Following big options trades can be a very smart way to see what upcoming moves seasoned investors are betting on. In my experience, many of the smartest traders use options to make directional bets on stocks and indexes.

The trade I’m referring to took place in Micron Technology (NASDAQ: MU).

Micron is a semiconductor company which focuses on storage and memory chips.

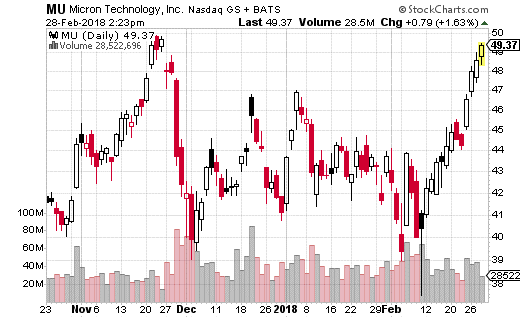

After struggling for several years, the stock has had a solid past year of performance.

Well, a very big trader, or perhaps a couple different traders, are betting big money that MU is going to continue going up through March 22nd earnings. Although the company pre-announced strong earnings and raised guidance, the smart money seems to believe the good times will continue, at least until April expiration.

Here’s the deal…

A couple very large call spreads traded [last] week in MU April options which are very bullish for the stock. Both trades involved buying the April 50 calls while simultaneously selling the April 55 calls. The trades occurred with MU stock at right around $48 per share.

In total, over 30,000 of these 50-55 call spreads traded for about $1.38 per spread. The premium cost of $1.38 is also the max loss on the strategy and it puts the breakeven point at $51.38. That also means max gain is $3.62. In dollar terms, the trader(s) spent about $4.1 million on the trade with the potential to earn $10.9 million if MU goes to $55 by expiration.

So why make such a bullish bet if the company pre-announced strong earnings? It could be investors believe the details of the earnings call will be even more bullish than the broad numbers already released. Or perhaps, it’s the result of the semiconductor industry seeing a lot of strong results overall.

Demand for flash memory is certainly increasing, judging from MU’s competition. And since flash memory is one of Micron’s specialties, investors may be betting on a bright future for the company – at least for the next few months.

That being said, what can we do to profit from knowing where the smart money is positioned on MU? It’s pretty easy in this case because we can do the exact same trade. There’s nothing fancy or prohibitive about a call spread, so there’s no reason we can’t emulate the trade.

Now, you can pay a bit less on the spread by not going all the way out to April expiration. For instance, if you think the stock is going to jump immediately after earnings, the earnings week 50-55 call spread (expiring March 23rd) is trading for $1.30 with the stock at $48.70.

However, I believe in this case, buying a little extra time is a good idea. And, since the stock has gone up almost a $1 since the big trades were made, it makes sense to save a bit in premium costs by not going out quite so far.

I recommend the March 29th 50-55 calls trading for about $1.37. At that price, max gain is $3.63 which works out to 165% returns if the stock goes to $55 or above by the expiration date.

— Jay Soloff

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Investors Alley