There are cheap stocks and then there are stocks that are cheaply priced.

In the case of Walgreens Boots Alliance (NASDAQ:WBA), WBA stock is cheaply priced and the company is loaded with impressive, hard-to-replicate assets in markets with promise that are just hitting their stride.

Walgreens stock went from a recent high last year of $85.69 in December to its current discounted price around $61 per share. But it has a pedigree of delivering to shareholders, and that cannot be ignored.

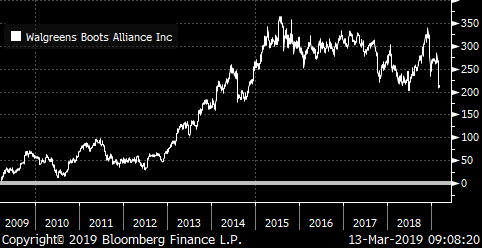

For over the trailing ten years, WBA stock has returned 214.79% for an average annual equivalent return of 12.15%.

Source: Bloomberg

Source: Bloomberg

Pay More Attention to WBA Stock

Walgreens has over 13,000 pharmaceutical and retail stores in 11 countries and remains one of the dominant pharmacies in the U.S. and Britain. This is a good market segment to be in. Drug spending continues to be buoyant, with growth in the U.S. alone on an annual upward march.

Sales overall for the company are up by 11.30% for the trailing year. And in a market where margins can get pretty thin, WBA maintains an operating margin that is running at an annual rate of 4.70%.

This, in turn, is driving very impressive returns for the company. The return on shareholders’ equity is at 20.70% and the return on assets is running at 7.80%. The company also delivers a solid return on capital of 14.10%.

It does this with very modest leverage. Its cash continues to be ample with continuing flows from rising retail sales. And it has minimal debt, with a debt-to-assets ratio sitting at only 21.10%.

Walgreens stock pays a nice dividend that continues to be above the average of the S&P 500 Index, at 2.90%. The current distribution is running at 44 cents a share and it has been rising on average over the past five years by 7.11% a year.

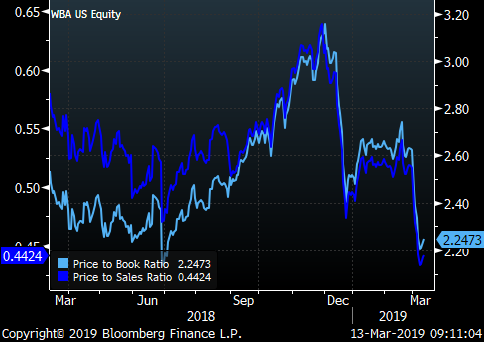

All of these positives mean little to the recent market, though — WBA stock is valued at over a 60% discount to the trailing sales. And again, note that sales have been continuing to rise, making it even more of a bargain.

Price-to-book is at 2.25X, which is modest in the current market. And that underlying book value in Walgreens stock continues to climb from recent lows in 2017 to a current $27.14 per share.

Source: Bloomberg

Source: Bloomberg

Bottom Line on Walgreens Stock

WBA stock is a bargain.

And management seems to notice this. Share buying by insiders was on a tear throughout 2018, with buys topping out at over $85 million into December 2018.

But what’s holding back the outside stock buyers?

First, the presence of Amazon (NASDAQ:AMZN). This company, through its acquisition of an online pharmaceutical subscription company, is building its capabilities to reach consumers directly. And that’s competition. But WBA is so ubiquitous in its availability and ease of delivery that it is more of a threat to Amazon’s developing market for now than Amazon is to its business.

Then there is the concern over the costs and efficiency of brick and mortar retail, which is also part of the Walgreen’s business.

Again, Walgreens continues to provide an expansive localized outlet for convenience for consumers beyond just prescription drugs. And there is the move already underway by management to review every store location in its vast network for the greatest returns for shareholders.

While Walgreens might be slipping back in the pack of the stock market of recent, there’s a lot behind this stock to value as it may well make for a good bet for dividends and a win for growth.

— Neil George

Silicon Valley venture capitalist Luke Lango says this little-known Apple project could be 10X bigger than the iPhone, MacBook, and iPad COMBINED! Investing in Apple today would be a smart move... but he’s discovered a bigger opportunity lying under Wall Street’s radar -one that could give early investors a shot at 40X gains! Click here for more details.

Source: Investor Place