Eleven billion dollars…

That’s how much money two major funds lost in combined market value over the last few weeks.

You might expect this, since the stock market just suffered a correction. But interestingly, these aren’t stock funds…

Sure, stock funds lost money as prices fell. And folks are certainly worried about the market after the recent decline.

But this mass exodus happened in another asset. And you should consider this as a massively contrarian opportunity right now.

Let me explain…

An $11 billion loss means these two funds saw 19% of their combined assets disappear… in less than three months.

The crazy part is that both funds fell less than 3% over that time. So they haven’t lost assets because share prices are down, but because investors have pulled their money OUT of these funds.

Again, these aren’t stock funds. They’re two of the largest bond exchange-traded funds (ETFs) – the iShares iBoxx Investment Grade Corporate Bond Fund (LQD) and the iShares iBoxx High Yield Corporate Bond Fund (HYG).

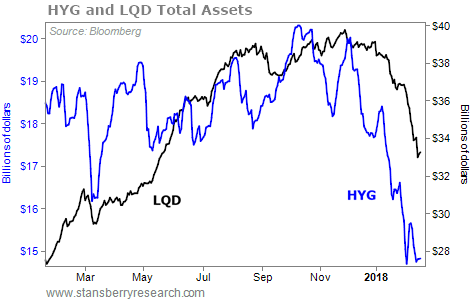

LQD is the largest investment-grade bond ETF, while HYG is the largest “junk” bond ETF.

At the end of November, these two funds held nearly $60 billion in total assets put together. Both have lost more than $5 billion since. Take a look…

The mass exodus from these two funds has a single culprit: rising interest rates.

Yields have been moving higher since September. And fears of higher interest rates are hitting an extreme right now. You see it everywhere…

Inflation and a resulting bond crash are fund managers’ biggest fears right now, according to the latest Fund Manager Survey from Bank of America.

Real-money traders are making the same crowded bet…

The Commitment of Traders (COT) report tells us what futures traders are doing with their money. And right now, futures traders are betting on higher interest rates at near-all-time extremes.

It’s across the board. Futures traders are unanimously betting on higher two-, five-, and 10-year Treasury yields.

The thing is, we know that when EVERYONE believes in one trade, the trade is usually over… It means there’s nobody left to buy. That’s where it looks like we are now with this interest-rate trade.

Investors expect higher rates. They’re selling bond funds to avoid losses if rates rise. And futures traders are actively betting on higher rates.

This all means betting on higher interest rates is a crowded trade right now.

And as a contrarian investor, that gets me interested.

LQD and HYG saw $11 billion disappear in just a few weeks. If you’re bold, now is a moment to consider going against the crowd and betting on bonds… betting on lower rates.

Do it as a three-month sentiment trade. And set a tight stop loss to limit your downside.

Trades don’t get more contrarian than this. But the time is right… Are you contrarian enough for this trade?

Good investing,

Steve

Marc Chaikin built the system that isolated NVDA before it became the best-performing stock of 2023. Click here to get his latest buy. More here.

Source: Daily Wealth