Philip Morris International (PM) was spun off from Altria (MO) in 2008, with Altria serving the U.S. and Philip Morris owning the international rights to all of Altria’s most famous brands, including Marlboro, Merit, Parliament, Virginia Slims, L&M, Bond Street, Chesterfield, Lark, Muratti, Next, and Red & White.

Philip Morris markets its cigarette brands to more than 150 million customers in over 180 countries and has close to 30% international market share (excluding China and the U.S.). That’s largely due to selling Marlboro, which is the No. 1 cigarette brand in the world and accounts for approximately 35% of the company’s total volumes.

These products also carry higher margins because they have lower taxes compared to traditional cigarettes.

Geographically, the European Union (35% of sales, 36% of income) and Asia (29% of sales, 39% of income) are the company’s most important regions, followed by Eastern Europe, Middle East and Africa (23% of sales, 27% of income) and Latin American and Canada (13% of sales, 10% of income).

Since separating from Altria in 2008, Philip Morris has raised its dividend each year.

Business Analysis

Philip Morris International is a giant in the global tobacco world, which serves over 1 billion people according to the World Health Organization. At the end of 2017 the company was the market share leader by volume in seven of the 10 largest OECD countries (an organization of 34 international countries) and is the second largest player in another two.

Outside of OECD countries, Philip Morris holds onto the number one market share spot in three of the 10 biggest countries by industry volume and is the number two player in another four.

Source: Philip Morris Investor Presentation

Source: Philip Morris Investor Presentation

The company’s dominance is driven by the strength of its brand portfolio. Philip Morris has six of the world’s top 15 cigarette brands, including the world’s number one brand – Marlboro.

As a result, the company enjoys excellent pricing power. Since 2008, Philip Morris’s average annual pricing gain has been 6.5%, excluding excise taxes. Through the first nine months of 2018 the company increased prices by 7%, in line with full-year guidance and indicating that its brands continue to hold sway with consumers.

A key factor supporting Philip Morris’s pricing power is the firm’s focus on premium brands, which accounted for just over 50% of the company’s 2018 volume (compared to less than 30% for the industry). Studies have also shown that premium brand smokers are less likely to quit, helping cushion the company’s exposure to a powerful secular decline in global smoking rates.

Despite its strengths, Philip Morris International has run into some major growth headwinds in recent years.

