Wall Street’s pundits love touting the Dividend Aristocrats as the crème de la crème of the income world. I get it.

But that doesn’t make all Dividend Aristocrats buys.

And in fact, five of them – which I will highlight for you today – are downright dreadful long-term dividend holdings.

When investors think of dangerous dividends, they tend to think of companies whose payouts could evaporate overnight.

As well they should – nothing can derail your retirement plans faster than watching the dividends you rely on disappear in a flash.

But there’s a less flashy dividend danger that investors often ignore at their own peril: inflation.

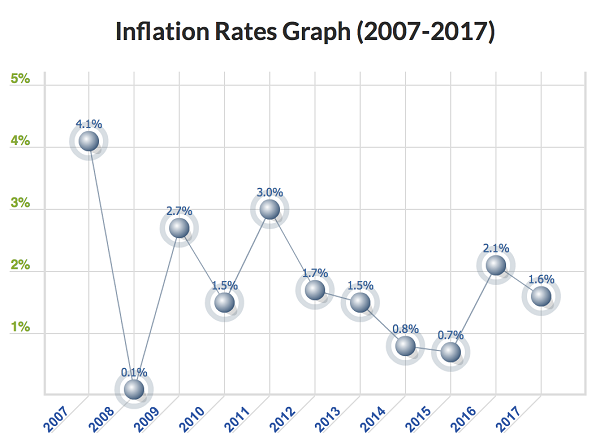

SOURCE: US Inflation Calculator

SOURCE: US Inflation Calculator

Investors tend to ignore inflation rates because they’ve been low for years. We’ve only touched 3% annually once since the 2007-08 market crash, and the June reading was a paltry 1.6%. Thing is, companies still need to increase their dividends faster than the rate of inflation, or else their payouts will actually have less purchasing power than they were the previous year.

And while 1.6% seems like an awfully low bar to clear (it is!), five Dividend Aristocrats have won this investor-cheating game of limbo, offering some of the most meager dividend growth on Wall Street of late:

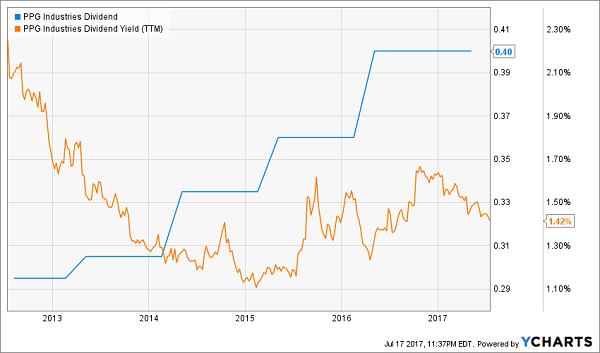

PPG Industries (PPG)

Dividend Yield: 1.42%

Last Dividend Increase: 0%*

File this first one under “to be determined.”

PPG Industries (PPG) is a paints fiberglass specialist whose reach spans more than 70 countries, and in fact is the world’s largest coatings company. PPG does its business via brands such as Glidden, Pittsburgh Paints and Olympic.

However, while PPG still does a robust domestic and international business, growth has disappeared of late. Revenues declined in both 2016 and 2015, and last year’s profit was the company’s lowest in years.

PPG’s 40-cent-per-share quarterly dividend still is well-covered, and it’s riding a streak of 475 uninterrupted dividends. But the company threw investors a curveball in April by not announcing an increase as expected, and the payout has now gone unchanged for five quarters.

PPG Industries does report earnings soon, so it still has time to rectify the situation, and considering the paintmaker’s last dividend hike (more than a year ago) was by about 11%, it’s hardly time to hit the panic button.

But if 2017 comes and goes without the company extending its 45-year dividend growth streak, management will have a lot of explaining to do.

PPG Industries (PPG) Missed a Step

Sherwin-Williams (SHW)

Dividend Yield: 0.85%

Last Dividend Increase: 1.19%

You could argue that PPG rival Sherwin-Williams (SHW) has an excuse for its most recent dividend hike, which was unsatisfying at best. But I would say that excuse is flimsy.

Sherwin-Williams announced a bid for competitor Valspar in 2016, and eventually closed the deal this summer at a $11.3 billion price tag. In the interim, SHW doled out a mere 1-cent uptick to the payout.

The thing is, the Valspar acquisition didn’t come from Sherwin-Williams’ cash hoard – SHW issued a ton of debt to finance the merger, and as a result, Moody’s downgraded Sherwin’s bonds by three notches! However, Sherwin-Williams ended up posting record profits for the fifth consecutive year, and it paid out less than 30% of its net income as dividends.

I understand exercising fiscal caution, but SHW cranked back its payout while leveraging the farm to make an aggressive buyout. That doesn’t mean the ploy won’t work, but given an already low yield, income investors who depend on Sherwin-Williams’ traditionally robust dividend growth may call foul if the company doesn’t return to form.

Will Sherwin-Williams (SHW) Get More Aggressive Again?

Emerson Electric (EMR)

Dividend Yield: 3.2%

Last Dividend Increase: 1.05%

Unlike PPG and SHW, where the jury might still be out, Emerson Electric (EMR) looks just plain lifeless.

Emerson is a multinational industrial headquartered in Missouri that offers a wide swath of solutions, from ASCO valves and fluid control to Kato Engineering generators to Nelson industrial heating cables. However, the company is partly beholden to oil and gas companies for some of its products – a condition made more acute thanks to its 2016 acquisition of Pentair’s valves and controls division.

While shares are in a two-year upswing, it’s just the latest in a set of peaks and valeys that has EMR trading essentially flat since 2007. In fact, Emerson has fallen from the $60 perch thrice since then.

