You buy a stock for the long haul…

It’s a great business. It trades at a great price. And you know its upside potential is huge.

So you take a medium- to large-sized position. And what do you know? The stock starts to rise.

You’re right… And you’re making money.

Then, doubt sets in…

You turn on the TV and Joe Analyst from Big Bank X rattles off three reasons why your stock is doomed. You turn on your computer and learn that a senior analyst from another big firm just downgraded the stock… and shares drop 5%.

“Maybe they’re right,” you think. “Maybe I should get out now, while I’m still up on the position.”

That’s dangerous thinking. You see, these types of positions are your best shots at supercharging your portfolio…

As our colleague Steve Sjuggerud has pointed out…

What distinguishes a great track record from an ordinary one? It’s typically one thing: a couple of big winners…

If your track record includes a lot of ordinary returns and a couple of big winners, then chances are you’re doing well with your investments. But if you have a lot of ordinary returns and NO big winners, then chances are you’re underperforming the market.

You can’t underestimate the power of big winners. You can’t sell early.

So how do you prevent yourself from selling early – before your stop loss is triggered – when it seems like the reasons to abandon ship are building?

Look at the facts… And ask yourself, “Is the company guilty beyond a reasonable doubt?” Has good turned bad? Have the reasons you bought the stock in the first place reversed? Has something dramatically and permanently changed for the worse?

If not, you’re likely letting emotions get the better of you.

Today, we’ll look at this idea in practice. We’ll review our biggest winner in DailyWealth Trader (DWT) last year…

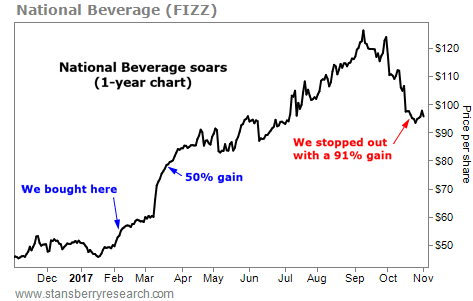

We recommended buying shares of sparking-water and soft-drink producer National Beverage (FIZZ) on February 3. The company was growing rapidly. Its flagship brand LaCroix was flying off supermarket shelves, and its CEO owned a huge 74% stake in the company.

We said the stock had at least 50% upside potential… And we passed the 50% mark in less than two months. Not long after, the naysayers started to speak up…

On April 21, Credit Suisse downgraded the stock from an “outperform” rating to a “neutral” rating. The financial-services company’s analyst stated that National Beverage was overvalued. Shares fell 5.3% that day.

On May 4, the Maxim Group issued a “sell” rating on the stock and gave it a $33 price target. It mentioned a lack of transparency and corporate governance issues. Shares fell 8.2% that day.

On July 21, Credit Suisse downgraded the stock again to a “sell” rating. It gave the stock an $82 price target. This time, the company’s analyst said National Beverage’s shares had come too far, too fast. Shares fell 4.3% that day.

Each time, it was tempting to think that the trouble had started for National Beverage shares. We were already up a lot in a short period of time… And smart people were saying the stock should fall.

But was National Beverage “guilty beyond a reasonable doubt”? Not by a long shot…

We checked in on the company in August to see if the naysayers were right. As it turned out, the business was doing well. Over the prior 12 months, sales and profits had jumped about 17% and 75%, respectively. Plus, it had a big 13% profit margin. So we continued holding with our 20% trailing stop.

As you can see in the chart below, shares blew past our initial 50% target. We finally stopped out of the position in October – for a 91% gain in eight months…

If we had sold National Beverage early, we could have missed the last 41% in gains.

The lesson from our biggest winner of 2017 is clear. You can hear the critics out. But don’t sell based on opinions. Focus on how the business is performing.

If the stock hasn’t triggered your stop loss, ask yourself, “Is the company guilty beyond a reasonable doubt?” If it’s not, your best bet is to hold on.

Let your winners ride… And continue to protect yourself with trailing stops.

Good trading,

Ben Morris and Drew McConnell

[ad#stansberry-ps]

Source: Daily Wealth