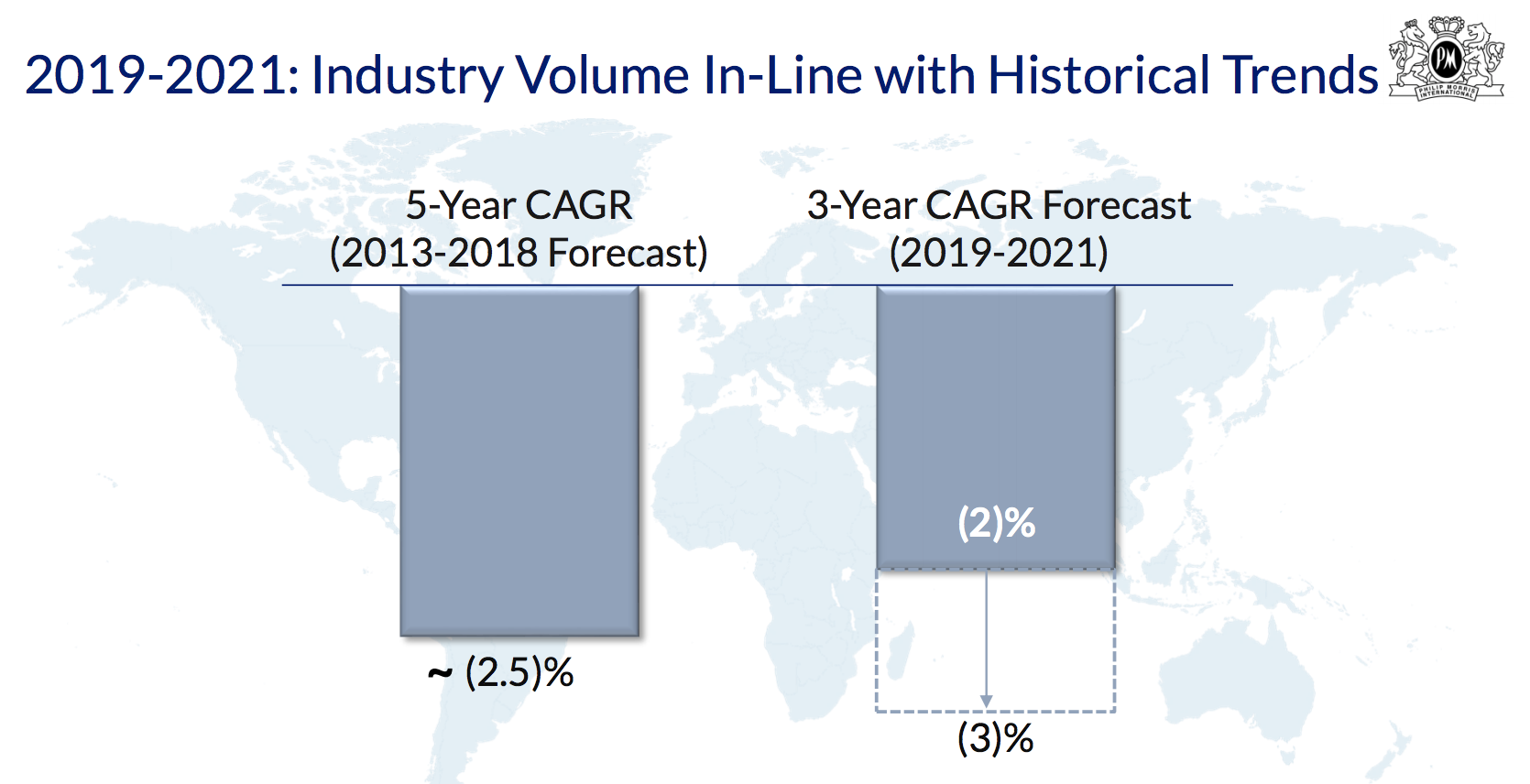

Part of this is due to lower cigarette volumes because smoking is an industry in secular decline. Excluding the U.S. and China, management expects cigarette volumes for the industry to decline by 2.5% in 2018 while it expects to see a decline of just 2%, indicating a slight market share gain.

While more smokers continue to quit each year, with many migrating to RRPs, management believes industry volumes will continue their moderate erosion through 2021. This forecast is critical since tobacco makers remain dependent on their core cash cows to keep producing stable results as they work to reinvent themselves for an eventually smoke-free world.

Source: Philip Morris Investor Presentation

Source: Philip Morris Investor Presentation

One of the reasons for the cigarette volume declines in recent years is higher government taxes in some of Philip Morris’ largest regions, such as the EU, Russia, and the Philippines (three of the company’s top four markets). That’s part of a concentrated effort by governments around the world to reduce smoking rates which can be up to five times higher than in the U.S. according to the World Health Organization.

In fact, in some Asian and Middle Eastern countries the smoking rate today is over 50%, a level that the U.S. never saw even at the peak smoking rates in the early 1960s (42%).

The EU implemented anti-smoking legislation in mid-2014, aiming to reduce tobacco consumption by 2% over the next five years, the equivalent of 2.4 million smokers. The EU has one of the highest excise tax rates on tobacco in the entire world, and roughly 70% of Philip Morris’ revenue from the region goes to the government.

In 2013, the Philippines raised excise taxes to boost the average price per cigarette pack by a whopping 48%. Annual excise taxes are expected to continue in the region, putting more profits into the government’s coffers at the expense of Philip Morris’ bottom line.

Russia initiated a new law in 2013 that banned smoking in many public places and restricted advertising. Excise taxes in Russia have more than tripled the cost of a pack of cigarettes since 2006.

Saudia Arabia is another example, implementing a new excise tax in June 2017 that doubled the retail price of cigarettes. Philip Morris immediately saw its volume drop more than 40% in the region after that tax was implemented.

