Something strange happened recently, and it’s set up a terrific—and almost totally overlooked—profit opportunity for you.

What is it?

The European Union is going to ensure that people who held bonds in two recently failed banks (Veneto Banca and Popolare di Vicenza) will get a 100% bailout.

[ad#Google Adsense 336×280-IA]Now unless you’re holding these specific bonds, you’re probably wondering what this could possibly have to do with you.

Stick with me—I’ll get to that in a second. First, back to the bailout.

The EU’s move isn’t actually all that surprising.

We’ve seen governments bail out bondholders many times since 2007 (and the EU has been doing even more bond bailouts in the last couple years).

However, investors had already given up on some of these bonds, believing their legal covenants gave the EU the opportunity to let them lose value.

But the EU didn’t do that. Instead, for whatever reason, European politicians decided to use taxpayer money to guarantee bondholders don’t lose any of their cash.

If this sounds like reverse Robin Hood to you, it’s because it is. Many of these bondholders are huge investment firms worth several billions of dollars. But the EU is so worried about making sure they don’t lose any money that they’re going to fund the bailouts using cash from middle-class taxpayers.

There are a couple ways to look at this: we could get enraged at how unfair life is, or we could ask ourselves how we can get in on the action. The first response might feel good, but the second response will make you money.

So how can we benefit from the EU’s obsession with protecting bondholders?

It’s simple: we need to become the bondholders.

The Funds to Buy

If Europe is going to protect bondholders no matter what, we want to buy European bonds.

There are twelve funds specializing in international bonds with at least some exposure to Europe. However, these funds will also benefit from broad confidence in the foreign bond market. With greater security in European bonds, more investors will flock to this asset class—especially as they see high valuations in stocks—which is going to lift all boats in the bond market.

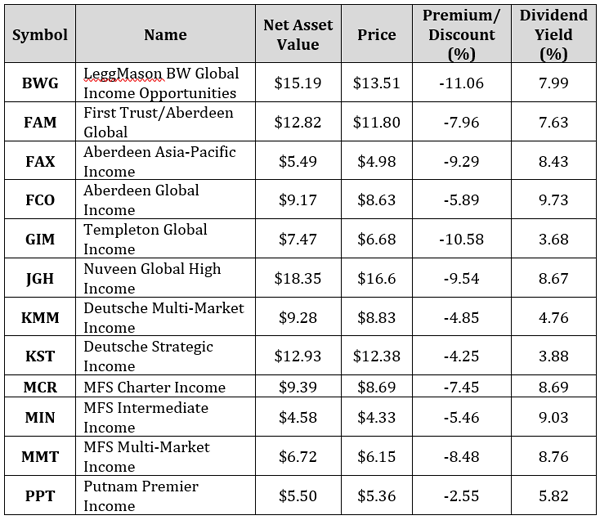

So what are these funds? Take a look at the list below:

There are a couple of exciting things about these funds. One of them is that they’re on sale. The actual price of these funds on the market is less than the net asset value (NAV) of the funds themselves, with PPT being the most expensive, at a 2.6% discount, while BWG is the biggest deal, with a huge 11.1% discount.

There are a couple of exciting things about these funds. One of them is that they’re on sale. The actual price of these funds on the market is less than the net asset value (NAV) of the funds themselves, with PPT being the most expensive, at a 2.6% discount, while BWG is the biggest deal, with a huge 11.1% discount.

Keep in mind that if you try to buy these bonds directly on the market or through broad-index ETFs or international bond–focused mutual funds, you’ll pay full value for them. The closed-end funds in the table above are giving you a discount right away.

(If you’re not familiar with CEFs, I wrote a primer and spotlighted some of the best-performing CEFs so far this year in a June 22 article.)

The Yields You’ll Get

Buying assets at a discount isn’t the only exciting thing here; the dividends are nice, too. KST’s 3.9% dividend yield is impressive, while FCO’s 9.7% payout is phenomenal. On average, these funds are yielding 7.3%, which is much more than anyone should expect from government-backed bonds. And after the EU’s recent action, it seems like a lot of foreign bonds are suddenly government backed.

How does that compare to US bond fund yields?