Emerson has become more adept at squeezing profits out of its business, but there’s only so much you can do when revenues are off more than 40% in a three-year span. And shrinking income, combined with an M&A-happy culture, is making dividend growth more and more of an afterthought.

EMR’s dividend has grown at less than 4% annually on average since 2012, and last year’s hike was a lonely 1%. That’s a lousy figure that ensures investors will have to settle for a modest 3% yield for some time.

Emerson Electric (EMR), Could You Spare Some Change?

Chevron (CVX)

Dividend Yield: 4.2%

Last Dividend Increase: 0.93%

At least Chevron (CVX) has a healthier yield that sits north of 4%, but that’s the best thing I can say about its dividend.

Oil price declines starting in mid-2014 put most energy stocks in a hurt locker, and CVX was no exception, plunging more than 40% from 2014 peak to 2015 trough. For a time, Chevron’s dividend appeared to be in real jeopardy, though its 1-cent raise last August was enough to quell investors’ worst fears.

But “not awful” is far different from “good.”

West Texas Intermediate (WTI) crude oil is down more than 15% so far in 2017, and energy stocks are back on the ropes. OPEC production cuts haven’t been able to counter increased production in places like Libya and Iran, not to mention the U.S., and earnings projections are tanking across the board. In the past 90 days alone, analysts have dropped their EPS estimates for Chevron by more than 7%!

CVX is averaging sub-4% dividend growth across the past five years, and 2016’s hike might not be an anomaly. Chevron is still one of the titans of energy, but on the income front, its potential needle is resting on “E.”

Chevron’s (CVX) Dividend Is Running on Fumes

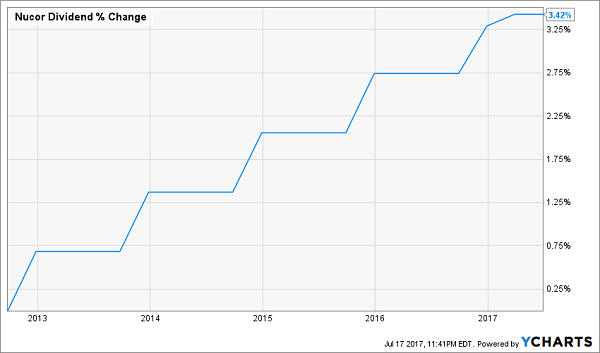

Nucor (NUE)

Dividend Yield: 2.5%

Last Dividend Increase: 0.67%

Steel and steel products manufacturer Nucor (NUE) has had an exciting past year or so as it and other steelmakers – from Steel Dynamics (STLD) to U.S. Steel (X) – have soared and crashed depending on how optimistic the market is about President Donald Trump’s ability to get his promised agenda through Congress.

The broader trend has been up, though, and not just on presidential conjecture. While revenues remain listless, the company’s tight management and ability to keep costs low helped Nucor turn out its biggest quarterly profit since 2008. That followed a 2016 in which NUE posted one of its best full-year profits in years.

However, it seems Nucor is miserly in good times and in bad.

Nucor (NUE) Isn’t Even Trying

Nucor hiked its payout by a quarter of a cent last year for a 0.67% improvement, and infuriatingly enough, that met the gold standard of NUE dividend increases. That’s right: Nucor has averaged a sub-1% annual dividend hike every quarter for the past five years – a gesture that technically maintains its standing as a Dividend Aristocrat, but shows little regard for income-minded shareholders.

— Brett Owens

How to Earn 12% Annual Returns For Life! [sponsor]

Lousy dividend growth that can’t even outrun inflation is a one-way ticket to the retirement poorhouse, especially in stocks that only yield 1% or 2% to begin with! In fact, none of these stocks have the potential to get you anywhere near what you need if you want to make it through retirement fully funded and worry-free.

So, what will it take?

12% in safe, annual returns.

It’s not easy. I’ve been buried for months trying to track down the kind of portfolio that offers the high current yield, dividend growth track and capital gains potential possible to reach double-digit returns … without betting the farm on yield traps whose payouts could collapse at any moment.

But I’ve compiled a set of stock picks that will reap at least 12% in annual returns – which is what you need to ensure the kind of no-worries retirement you’ve been busting your hump to achieve for the past few decades.

My “12% for Life” portfolio is not your garden-variety dividend portfolio.

You’re not going to find pundit favorites like Exxon Mobil, Coca-Cola or any other “safe” but slow-growth blue chips with mediocre yields. You’re going to find these kinds of picks instead:

- A stock that has already boosted its dividend payments more than 800% over the past four years, and has at least another decade of double-digit growth left in the tank!

- A “double threat” income-and-growth stock that rose more than 252% the last time it was anywhere near as cheap as it is right now!

- A 9%-plus payer that raises its dividend more than once a year, and will double its payout by 2021 at its current pace!

This portfolio is retirement catnip, because it provides the best aspects of numerous types of investment strategies – income, growth and even nest egg protection! This basket of seven conservative investments includes under-the-radar stocks that can return 12% annually, which is enough to double your portfolio in six years. It also is built to be more durable against market downturns like 2008-09, which ruined retirement for countless Americans.

And best of all: It provides three times more income than most retirement experts say you need!

The real-life benefits are plain as day. This retirement portfolio will allow you to pay your bills from dividend income alone, with enough left over for all the extras – the vacation timeshare, the European cruise or the patio extension you’ve waited too long to build. All the while, you’ll be able to grow your nest egg, which acts as extra protection against life’s ugly surprises.

Let me show you the way to double-digit returns that you can actually depend on. Click here and I’ll GIVE you three special reports that show you how to earn 12% for life. You’ll receive the names, tickers, buy prices and full analysis for seven stocks with wealth-building potential – completely FREE!

Source: Contrarian Outlook