And in Australia, the government has imposed arguably the most severe anti-tobacco regulations and taxes of all. The price of cigarettes has doubled since 2008 and is the highest in the world.

Overall, excise taxes account for around 63% of Philip Morris’s total revenue today, up from 59.5% in 2012 (and more than double Altria’s level). Fortunately, that figure has stabilized in recent years, thanks in part to the company’s big push into RRPs which are likely benefiting from lower taxes compared to cigarettes and more lenient marketing rules.

Regardless, the regulatory landscape for tobacco seems unlikely to improve anytime soon. For example, in 2016 the EU passed a law that will ban popular menthol cigarettes in Europe starting in 2020. Simply put, governments worldwide continue to crack down on tobacco in an effort to reduce smoking rates and accelerate volume declines for the entire industry.

While Philip Morris’s operating margins have declined in recent years due to rising taxes, unfavorable currency exchange rate fluctuations, and investments in RRPs, the company has managed to use aggressive cost-cutting to lessen the blow. A lot of this success has to do with the industry’s favorable qualities and Philip Morris’s competitive advantages, driven by the company’s excellent brands and pricing power.

Commenting on the tobacco market, perhaps Warren Buffett put it best when he once remarked, “It costs a penny to make. Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty.”

These qualities can help Philip Morris keep its revenues stable and hopefully growing despite the ongoing cigarette volume pressure caused by rising anti-smoking sentiment around the world.

Management is also working hard to insulate the company from the worst of the long-term decline in global smoking with its aggressive push into reduced-risk products.

Specifically, the company has invested about $4 billion since 2008 into developing its IQOS heat stick (which doesn’t burn tobacco) and its MESH vaporizer technology (which creates a nicotine-rich vapor with none of the carcinogenic chemicals found in tobacco).

Source: Philip Morris Investor Presentation

RRP volumes have grown quickly thanks to the company’s aggressive worldwide rollout of its heat sticks (especially IQOS). The initial effort was mostly focused on Japan, which is the world’s leading RRP market thanks to unique anti-vaping regulations (nicotine liquids are classified as pharmaceuticals). This caused many tobacco users to quickly switch to IQOS.

