A stock’s yield is only as good as its cash flow because, after all, a dividend is nothing more than a promise from a company.

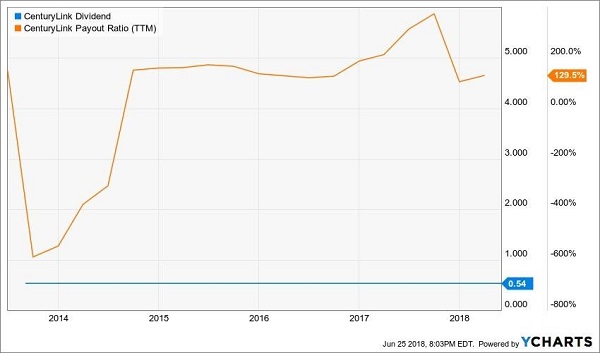

CenturyLink (CTL) recently reminded us of this. Its promised $0.54 per share dividend exceeded its ability to pay. The firm’s payout ratio of 130% – the percentage of profits that it was paying as dividends – was an absurd overpromise that couldn’t last forever:

CenturyLink’s Payout Promise Was Always on Borrowed Time

CEO Jeffrey Storey insisted his team remained “committed to and confident in our ability to maintain the dividend.”

As recently as February 8, I warned investors that CenturyLink was a high yield trap. It was inevitable that its lack of cash would topple any commitment and confidence. Sure enough, just six days later, Jeff and the boys made me look good by slashing their payout by a cool 54%.

The “all-knowing” market sniffed out some of Jeff’s BS beforehand, but not the full extent of it (like I had all the way back in June 2018!).

CTL topped in late August and has spiraled downwards since. Shares are down 45% in just six months:

A 54% Dividend Cut = A 45% Price Cut (and Counting)

As we’ve discussed time and again, dividends are “magnets” that drag their share prices along. This is great when dividends are growing, but disastrous when they are slashed!

With CTL’s latest payout cut now in the rearview mirror, my publisher patted me on the back – and tasked me with finding eight more dividends likely to drop! Luckily I keep a short list of problem payouts handy. So, let’s talk through another eight-pack of dividend dumpster fires. If you own any of these stocks, you should probably sell them today to avoid heartache tomorrow.

Dumpster Fire #1: GameStop (GME)

Brick and mortar video game retailer GameStop (GME) is a throwback to yesteryear. It’s survived the rise of digital distribution for video games thus far because Microsoft, Sony and Nintendo haven’t fully digitalized their sales. (In other words, they still sell physical boxes that are bought at stores like GameStop.)

But this sales model is ultimately toast and GameStop doesn’t have a convincing second act. Income investors who mistakenly think they are connecting with millennials with this double-digit dividend should give their kids (or better yet, their grandkids) a call to see how they’re buying their video games these days.

Dumpster Fire #2: Barnes & Noble (BKS)

As someone who writes for a living and loves books, especially the physical variety, it pains me to write this. But it’s time to close the book on this original Amazon victim.

Barnes & Noble (BKS) has been duking it out with Jeff Bezos longer than any other surviving retailer. Kudos to the company for surviving this long, but now, Amazon is going in for the coup de grace.

In 2015, Amazon opened its first physical bookstore in Seattle. It now has 10 across the country, with four more in the works.

Barnes & Noble has mostly been in decline since the 2015 spinoff of its college bookstore business, Barnes & Noble Education (BNED). Shares plunged 41% alone in 2017. Free cash flow was barely enough to cover the dividend last year. Barnes & Noble simply can’t afford to keep paying shareholders.

And if it keeps things up, within a couple of years, it might be forced to pay the piper.

A Zombie Retailer

Dumpster Fire #3: Ford (F)

Ford (F) is fine for now, but in the long run it’s dead (more so than the rest of us). Driverless cars are on the way, and in the meantime, millennials aren’t buying many automobiles for themselves to drive around anyway.

Ford is plenty profitable for now and is unlikely to see any dividend danger in the near term. But collecting payouts from a 20th century relic brings too much downside without the upside.

Dumpster Fire #4: International Business Machines (IBM)

The cryptocurrency bubble made International Business Machines (IBM) a hot name for a minute. Eggheads on CNBC crowed about IBM benefitting from “the blockchain” – the underlying technology behind Bitcoin – without having a clue about the details.

