Here’s a harsh dose of reality: If you ignore dividend growth when you select your income investments, you are actively reducing the quality of your own retirement.

Today, I’m going to show you how you can use dividend growth to reap safe 12% annual returns by looking for just a handful of qualities in a company, but first, I’m going to show you something that should make at least a few of you sick:

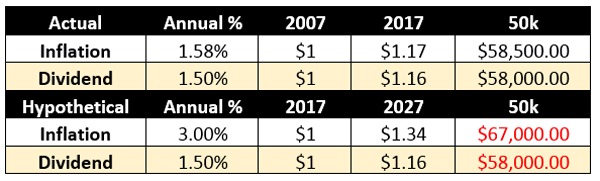

You might not recognize it, but this is what losing money looks like.

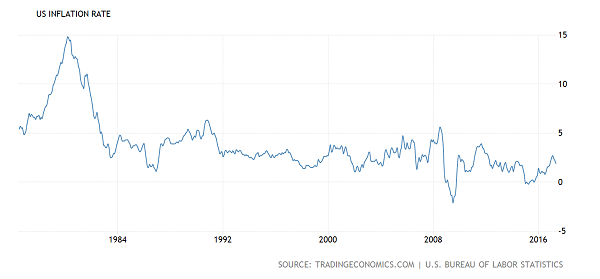

Inflation hasn’t touched 3% since 2011, and as a result, even the most skinflint dividend raisers have gotten away with larceny.

As you can see, a company that has been raising its dividend by a mere 1.5% annually for the past decade technically isn’t keeping up with inflation … but it’s at least close.

That’s changing, and for the worse.

Inflation is creeping higher again, and 3% annual expansion isn’t unthinkable. Look at the hypothetical situation, in which that same company is putting up 1.5% annual dividend increases for the next decade. By 2027, it’ll be producing $58,000 annually in dividends on 50,000 shares … but that’s WAY short of the $67,000 you’d need to have the same purchasing power those dividends had in 2017! If you do the math, your dividends will be worth about 13% less!

You cannot afford to let inflation devour your retirement. That’s why I’m going to show you some key factors to look for that will help you identify the absolute best dividend growth stocks you can depend on for market-busting returns.

Wide Moat

The first thing to look for in a dividend growth stock actually has nothing to do whatsoever with dividend growth.

At least not directly.

Warren Buffett famously seeks out “wide moats” when evaluating potential investment choices. Much like an actual moat around a fortress is an advantage in battle, certain traits – think a high cost to even entering a market, or a company’s ability to produce something at a far lower price than its competition – is an economic moat that keeps other businesses from taking its market share.

These wide moats ensure business stability, sure, but they also allow companies to dole out more of their cash as dividends rather than plow every cent they earn into R&D to beat back a mob of competition. Just consider the ranks of the Dividend Aristocrats: AT&T (T), which shares a virtual duopoly with Verizon (VZ) in one of the most infrastructure-intensive industries on the planet; Exxon Mobil (XOM) and Chevron (CVX), two of the most well-financed titans in energy; or Clorox (CLX) and Colgate-Palmolive (CL), whose brands have enjoyed decades of dominance, making it difficult for anyone to compete anywhere but ultra-low costs.

A wide moat doesn’t guarantee dividend growth, but where you find one, you often find the other.

Payout Ratio

The payout ratio – how much of a company’s earnings are paid out as dividends – is one of the most important metrics in all of investing. While not perfect, it’s the premier way to gauge how sustainable a stock’s dividend is … but also how much room that payout has to grow!

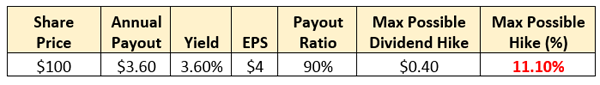

Consider the following hypothetical example:

In this example, Company A is already paying out 90% of its earnings as dividends. Barring an increase to its annual profits, the most Company A can hike its dividends without paying out more than it brings in is 11.1% — that’s a decent amount, but what about next year, and the next five after that? And how secure would you feel if your holdings paid out every last cent in dividends without holding anything back for a rainy day?

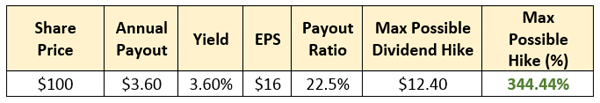

Now, consider this company:

Company B won’t necessarily quadruple its payout this year, but it can easily issue double-digit increases for years without breaking a fiscal sweat.

High payout ratios are an early warning sign of stocks that are about to cut their dividends. The flip side? Low payout ratios are one good sign that a company has the financial flexibility to both continue writing its current checks, and provide substantial dividend growth going forward.

Dividend Growth History

What’s important about this particular trait is that it’s not about a deep history of dividend growth – just a robust recent history.

The aforementioned Dividend Aristocrats are a great place to look for companies that truly value shareholders and are dedicated to improving their annual payouts. But if you want inflation-beating dividend growth, many Aristocrats will leave you disappointed, throwing off token 1%, 2% hikes every year because they sport relatively high dividend payout ratios and slow earnings growth.

Consider my recent analysis of five dividend growers, where the focus wasn’t on several decades of data, but merely the past five years. That might sound reckless, but if you catch a company with a clear emphasis on breakneck dividend growth when it still has the available cash to achieve it – think Apple (AAPL)! – you can watch even 2% yields double in a snap!

— Brett Owens

How Dividend Growth Will Score You 12% Annually For Life! [sponsor]

Clearly, 2% yields aren’t enough. But even 4% yields aren’t enough. In fact, even if you assume another 2% or so of actual appreciation for the kinds of blue-chip stocks most investors buy for these so-so yields, that 6% per year isn’t even enough to match the market, let alone fund a comfortable retirement!

But 12% in safe, annual returns? That will ensure the kind of no-worries retirement you’ve been busting your hump to achieve for the past few decades.

And I’ve tracked down the dividend growth stocks that can get you there.

My “12% for Life” portfolio isn’t your garden-variety dividend portfolio. You’re not going to find Exxon Mobil, Coca-Cola or any other slow-growth, mediocre yielders that have weighed down thousands of unwitting investors.

You’re going to find these kinds of picks instead:

- A stock that has already boosted its dividend payments more than 800% over the past four years, and has at least another decade of double-digit growth left in the tank!

- A “double threat” income-and-growth stock that rose more than 252% the last time it was anywhere near as cheap as it is right now!

- A 9%-plus payer that raises its dividend more than once a year, and will double its payout by 2021 at its current pace!

This portfolio is retirement catnip, because it provides the best aspects of numerous types of investment strategies – income, growth and even nest egg protection! This basket of seven conservative investments includes under-the-radar stocks that can return 12% annually, which is enough to double your portfolio in six years. It also is built to be more durable against market downturns like 2008-09, which ruined retirement for countless Americans.

And best of all: It provides three times more income than most retirement experts say you need!

The real-life benefits are plain as day. This retirement portfolio will allow you to pay your bills from dividend income alone, with enough left over for all the extras – the vacation timeshare, the European cruise or the patio extension you’ve waited too long to build. All the while, you’ll be able to grow your nest egg, which acts as extra protection against life’s ugly surprises.

Let me show you the way to double-digit returns that you can actually depend on. Click here and I’ll GIVE you three special reports that show you how to earn 12% for life. You’ll receive the names, tickers, buy prices and full analysis for seven stocks with wealth-building potential – completely FREE!

Source: Contrarian Outlook