Source: Philip Morris Investor Presentation

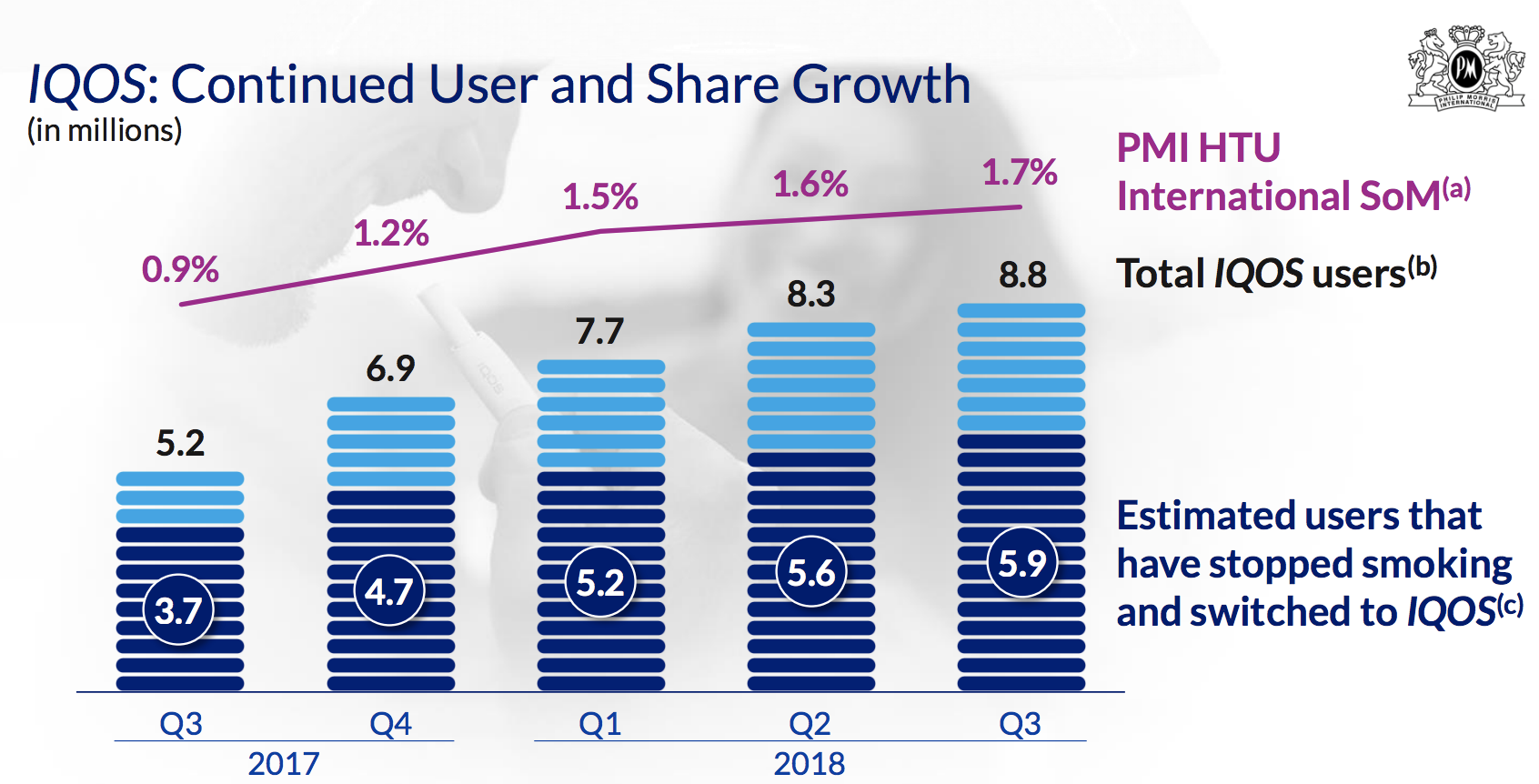

Philip Morris has taken what it’s learned in terms of marketing and distributing RRPs in Japan and applied that to 37 other markets, such as the EU, South Korea, and Russia. As you can see by the rising purple line below, IQOS is gaining share of the total industry sales volume for cigarettes and heated tobacco units (HTU), excluding the U.S. and China.

Source: Philip Morris Investor Presentation

Source: Philip Morris Investor Presentation

Management is banking on growth in heated tobacco to help offset continued volume declines in cigarettes. In the first nine months of 2018, Philip Morris’s heat stick volumes grew over 40%. While they represent just 7% of total company volumes, their strong growth rate helped buoy the firm’s overall volume decline to outperform the broader industry.

Even better, IQOS is a higher-margin product for the company since it is not (yet?) weighed down by the steep excise taxes placed on traditional cigarettes. As a result, the company could maintain its strong profitability for many years to come if heated tobacco products take off, helping the firm’s bottom line continue growing even if the overall cigarette market experiences a more severe volume decline.

Simply put, the importance of IQOS to the company’s long-term future can’t be understated. However, as management notes and the market share chart above confirms (just 1.7% share of the overall industry), we are still in the early stages of RRP adoption. Growth could increase or slow any given quarter, creating some anxiety for investors who are nervous about the tobacco giant’s ability to thrive in a smoke-free world.

Management’s big bet on RRPs like IQOS is being made with the expectation that by 2025 they will account for over 30% of company-wide volumes (up from 4% in 2017) and about 40% of net revenues (up from 13% in 2017). If successful, that should help the firm maintain steady revenue and earnings growth despite the ongoing decline in cigarette volumes.

It’s also worth noting that at the end of 2016 the company submitted a product application for its IQOS product to the U.S. Food and Drug Administration (FDA), hoping to open up a large market opportunity. The FDA has yet to approve the sale of IQOS in the U.S. but has said that Altria and Philip Morris won’t be able to use a reduced risk label on these products. That could limit the success of IQOS in the U.S. and thus any royalty payments the company can expect from its partnership with Altria.

Only time will tell whether or not Philip Morris’s customers will decide that “heat-not-burn” alternatives to traditional cigarettes are truly a fulfilling substitute, and more importantly, whether they wish to continue using them or just view them as a tobacco cessation method. Future excise taxes, marketing restrictions, and other regulations affecting RRPs are also a major uncertainty.

