Most very high yields are not safe.

In fact, of the companies ranked by SafetyNet Pro with the 20 highest yields, 15 are rated Fs and two are rated Ds.

It’s not too common to find a double-digit yield with a strong dividend safety rating.

Golar LNG Partners (Nasdaq: GMLP) is a master limited partnership (MLP) that owns ships that carry and store liquefied natural gas (LNG).

Golar LNG has paid a quarterly distribution since 2011.

It raised the distribution regularly until 2015. Since then, it has stayed the same. The $0.5775 quarterly dividend comes out to an 11.3% yield.

The company has never cut the distribution since it began paying one six years ago.

Last year, Golar LNG paid out $154.7 million in distributions while generating $261.2 million in free cash flow, for a payout ratio of 59%.

Generally, I want my companies to pay out 75% or less of their cash flow in dividends in order for me to feel confident that the dividend is secure, even if the company goes through a difficult year or two.

So Golar LNG’s 59% payout ratio is well within my comfort zone.

In 2017, the distribution is forecast to stay the same at $154.7 million, but free cash flow is projected to rise to $316 million, lowering the payout ratio to 49%. The company could easily raise the distribution if it wanted to. Though with an 11% yield and $1.2 billion in debt, it may be wiser to pay down some of that debt.

In fact, debt is the only thing that would point to a downgrade in the near future.

In fact, debt is the only thing that would point to a downgrade in the near future.

If its debt rises or earnings before interest, taxes, depreciation and amortization (EBITDA) falls, Golar LNG’s dividend safety rating could come down. Debt-to-EBITDA is one factor that SafetyNet Pro looks at, and right now, it’s close to causing a downgrade.

But for now, considering its short but respectable payment history, solid financials, and low payout ratio, Golar LNG’s distribution is safe.

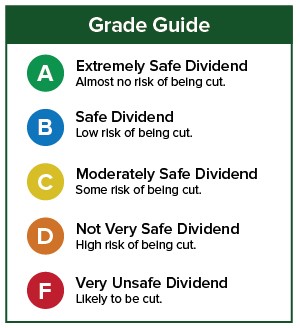

Dividend Safety Rating: A

Good investing,

Marc

[ad#wyatt-income]

Source: Wealthy Retirement