I’m not sure IBM’s management has a clue about the details of their future plans either. We heard about Watson for years, but the supercomputer looked better in commercials than it does on IBM’s bottom line (where the hype isn’t translating to profits.) And IBM needs all the profits it can get – its earnings-per-share (EPS) are down by one-third over the past five years.

Dumpster Fire #5: General Mills (GIS)

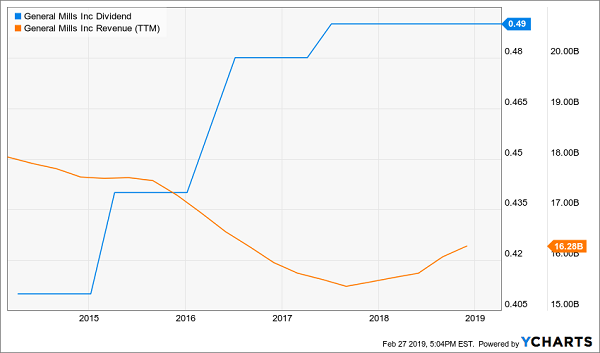

Green Giant peas? Cheerios? Seriously? This company dominates food staples of yesterday. General Mills (GIS) is behind the curve on every current food trend. The numbers don’t lie – it’s been evident in the firm’s slowing dividend growth and falling revenue:

Beware the Slowing Dividend and Declining Sales

The packaged food king must acquire some fresher options to grow. But it isn’t the only legacy firm scrambling for organic labels. GIS must overpay to win deals and bank on its superior distribution for payback over the long haul. That’s an uphill battle to begin with, but worse is that its premium grocery store placement isn’t as valuable as it once was, with old school grocery stores in decline themselves! Pass on (and sell if you own it) GIS.

Dumpster Fire #6: Kellogg (K)

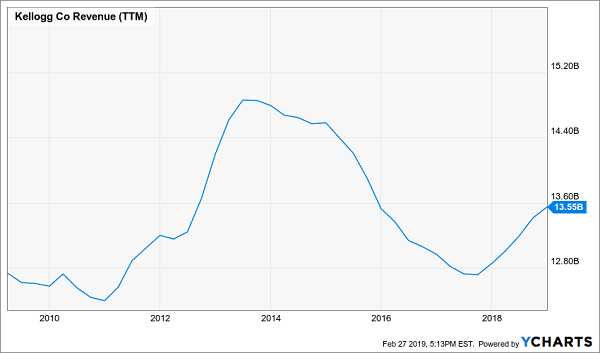

Short the cereal market. That includes Kellogg (K).

Cereal sales have been in freefall for several years. Some folks are too busy for breakfast. Others have realized that a bowlful of sugary grains isn’t the healthiest way to start your day after all!

Kellogg has tried to pivot by peddling protein shakes and leaning on its NutriGrain and other “grab and go” breakfast bars. But the numbers don’t lie: “Peak Cereal” is in, and the downslope is a slippery one for Kellogg shares:

The Backside of Cereal Mountain

You’re better off skipping this breakfast dividend.

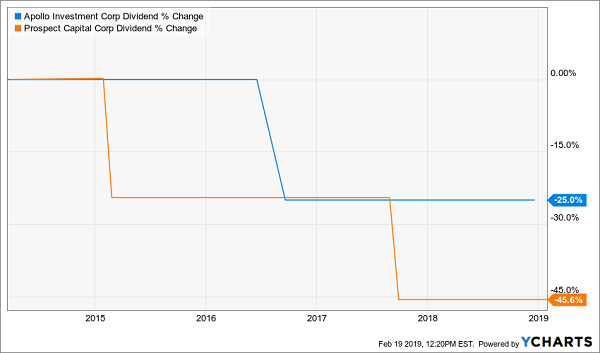

Dumpster Fires #7 and #8: Prospect Capital (PSEC) and Apollo Investment (AINV)

Most income investors find their way to business development companies (BDCs) by screening or searching for big yields. Reason being, these firms that lend to certain types of small companies get a pass on their tax bill if they pay out at least 90% of their income to shareholders as dividends. Hence the big yields they typically boast.