However, the early traction is encouraging as Philip Morris looks to gradually shift its business from being a manufacturer of combustible tobacco products to an RRP-focused company. The firm’s early mover advantage in global RRPs, massive distribution channels, solid brands, and pricing power are all important assets as it adapts for the future.

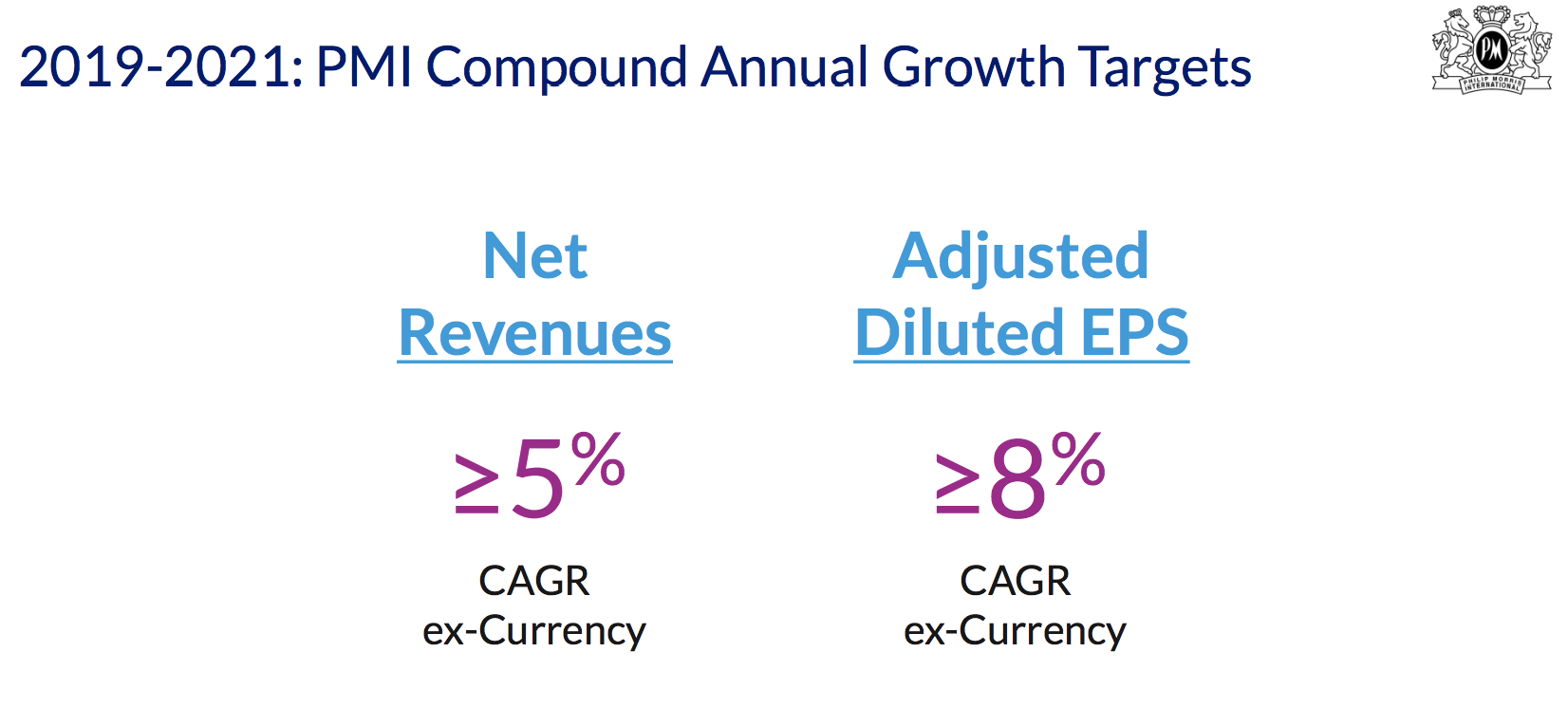

Nothing happens overnight either. Through 2021, management expects more of the same from Philip Morris. Excluding currency fluctuations, guidance calls for annual net revenue and adjusted EPS growth of at least 5% and 8%, respectively. If successful, the firm should have no trouble continuing its dividend growth streak.

