U.S. President Donald Trump’s trade war is getting increasingly expensive. And U.S. consumers and investors will bear a lot of the cost.

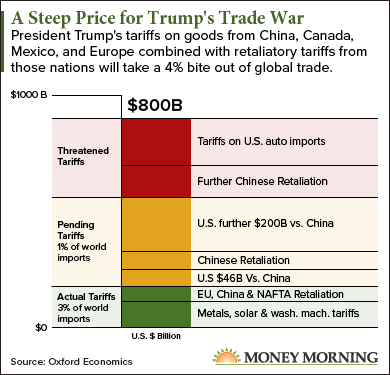

In the big picture, President Trump’s tariff policy is having a significant impact on global trade. According to UK-based research firm Oxford Economics, a full-blown trade war will chop global trade by 4% — the equivalent of $800 billion.

And it appears the world is moving headlong toward the scenario Oxford outlined in a report earlier this month.

And it appears the world is moving headlong toward the scenario Oxford outlined in a report earlier this month.

Wednesday, the Trump administration unleashed tariffs on $200 billion worth of Chinese products, one of the possibilities the Oxford report warned about.

“Recent tariff threats, if realized, would extend high tariffs to over 4% of world imports – a tenfold rise,” Oxford lead economist Adam Slater wrote in the report. “This comes just as the global upturn shows signs of faltering.

The threat to world growth is significant: in a scenario of escalating tariffs, our modelling suggests world GDP could be cut by up to 0.4 percentage points in 2019.”

As he announced the latest round of tariffs, President Trump said levies on $200 billion more of Chinese imports await if China retaliates. China vowed it would shortly after Trump’s announcement.

President Trump is confident the tariffs are the right way to go – in March he tweeted “trade wars are good, and easy to win.” But as I warned back in 2015, a tariff-heavy trade policy is likely to do more harm than good.

And the costs to Americans are already adding up…

Wall Street Hates the Trump Trade War

Investors get slammed every time another salvo is fired in the trade war.

Back in March, when President Trump announced tariffs on steel and aluminum, the Dow Jones Industrial Average plummeted 420 points.

A late June report that the Trump administration was going to prevent Chinese firms from investing in U.S. tech companies while curbing technology exports to China sent the Dow down 328 points.

And this week’s news that the United States would slap tariffs on $200 billion of Chinese products sliced 219.21 points off the Dow Wednesday.

Concerns about the escalating Trump trade war have been a drag on stock prices for most of 2018. They’ve contributed to the 7% decline in the Dow since its Jan. 26 closing high of 26,616.71.

Meanwhile, the new tariffs are going to raise the prices of hundreds of common products here in the United States…

How the Trump Tariffs Will Hit Your Wallet

The first batch of tariffs mostly targeted imported materials such as lumber, steel, and aluminum.

The tariffs increase the cost of these materials, which either must be eaten by the manufacturers or passed on to the consumer.

The National Association of Homebuilders said last month the lumber tariffs have added about $9,000 to the cost of a single-family home.

And the steel and aluminum tariffs will add thousands of dollars to the cost of a new car, according to the Alliance of Automobile Manufacturers. But Harley-Davidson Inc. (NYSE: HOG), rather than raise prices on its motorcycles, is opting to move several of its factories out of the United States. That will cost jobs.

“While President Trump says his trade policy is meant to punish China, the numbers show that, in reality, U.S. businesses, workers, and consumers will pay the price under this policy,” Sage Chandler, vice president for international trade at the Consumer Technology Association, wrote in a July 5 blog post on the CTA website.

The just-announced round of tariffs are extensive and hit a broad range of everyday goods. The document listing them is a hefty 195 pages long.

Here are just a few of the products that will cost you more as a result of the trade war:

- Fabrics: Wool, leather, cotton, fur products, synthetic fibers, and woven and knitted products.

- Electronics: Batteries, remote controls, flash drives, and thermostats.

- Food: Dried fruit, wheat and grain, beer, wine, seafood, nuts, fruits, and fruit juices.

- Furniture: Chairs, couches, mattresses, tables, and paintings.

- Machinery: Combustion engines, air conditioning units, washing machines, and hydraulic jacks.

Unfortunately, there isn’t much you can do about rising prices. But you can take action to protect your investments…

What to Do with Your Investments to Beat the Trade War

Money Morning Chief Investment Strategist Keith Fitz-Gerald has time-tested strategies for times like these.

“Make sure your trailing stops are in place to control downside risk. Your goal is to stop small losses from becoming catastrophic portfolio killers,” Fitz-Gerald said. “You can always re-enter the stocks you want to when things calm down.”

For those who want to take profit from the trade war’s negative effect on the markets, Fitz-Gerald suggested two specialized inverse funds: the Rydex Inverse S&P 500 Inverse Fund (MUTF: RYURX) and its ETF cousin, the ProShares Short S&P 500 (NYSE Arca: SH).

He said particularly aggressive traders may also want to use options on individual stocks or indexes. Money Morning’s options trading specialist, Tom Gentile, believes options are the ideal way to cope with the Trump trade wars.

There’s no telling how or when these trade wars might end. But you can make moves now not just to minimize your losses, but to capture some profits while others are running for cover.

— David Zeiler

According to one of the world's top AI scientists, there's a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead... but whatever you do, don't go all in on big tech before you have all the details. Click here.

Source: Money Morning