As tempting as it is to invest in initial coin offerings (ICOs) right now, the last thing you want is to lose your money to a crypto-scammer.

By now, almost every investor is aware of major cryptocurrencies like Bitcoin and Ethereum, and how they’ve delivered almost unheard-of returns to early investors. In 2017 alone, the Bitcoin price is up more than 740%; the Ethereum price is up more than 4,000%.

By now, almost every investor is aware of major cryptocurrencies like Bitcoin and Ethereum, and how they’ve delivered almost unheard-of returns to early investors. In 2017 alone, the Bitcoin price is up more than 740%; the Ethereum price is up more than 4,000%.

The past year has brought an explosion of new cryptocurrencies, most of which arrive in the form of an ICO.

Some ICOs have raised stunning amounts of money in the blink of an eye. In August, Filecoin set the current record by raising $252 million in 30 minutes.

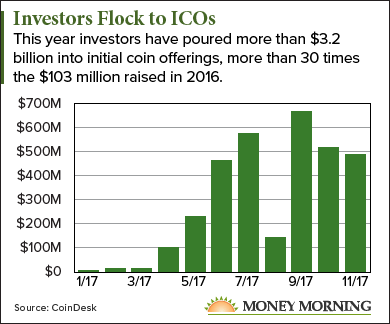

This year, more than 200 ICOs have attracted more than $3.2 billion of investor money.

But unlike the IPO concept on which they are modeled, ICOs are virtually unregulated.

And that’s fertile ground for scam artists…

Why Initial Coin Offerings Are Riskier Than Other Investments

For one thing, no regulatory oversight means the people behind an ICO don’t need to follow strict disclosure requirements.

And because ICOs sell their tokens directly to the public, they don’t need Wall Street investment banks or stock exchanges. Taking Wall Street out of the equation may sound appealing, but it removes another crucial layer of protection for retail investors.

A scam company would be exposed long before it reached its IPO date.

That lack of scrutiny makes it easy to launch an ICO designed solely to extract money from investors eager to get in on the ground floor of a fresh cryptocurrency.

It also means that if you fall into a scammer’s trap, you have little recourse to recover lost funds. Money lost to crypto-scammers is usually gone for good.

But you don’t have to pass up the extraordinary gains possible in cryptocurrencies out of fear. You just need to know how to tell legitimate ICOs from the risky ones.

Here are the red flags you should look for…

How to Spot an ICO Scam

- The Business Plan – or Lack Thereof: While ICOs don’t need to disclose anything, they almost all set up a website where you’ll find a white paper and some of the basic information. The white paper is probably the best place to start looking for clues about whether an ICO is legit. If there are a lot of grandiose claims but few specifics, beware. Also, pay close attention to how the money that’s raised in the ICO will be used. The tokens created should have an integral role in the business plan, not just be a mechanism for raising funds. A study in October by Token Report found that only 20 digital tokens out of 226 issued via ICO were being used as part of the company’s network.

- The Team: Knowing who’s behind the ICO is key. Do they have a reputable background? What projects have they worked on in the past? They should have a history on social media. Scam ICOs often create fake identities. Just this week, the originators of an ICO called Confido vanished with $375,000 of investor money. In the aftermath, jilted investors found many of the identities of the team members had been faked. Another trick scammers use is to post the photos and bios of well-known cryptocurrency personalities on their website – even though they have no connection to the ICO. Check their social media to see if they’re talking about the ICO.

- Impossible Promises: Another major warning sign that an ICO may be a scam is too-good-to-be-true claims. It’s very unlikely, for instance, that a new token will be “bigger than Bitcoin.” Also watch out for outsized claims of what the crypto token will do, such as “change the way” some sector operates. Some even go so far as to suggest their new coin will help solve climate change or reinvent the Internet.

- A Barrage of Buzzwords: Digital currencies are complex enough that it’s easy for scam ICOs to cover their true intent with a lot of cryptocurrency jargon. Watch out for a lot of impressive talk about blockchains, decentralization, tokens, trustless databases, ecosystems, and platforms. These are legit terms, but a scam ICO will throw them around without actually explaining how its cryptocurrency is supposed to work or what makes it unique.

- The Escrow Account: Most ICOs use an escrow account to hold customer funds during the initial sale of tokens. Only when the tokens are released to the buyer is the money transferred to the ICO. The safest way to set up a crypto escrow account is with a “multi-sig” wallet that requires multiple people to sign off on a transaction. Ideally, one or more of these people will be a neutral, trusted third party. Scammers will set up escrow accounts where only one or two team members control the escrow money, making it easy to steal customer funds. Scrutinize the white paper for these details.

Unfortunately, scam ICOs aren’t the only bad actors in the cryptocurrency universe. Some scammers base their ploys on tricking people into surrendering their legitimate cryptocurrencies.

Often these scams take the form of a spoof website designed to look like that of a legitimate ICO. People fooled into using these fake websites to participate in an ICO end up sending their money directly to the scammer. If you’re going to send money on a website, check – and double-check – the website address.

Other scams send e-mails claiming to be from an ICO operator. These often will advise the victim to send funds to a particular address to participate in an upcoming ICO. But the address they provide is to a wallet they control, not the official ICO address.

Investing in ICOs can be lucrative, but as you can see, it’s fraught with danger. And for now, you have to be your own policeman.

— David Zeiler

[ad#mmpress]

Source: Money Morning