I sure hope you’re following along as directed!

I’ve repeatedly identified The Boeing Co. (NYSE: BA) as particularly at risk of retaliatory trade tariffs, should President Trump press on with his wishes to hit China with $60+ billion in tariffs.

My reasoning was very simple and based on first-hand experience.

Starting, most likely, with Boeing.

The company already sells one in every four aircrafts it produces to Chinese buyers, recently announced a $37 billion order for another 300 planes from China Aviation Supplies Holding Company, and expects China to acquire more than $1 trillion in aircraft over the next 20 years.

Roughly “7,000 are in China” according to Boeing CEO Dennis Muilenburg, who made the observation on CNBC’s “Squawk” on the Street last month.

Simply put, Boeing is China’s single most important target:

- More than 80% of the company’s commercial planes are sold overseas, which means that foreign customers are its bread and butter – every one of which can easily shift to competitors like Airbus Group (OTC: EADSY) or cancel orders entirely… or both.

- The company employs more than 137,000 people, which is nearly as many as the total number of people working in the steel and aluminum industries the president wants desperately to protect. Factor in suppliers around the country, and you may be talking a quarter million or more folks at risk. That’s the kind of number that could almost single-handedly result in a “jobs” recession if it goes the other way.

- Boeing is opening a plant in Shanghai later this year for high-value finishing because China does not yet have the expertise to do that domestically. So, those jobs are on the line, too, as are valuable direct labor savings and bottom-line profits.

- Chinese orders may account for upwards of a fifth of Boeing’s $488 billion backlog.

- Boeing stock rose more than 90% in 2017, making it one of the single best-performing Dow components – a trend it was continuing this year.

Until last Wednesday.

That’s when it finally dawned on traders that the trade war concerns that you and I have been talking about for months might be for real and, worse, that there would be a devastating economic impact that goes waaaaay beyond the narrowly defined industrial ballgame the president wants to play.

Boeing stock dropped $8.41 per share and the company got an involuntary $4.89 billion buzzcut in market capitalization.

The irony, of course, is that Trump’s proposed steel and aluminum tariffs themselves really don’t amount to much in the scheme of things for Boeing itself. Aluminum, for example, only makes up about 12% of the cost of an aircraft like the 737 or 777, according to Reuters, most of which is domestically produced anyway.

It’s what happens when China strikes back that really gets expensive in a hurry. Unbeknownst to most people, the real money building an aircraft gets spent on electronics, avionics, and engines.

Moving an order from Boeing to Airbus is just one facet of the potential repercussions.

Three Ways to Immediately Position Yourself to Profit

I see several ways to play the situation for maximum profit potential.

First, if you already hold Boeing stock, you’re gonna to want to capture profits if you haven’t already. The stock is up more than 100% since January 2017, which means you’ve got a lot of money on the table worth protecting if you’re on board.

My favorite way to do that is also the simplest Total Wealth tactic of all… to set a trailing stop at a past resistance point – $295.00 per share, for example – or by using a simple percentage retracement from the company’s high of $371.60 a share on Feb. 28, 2018. That can be volatility-based or a simple rule of thumb like 10%, for instance.

Second, geopolitical tensions are higher than they’ve been in 70 years, which means that Boeing’s military contracts are rock-solid and likely undervalued. Military defense spending makes up 22.54% of company revenues. That speaks to buying shares… on the way down and even if you’re ahead of THE bottom, which might not occur for some time.

My preferred Total Wealth tactic (and the one most suitable for the majority of investors) here is to simply dollar-cost average in over time. That way you’re harnessing growth and forced to buy at lower prices over time, even if you don’t want to – emotionally speaking.

And, third, a trade war could be really bad for a broad swath of companies related to Boeing, which means you’ve got the opportunity to buy into otherwise great companies using the same “military logic” on the cheap.

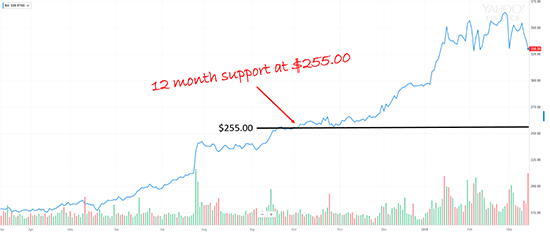

Placing lowball orders at ridiculously low prices is a great way to do that. A quick look at the chart tells me that $255.00 is in the neighborhood because it’s consistent with past support.

Incidentally, you’ll know you’re in the right neighborhood when your neighbor or your broker tells you “that’s ridiculous… the stock will never trade at that deep a discount.” More often than people realize, it does.

In closing, I’ve obviously just scratched the surface.

We haven’t even begun, for example, to talk about how you trade Boeing’s suppliers, related technology companies, or even completely unrelated sectors – all of which will be negatively impacted by a retaliatory trade war and all of which have enormous profit potential as a result.

I’ve identified 10 companies that are particularly at risk from retaliation – all of which are household names and all of which derive between 40% and 85% of their sales in China.

I’ll be back in the weeks ahead as the situation develops and the profit potential accelerates.

— Keith Fitz-Gerald

According to one of the world's top AI scientists, there's a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead... but whatever you do, don't go all in on big tech before you have all the details. Click here.

Source: Money Morning