I’ve zeroed in on five real estate investment trusts (REITs) set to hand you three critical things in 2019:

- High, safe payouts whose yields crush the typical S&P 500 dividend.

- Booming dividend growth: These five have already boosted their payouts an amazing 38%, on average, in the last five years—and they’re just getting started!

- Double-digit upside as an overlooked market shift kicks in, sending investors scrambling into these ironclad income plays.

Why am I so confident?

Because a long-running (and needless) worry that’s shackled REITs through 2018 has just been cast aside—but most folks are only starting to sense this big shift.

What Will Drive the Coming REIT Rally

Before we get to the five REITs I want to show you today, let’s dive into that barely noticed shift I just mentioned, which is the main reason I see REITs making a big move up in 2019.

To get the full picture here, we need to take a quick look back at what happened in 2018.

REITs languished this year as investors fretted (falsely) that rising interest rates would pump up yields on so-called “safe” investments, like Treasuries and CDs. That would theoretically hurt REITs, as they tend to appeal to the same type of investor as fixed-income investments do.

Check out how the go-to REIT benchmark, the Vanguard Real Estate ETF (VNQ) has lagged the market since Jan. 1:

A Textbook Undervalued Income Play

The thing I really want you to focus on, though, is how REITs reeled in the S&P 500—and briefly overtook it—at the end of that chart.

The thing I really want you to focus on, though, is how REITs reeled in the S&P 500—and briefly overtook it—at the end of that chart.

This shows us that the herd is starting to sense that something’s shifted. And that’s the moment we want to buy: when REITs are still cheap, but the next move up has clicked in and is about to really get rolling.

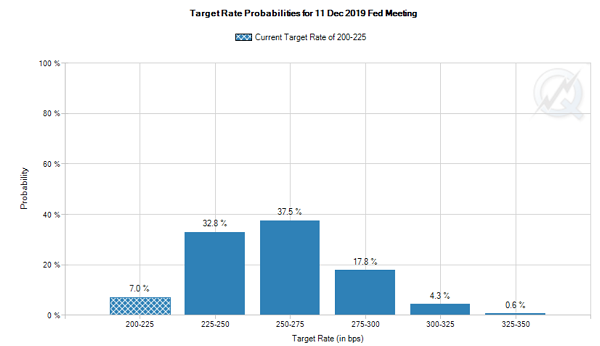

Because here’s what just changed about interest rates: a couple weeks back, we were expecting 4 increases from the Federal Reserve in 2019. But fast-forward to today, and we’re looking at just one (and maybe none!), according to traders betting through the Fed futures markets:

Source: CME Group

Source: CME Group

Meantime, 10-year Treasuries yield all of 2.8% today, so no one’s retiring on them, either.

The key takeaway? With the Fed sidelined and the economy still piping along nicely (pushing up demand for REITs’ rental space), we’ve got a perfect “goldilocks” situation for REITs in 2019.

To help you get in on it, I’ve pored over my last 12 months of ContrarianOutlook.com articles to bring you the five REITs that should be at the top of your year-end shopping list.

They are: office landlord Boston Properties (BXP), healthcare-property investor National Health Investors (NHI), hotel owner Ryman Hospitality Properties (RHP), data-center owner Digital Realty Trust (DLR), and warehouse manager STAG Industrial (STAG).

All have unbeatable strengths that safeguard our cash and set us up for serious gains in 2019.

Ryman, for example, is a small-cap REIT (its market cap is just $3.8 billion) with four resorts operating under Marriott’s Gaylord hotel brand.

You might think Ryman’s small size leaves it vulnerable to the whims of the broader economy, but the REIT cuts its risk by zeroing in on business conferences. This is a wonderful market, because once these clients find a resort they like, they tend to keep coming back. And Ryman’s hotels are sitting in conference hotspots like Nashville, Orlando, Dallas and Washington, DC.

The best news for Ryman is that the “meeting market” is growing, with spending jumping 23% from 2009 to 2016, according to the latest numbers from travel research firm Tourism Economics.

Meantime, Digital Realty, as I pointed out a couple weeks ago, is at the heart of the shift toward artificial intelligence, one of the many tech megatrends that will power this data-center landlord’s share price and dividend for decades to come.

Finally, National Health Investors adds ballast to our portfolio, providing financing for steady medical tenants, such as seniors’ homes and hospitals.