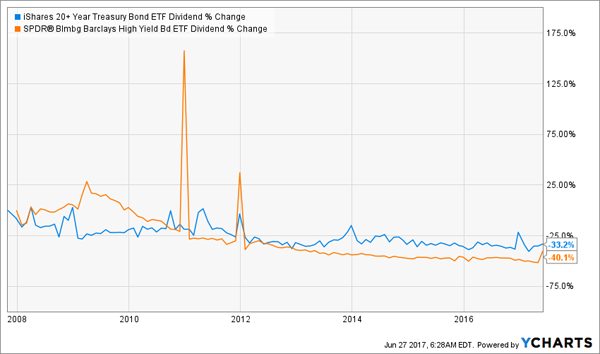

Quite well, in fact. The iShares 20+ Year Treasury Bond ETF (TLT) is yielding a paltry 2.4%. Even if you go for the riskiest bonds and buy a bunch of junk bonds with the SPDR Barclays Capital High Yield Bond ETF (JNK), you’re only getting a 5.9% dividend.

One word of caution, however; no matter what fund you get—whether it’s one of the global closed-end bond funds or the US-focused ETFs—the dividend income will likely go lower. Both JNK and TLT have seen their payouts shrink over the last decade:

A Steady Decline … But There’s More to the Story

The good news is that if you start with a 7.3% yield, you’ll still get an income stream that exceeds what you’d get with these ETFs, even if your payouts decline.

The good news is that if you start with a 7.3% yield, you’ll still get an income stream that exceeds what you’d get with these ETFs, even if your payouts decline.

But there’s much more to foreign bond funds than just income—and that’s the real reason why you want to buy now.

The Returns You’ll See

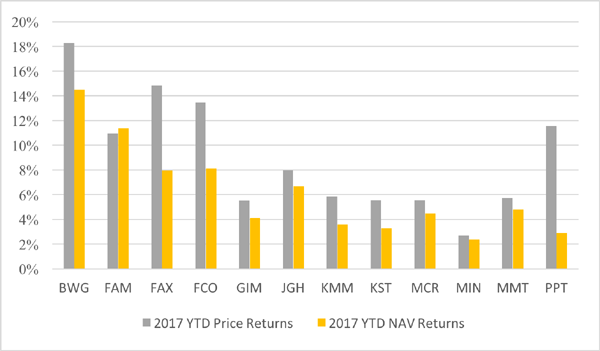

On top of a 7% return, expect strong capital gains to come.

Global Fund Prices Soar

It’s true that MIN’s price return is pretty weak, but the average price return for these funds is 9% for 2017. That’s double JNK’s 4.4% return and a bit higher than TLT’s 8.8% return for the same time period.

It’s true that MIN’s price return is pretty weak, but the average price return for these funds is 9% for 2017. That’s double JNK’s 4.4% return and a bit higher than TLT’s 8.8% return for the same time period.

But these price gains are just starting. The EU’s decision came at the end of June, and most investors still don’t understand what’s going on. That means the time to buy is now; then we sit back and wait until the rest of the market realizes that the foreign corporate bond market has changed forever.

— Michael Foster

How about a growing 7.6% dividend and 20% upside? [sponsor]

I’ve just uncovered 4 other funds that tick off ALL my boxes for the perfect investment: a 7.6% average payout, steady dividend growth and 20%+ price upside.

How do I know they’re about to soar?

Because they all share one blaring buy indicator: they’re not only trading at big current discounts to NAV but huge markdowns to their historical NAVs, as well.

Take my No. 3 pick, which I’ll reveal to you in a new FREE report you can download right here.

This all-star fund owns blue chip names like Google (GOOGL), Apple (AAPL), American International Group (AIG) and MasterCard (MA).

But there’s more. Their all-star management team then adds its “secret sauce”: a powerful, yet conservative, income strategy that delivers a far higher yield than you’ll find on pretty well any blue chip out there: a rock-solid 7.4%! (I’ll tell you exactly how their proven approach works in my NEW free report.)

The best part? This off-the-radar fund trades at a discount that’s far wider than its historic average, meaning our upside is built in!

Let’s grab a piece of the action NOW, before the market comes to its senses on this one. CLICK HERE and I’ll tell you all about this winning CEF and my 3 other top high-yield picks.

Source: Contrarian Outlook