Source: Philip Morris Investor Presentation

Source: Philip Morris Investor Presentation

That being said, there are numerous uncertainties facing Philip Morris in the coming years.

Key Risks

There are several important risks to consider before investing in any tobacco stock, but Philip Morris in particular.

First, understand that the company has no exposure to the world’s largest smoking population, China (where 30% of global smokers reside).

While other developing economies like India are potential growth markets, the risk of governments becoming increasingly anti-tobacco due to rising global health costs is ever present.

In fact, in recent years, governments around the world have started to increasingly crack down on tobacco, including bans on marketing, steadily rising taxes that threaten to eventually price many people out of the market, and increasingly gruesome warning labels on packaging.

Source: VOX

Such warning labels, as well as increasing regulatory pressure for “plain packaging” that limits branding, could threaten the company’s brand equity and pricing power, as well as overall smoking rates.

Additionally, while RRPs like IQOS represent a necessary adaptation to the future realities of declining smoking rates worldwide, keep in mind that regulators around the globe have remained largely hostile to these smoking alternatives (though not as much as cigarettes themselves).

In other words, while reduced-risk products may help to slow the decline in overall product volume, they may not be able to halt it entirely, and their high profitability could come under regulatory pressures. IQOS has been most successful in Asia, but raising awareness in other parts of the world could also be harder thanks to stricter limitations on marketing.

Most of its growth was fueled by rapid IQOS market share gains in Japan, where the company dominates with 80% RRP market share.

In late 2017, Japan Tobacco and British American Tobacco (BTI) launched major rival products to IQOS, initiating a price war that has helped both companies capture small but rising market share.

While Japan is just one of the dozens of markets where IQOS is sold, it’s unfortunately the most important one today.

In fact, Japan represents about 90% of the global $5 billion heat stick market, according to Euromonitor.

There is no guarantee that heat sticks like IQOS will see strong enough global adoption compared to its main rival, e-cigarettes (vaping). In other words, the company’s ambitious goal of generating 40% of it 2025 revenue from RRPs might not be achieved. The substantial amount of money Philip Morris is investing in RRPs may not earn the return management expects.

And as for the prospect for IQOS in the U.S., which has long served as a potential growth catalyst for Philip Morris, there is risk here as well. Specifically, Altria’s recent $12.8 billion investment in Juul (it now owns 35% of the leading vaping company in the U.S.) might minimize IQOS growth in this country, even if the FDA ultimately approves the product.

While Altria has said it plans to aggressively market both Juul and IQOS in the U.S., after paying such a steep price for Juul (over 30x sales), the company has taken a lot of heat. As a result, Altria’s management likely feels a lot of pressure to prove its Juul investment was a wise strategic move, so it may focus more on Juul products rather than marketing IQOS.

As a result, continued cigarette price increases and financial engineering (i.e. reducing share count over time) may become increasingly important components of Philip Morris’s long-term earnings growth, especially if RRP market share gains require price wars as the company has seen in Japan.

Closing Thoughts on Philip Morris

If you are willing to overlook the secular decline of the overall tobacco industry and don’t have moral misgivings about investing in an industry whose products ultimately harm its customers, Philip Morris International has the potential to be a decent high-yield investment for a diversified retirement portfolio.

At the end of the day, the tobacco industry appears to remain an attractive area for investment for income-seeking dividend investors because of its stable and recession-resistant cash flow, strong pricing power, and relatively slow (though potentially accelerating) pace of change, even despite growing regulatory pressures around the world.

While many international markets have demonstrated higher volatility in recent years due to new legislation, currency movements, and more, Philip Morris’ long-term prospects still hold potential. Specifically, the company continues seeing traction with its high-margin reduced-risk products, which could fuel market share gains and solid profit growth for many years to come. Investors just need to keep an eye on global cigarette volumes to ensure their rate of decline doesn’t accelerate.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends