks have cooled off – and such beverages are not yet legal in Canada – but you can certainly take it as a sign of what’s to come.

Tilray, for example, struck a deal last summer to be the exclusive supplier of adult-use cannabis for Nova Scotia Liquor. That state-owned enterprise is the only licensed retailer of alcoholic beverages in the province.

So you can bet that when alcoholic beverages become legal in Canada – which by some reports could come by this fall – these two companies are going to be among the best-positioned for it.

But hang on. Let’s not count Canopy out either. Just because it’s already had a great run, don’t assume that it can’t keep growing at a rapid pace for many years to come. Not only is it Canada’s biggest grower, it also has the backing of beverage giant Constellation Brands Inc. (NYSE: STZ). The producer of Negro Modelo, Corona, and Svedka Vodka, among other brands, holds a nearly 40% stake in Canopy.

So we have Aurora, Tilray, and Canopy: Which one should you buy?

All three, if you can.

When building your cannabis portfolio, you’ll want a few stable pick-and-shovel plays to start. That might include Microsoft, as we mentioned. You could also grab some shares of Scotts Miracle-Gro Co. (NYSE: SMG) or GW Pharmaceuticals Plc. (NASDAQ: GWPH), which both have their hand in the cannabis market.

From there, you want a healthy mix of pure-play weed companies so you’re not putting all your eggs in one basket. And Aurora, Tilray, and Canopy are a great trio to get you started.

Remember, this whole industry is set to nearly triple in the next four years. And that’s just the average. If just one or two of these pulls away from the pack, you’ll be looking at a truly handsome payday very soon.

As you can see, buy-and-hold stocks like the “all-star” picks featured here are a great way to generate solid, consistent returns over the long haul.

But if you’re looking for a way to accelerate your gains – and potentially amass a life-altering fortune – read on for a special opportunity you won’t want to miss.

— Stephen Mack

According to one of the world's top AI scientists, there's a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead... but whatever you do, don't go all in on big tech before you have all the details. Click here.

Source: Money Morning