Your 5-REIT Portfolio: What the Numbers Say

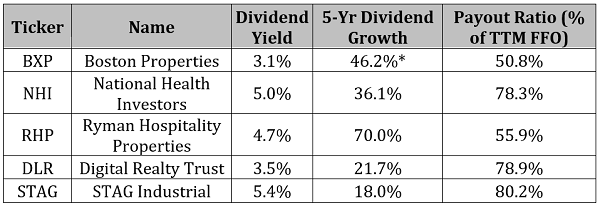

So with that, let’s put our 5 REITs to the test, starting with 3 crucial numbers for us income hounds: dividend yield, dividend growth and payout ratio (dividends as a percentage of funds from operations [FFO]; a vital measure of dividend safety).

*Not including special dividends paid in Dec. 2014, Dec. 2015 and Dec. 2016.

*Not including special dividends paid in Dec. 2014, Dec. 2015 and Dec. 2016.

As you can see, these 5 names give us a nice mix of high yields and dividend growth. (As I recently showed you in an example using 3M [MMM], a rising payout is the No. 1 driver of stock prices.)

And before you ask, yes, all of those payout ratios are easily manageable for well-run REITs like these. In fact, you’ll often find much higher ratios of 90% and more in REIT-land that are perfectly safe, as many REITs can count on steady, predictable rent checks from long-term tenants.

Finally, there are some real bargains in this bin. Ryman, for example, trades at a ridiculous 12.1-times adjusted FFO, with NHI and DLR also sitting at an attractive 16.0 and 17.8 times, respectively.

It’s no surprise that the two priciest trusts are STAG (20.7-times FFO) and Boston Properties (20.3). But those are fair prices (they’re both below the S&P 500’s 21.3) considering BXP has the second-fastest dividend grower in our basket and boasts the lowest payout ratio. And STAG sports the highest current yield and pays dividends monthly, to boot.

The bottom line? All the pieces are in place for REITs to book a nice run in 2019, as the market finally gets over its interest-rate phobia—and these 5 are perfectly positioned to lead the pack.

— Brett Owens

Revealed: My No. 1 REIT Pick for 2019 (7% dividends and big gains ahead) [sponsor]

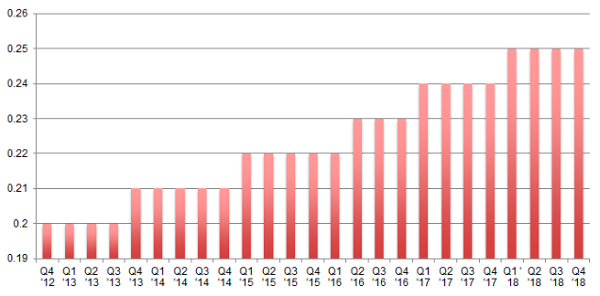

My No. 1 REIT pick for 2019 boasts an even higher payout than any of the 5 trusts above—I’m talking about a dividend yielding an incredible 6.9% as I write. What’s more, this payout isn’t just growing—its yearly increases are getting bigger and bigger!

Imagine What This Could Do for Your Retirement

I love it when a stock with a fat dividend yield gives us strong payout growth, too. It’s proof that management is making more money, so it can afford to pay us shareholders more. An accelerating payout is a flat-out cry for help!

I love it when a stock with a fat dividend yield gives us strong payout growth, too. It’s proof that management is making more money, so it can afford to pay us shareholders more. An accelerating payout is a flat-out cry for help!

Make no mistake: this payout’s growth is here to stay. This 7%-payer is backed by an unstoppable demographic trend that will deliver growing dividends for the next 30 years.

And before you ask, it doesn’t care about interest rates: no matter what happens with the Fed, this REIT will just continue to raise the rents on its “must-have” facilities.

That’s why I’ve made this unsung trust a cornerstone of my “8% No-Withdrawal” portfolio, a collection of 6 investments from every corner of the market that I’ve assembled to do one thing (two, actually):

- Deliver a safe 8% average dividend yield: That’s enough to pay you $40,000 in income—enough for many folks to retire—on a $500,000 nest egg.

- Safeguard your retirement stash, letting you fund your golden years on dividends alone without drawing down your nest egg by a single penny! This insures your retirement against a market meltdown and lets you leave a lasting legacy for your kids (and grandkids).

I’m ready to share the names of all 6 stocks and funds inside this dynamic portfolio with you now. Click here to get the name, ticker symbol and full details on my top REIT pick and all 6 of these perfect retirement investments now.

Source: Contrarian Outlook