We spend years contributing to our employer-sponsored retirement programs.

However, most of us spend very little time thinking about what we’ll do with our savings when we actually retire.

It’s an important question to ask yourself.

The solution isn’t one-size-fits-all, but there’s definitely a popular route.

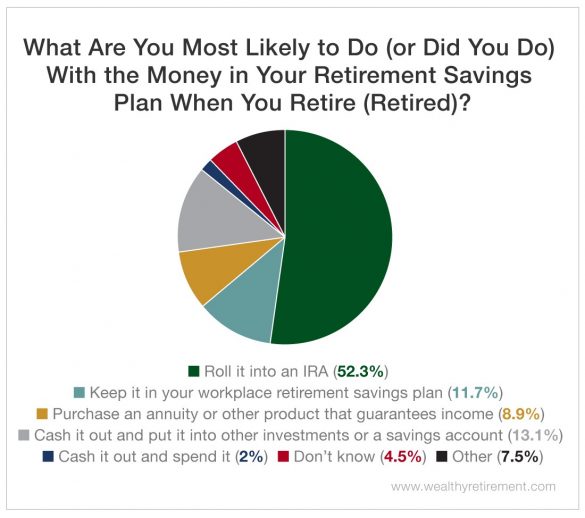

A recent survey of Wealthy Retirement readers found that more than 52% did or plan to roll their retirement savings plan into an IRA, or individual retirement account, upon retirement.

But the “nest egg roll” isn’t your only option – and while it’s by far the most popular solution, it’s not always the best choice.

It’s definitely the easiest option, but it could be the more expensive one – especially if your plan is on the smaller side.

It wasn’t that long ago that most 401(k) plan fees were more expensive than those associated with IRAs. Their investment options, compared with IRAs, were usually limited too.

Today, that’s not always the case. Many large 401(k) plans have been able to negotiate low fees, and their low-cost investment options are greater too. Some offer self-directed accounts with lower transaction fee charges than IRAs or other brokerage accounts. Finally, many 401(k) plans don’t charge you for keeping your balance there.

That’s why it’s a good idea to investigate this option before you roll your money into a new IRA account.

Remember, excessive fees are wealth-drainers. They’ll reduce your retirement savings and impede your ability to grow your wealth.

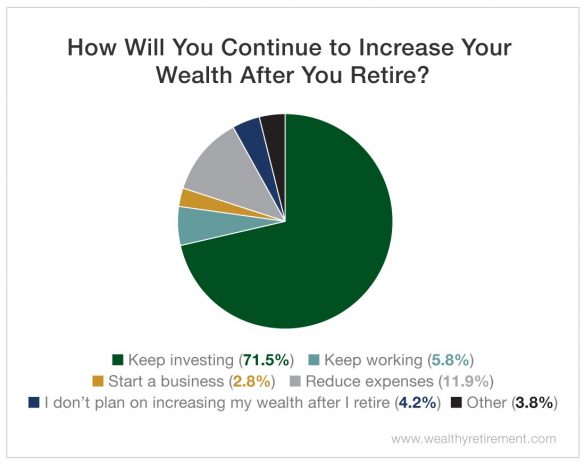

Most of our readers said that they’ll continue growing their nest egg even after they retire. The vast majority of them, 71.5% of those surveyed, said that they’ll keep investing. That’s why it’s so important to keep a close eye on fees and do what you can to reduce your investment expenses.

Remember, your 401(k) isn’t a slot machine. You don’t want to automatically slap the “cash out” button as soon as you win the retirement game. Before you retire, consider all of your options and be sure that you pick the one that’s best for you.

Good investing,

Kristin

The best way to earn monthly income is NOT a stock, bond or option... Rather, it's this little-known alternative investment. CLICK HERE TO FIND OUT MORE.

Source: Wealthy Retirement