My paid-up Money Map Report subscribers get a wealth of great recommendations every month.

Each one is carefully researched and calibrated to help investors build a risk-balanced “50-40-10” portfolio of stocks and funds that pivot on the six global “Unstoppable Trends” that have been making people wealthy for centuries – and should continue to do just that for the foreseeable future.

But today, in the midst of the volatility and uncertainty roiling global markets, I want to share one of the most important recommendations with everyone.

This “buy” is so important, in fact, it’s the very first investment I recommend each new subscriber make.

And even after more than 34 years in the global markets – including an action-packed decade as Chief Investment Strategist here at Money Map Press – it’s still my No. 1 choice for stability and superior returns.

Let’s dive right in…

The Oldest Fund in Existence Has Been Positive in 70 of the Past 88 Years

Founded on July 1, 1929 – just four months before the Great Crash – the Vanguard Wellington Fund Investor Shares (MUTF: VWELX) has weathered everything from the Great Depression to today’s misguided Federal Reserve meddling in style.

It’s a $90 billion fund, and it’s about as stable as they come.

That’s worth saying, because our goal is to maintain positive momentum in the face of market headwinds, not necessarily shoot for absolute outperformance at the moment.

Still… outperformance is what you can get with this fund.

Let’s talk about why.

For starters, the Wellington maintains a blend of 65.24% stocks, 30.26% bonds, and 4.5% short-term reserves. This means that there are both high-performance equities and “safe” bonds at work at all times.

To be fair, you could argue that both equities and bonds are likely to fall in the next 12 months, and I wouldn’t hold that against you. But I would challenge you to find another fund that’s been around the block as many times as the Wellington, and with anything even remotely resembling its success.

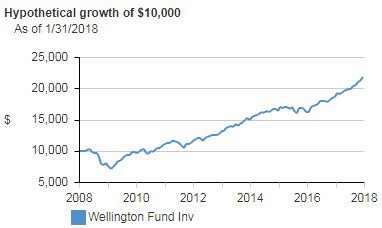

Unlike the “Johnny Come Latelies,” the Wellington is more than 88 years old and sports load-adjusted returns of 8.30% since its inception. And over the last 10 years – a time when many investors claim there was nothing worth buying – you still could have doubled your money with the Wellington!

I also like the fact that the fund has ultra-low fees of 0.26%. This puts it on par with almost any ETF and in a league of its own when it comes to the typical performance-robbing 1% fees associated with mutual funds.

I also like the fact that the fund has ultra-low fees of 0.26%. This puts it on par with almost any ETF and in a league of its own when it comes to the typical performance-robbing 1% fees associated with mutual funds.

Over 20 years, the reduction in fees is like getting a 15% booster that goes directly into your wallet. Oh… and there’s no “sales load” or commission, either.

Here’s something else to love.

The Wellington Is Chock Full of “Glocals”

VWELX holds many of the same deep-value, fortress-like “glocals” we’ve preferred for years. This offers us additional safety, stability, and diversified cash flow.

In fact, the fund’s holdings read like a “Who’s Who” of global leaders.

I’m talking about companies like Wells Fargo & Co. (NYSE: WFC), Merck and Co. Inc. (NYSE: MRK), Verizon Communications Inc. (NYSE: VZ), Microsoft Corp. (Nasdaq: MSFT), Comcast Corp. (Nasdaq: CMCSA), Exxon Mobil Corp. (NYSE: XOM), JPMorgan Chase & Co. (NYSE: JPM), and Apple Inc. (Nasdaq: AAPL), just to name a few.

Factor in the Wellington’s 2.29% dividend, and you’ve got a real market-beater, especially in a low-interest-rate world.

Speaking of zero interest rates, the Wellington’s bond holdings have an average yield to maturity of 2.30%, average coupon of 3.70%, average maturity of 9.5 years, and an average duration of 6.2 years.

This further reinforces our defensive position by keeping us in comparatively safe securities, while also allowing us the flexibility to adapt to rising interest rates.

So we’re in good shape regardless of what the Fed does or when it does it.

Management Has Already Been Tested (and Passed with Flying Colors)

Normally, mutual fund managers jump around. Most investors don’t realize just how much this cuts into their returns. Yet, new managers come in with new philosophies and re-jigger strategies; they move in and out of positions, which may leave you with more capital gains taxes to pay or – worse – losses to recoup.

So managers with long track records at the same funds are worth their weight in gold.

This is not lost on Vanguard’s management. That is why the Wellington’s managers, Edward P. Bousa and John C. Keogh, have been managing the fund since 2000 and 2003, respectively.

During that time, the team has had to contend with some of the most turbulent market upheavals of the modern era; the dot-bomb blowup, a real estate crisis, panicked bond investors, the global financial crisis, EU sovereign debt crisis, Brexit – you name it, they’ve seen it, and they’ve beaten it.

A lesser management team could have easily let these events derail an otherwise sound management plan, but they haven’t.

Who says stability is boring? Not me!

So let me show you how to add this must-own fund to your portfolio.

Here’s How to Buy Today

Buy Vanguard Wellington Fund (VWELX) at market, and set a 25% trailing stop to protect your principal and your profits.

Now, a word: I’ve heard from some subscribers whose brokers tell them the Vanguard Wellington Fund is “closed to new investors.”

That’s incorrect.

It’s true that the Vanguard Group stopped opening new accounts from financial advisers and institutional customers in February 2013.

But you can still invest in the VWELX in two ways:

1) through any broker or financial advisor who had an existing relationship with them before February 2013; or,

2) as an individual, you can open account directly with Vanguard.

— Keith Fitz-Gerald

According to one of the world's top AI scientists, there's a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead... but whatever you do, don't go all in on big tech before you have all the details. Click here.

Source: Money Morning