The problem is, their setup may be a little too sweet for the small niche they are all trying to serve. What’s to stop a small company from shopping around for its capital?

Over the long haul, very few BDCs deliver their dividends without “tapping” their investors’ pockets. In some cases, they fund their payouts partly from the income they derive from their loans (which is good) and partly by selling assets (which of course is bad).

Prospect Capital (PSEC) and Apollo Investment (AINV) are two of the “biggest losers” in this sector. Their lending businesses actually become less and less valuable over time, as you can see by their ever-declining dividends:

2 BDC Dividend Dogs

Their next cuts are never more than a few quarters away. Which makes each of these stocks an emphatic “stay away.”

— Brett Owens

The 3 Best Bear Market Buys (with 8%+ Dividends) for 2019 [sponsor]

With the fourth quarter’s market insanity, you’ve probably thought about dumping – or at least reducing – your stock holdings to focus on fixed-income investments as you near and enter retirement. It sounds like a smart move, but going lean on stocks leaves you open to two big risks:

- That you’ll outlive your savings, and

- You’ll miss out on the long-term gains only the stock market can offer.

So why not blend a portfolio of 8%+ bond funds with smart stock picks that provide you with similarly high yields with upside to boot? Sure, they may “sell off” a bit if the markets pull back. But who cares. Like a savvy income investor, you’ll be able to step in and buy more shares when they are cheap – without having to worry about your next capital withdrawal.

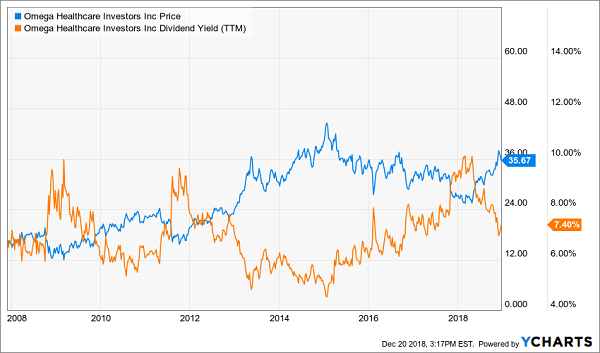

Let’s take healthcare landlord Omega Healthcare Industries (OHI). The firm’s payout is usually generous and always reliable – yet, for whatever reason, its sometimes manic price action gives investors heartburn.

But it shouldn’t. It’s actually quite predictable. Check out the chart below, and you’ll notice:

- When the stock’s yield is high (orange line), its price is low. Investors should buy here.

- When the stock’s price is high (blue line), its yield is low. Investors should hold here and enjoy their dividend payments.

Investing is Easy: Buy When Yield (Orange Line) is High

Of course this simple strategy is much easier to employ if you don’t need stock prices to stay high to retire. Most investors who sell shares for income spend their days staring at every tick of the markets.

You can live better than this, generate more income and even enjoy more upside by employing our contrarian approach to the yield markets. At the Contrarian Income Report, we live off dividends alone. And we buy issues when they are out-of-favor (like right now) so that our payouts and upside are both maximized.

— Brett Owens

Plus 8% Dividends, Paid Monthly, Make Retirement Even Easier [sponsor]

And by the way, you can even use my “no withdrawal” strategy to make sure you’re:

- Banking 8% annual dividends,

- Enjoying additional price upside, and

- Getting paid monthly to boot!

If this interests you, I’d recommend starting with my all-star retirement portfolio. It contains 8 of the absolute best preferred stocks, REITs and CEFs out there.

If you’re scratching your head at these terms, you’re not alone. These are investments that you won’t hear about on CNBC or read about in the Wall Street Journal. Which is why we have these fantastic opportunities available in this “no yield” world.

I’ll explain more about them in a minute. I’ll also show you why my 8% eight-pack is well diversified across all types of investments and sectors, and the cash flows funding these dividends will do well no matter what happens in the broader economy or stock market.

Plus, as I hinted, relentless dividend growth means your 8% yield will be more like 10% in short order.

I’m ready to take you inside this “no-worry” retirement portfolio now. Click here and I’ll show you the 8 bargain investments inside it and give you their names, tickers, buy-under prices and much more.

Source: Contrarian Outlook