“Give me a stock to buy,” my friend demanded.

“I can’t give personal advice,” I responded. “Besides, it’s not that simple, I don’t know your tolerance for risk, your long-term goals…”

He cut me off. “I just need something that’s going to make me a lot of money, quickly.”

What would the average time be between the buy alert and the sell alert? I don’t have months to wait for results.

It’s amazing how impatient some investors can be, but I get it.

Most people do not have enough money saved for retirement. And as they get closer to retirement age, panic sets in.

In fact, the number of people who are in good financial shape is stunningly low.

Only 15% of adults have $10,000 or more in savings. The same number of adults have between $1,000 and $10,000; 35% have less than $1,000. And 34% have zero, nada, zilch, bubkes.

So it’s no surprise that people want to make money fast.

And you can certainly make great money trading for the short term. But that should be done with only money you can afford to lose and are comfortable putting at risk.

Most investors who need to make money fast aren’t in that category. They likely can’t afford a loss.

The easiest way to make money in the markets is the least exciting way. But it works. And it has for decades…

Buy Perpetual Dividend Raisers, and hold on to them for years.

Perpetual Dividend Raisers are stocks that raise their dividends every year. And they beat the pants off the broad market.

Dividend Aristocrats are companies that have raised their dividends for 25 years or more.

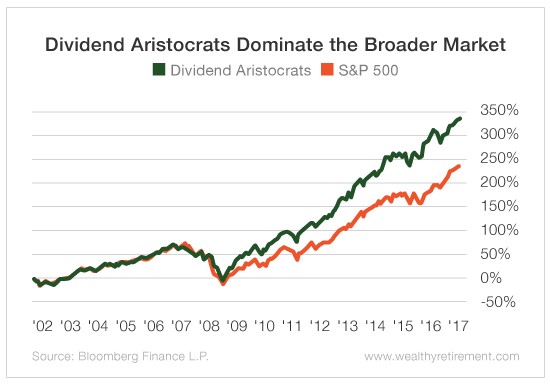

Over the past five years, Dividend Aristocrats have beaten the S&P 500 by 4%. But the more time that you’re invested in these stocks, the greater the outperformance.

The Aristocrats returned 159% over the past decade versus 100% for the S&P 500.

Over 15 years, they beat the S&P 332% to 232%.

And since the index was created in December 1989, Aristocrats nearly doubled the performance of the broad market 2,096% to 1,122%.

Even better, these are companies that are 13% safer than the broad market. The dividends provide a buffer against small losses. And these are mature businesses that are not susceptible to being the flavor of the month, like some high-flying tech stocks.

Since inception, Aristocrats have returned 12% annually. That includes the dot-com collapse and the Great Recession.

A 12% annual return more than triples your money in 10 years.

That might not be quick enough for my friend, but if you’re serious about growing your wealth while taking on lower than average market risk, investing in Perpetual Dividend Raisers will play a big part in helping you reach your financial goals.

Good investing,

Marc

[ad#mmpress]

Source: Wealthy Retirement