I’m getting a lot of questions about real estate right now and, specifically, about whether REITs are as “bad” as many investors think when rates are rising.

Nope.

In fact, the right REITs can be better, safer and potentially far more lucrative as interest rates increase.

[ad#Google Adsense 336×280-IA]Including the two I’d like to share with you today.

Many investors believe that rising rates are bad for real estate and, by implication, for Real Estate Investment Trusts or “REITs” for short.

So they’re starving themselves of badly needed income by lightening up their allocations or abandoning them entirely.

That’s a huge mistake – if you understand how to pick the right REITs.

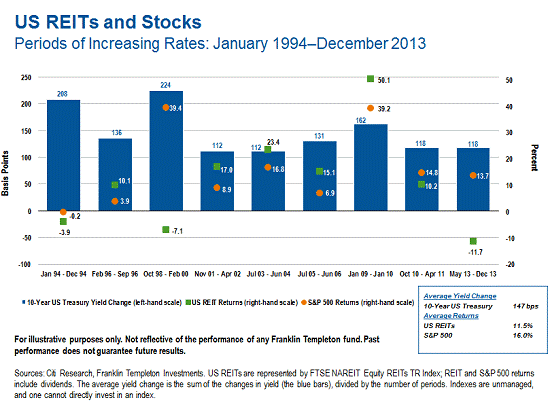

Contrary to what a lot of investors believe, REITs have historically done well when the cost of money is increasing. Between 1994 and 2017, for example, there were nine time periods when interest rates rose by more than 1% (or 100 basis points in trader speak) as measured by the 10-Year U.S. Treasury note.

Six out of nine of those times, REITs provided positive returns despite the fact that those rate changes were roughly four times larger than the measly 0.25% hike Yellen just made and the three additional hikes she says she’s going to make in 2017.

What most people miss is deceptively simple.

Namely that there’s a big difference between a sharp rate spike in the mold of Chairman Paul Volker’s 1970s “torpedo” and the slowest interest rate normalization in history that’s now Yellen’s legacy until, apparently, the end of time.

The former is a mechanism designed to shut down inflation and rein in speculation, while the latter is intended to maintain all the things policy makers believe free money makes possible – an improving labor market, consumer spending, and overall demand.

To paraphrase legendary executive and former presidential candidate H. Ross Perot, “lemme show ya a chart.”

Many investors worry that “it’ll be different this time” – usually more as it relates to traditional dividends and income than real estate – but either way, it really doesn’t matter much.

Many investors worry that “it’ll be different this time” – usually more as it relates to traditional dividends and income than real estate – but either way, it really doesn’t matter much.

The principle is the same.

There is a strong correlation between high total returns and the management approach taken to dividend policy over time whether it’s kicked off by regular investment activity or via real estate.

Imagine investing $200 in 1940, $100 of which you put in dividend producing choices and reinvested over time and the other $100 of which you put in non-dividend payers. By the end of 2011 the former would be worth approximately $174,000 while the latter would be worth only $12,000, or $162,000 less, according to a study by Dr. Ian Mortimer and Matthew Page of Guinness Atkinson.

To be clear, I’m not saying that growth investing is worthless. There’s always a role for growth investing when it comes to Total Wealth; it’s another subject for another time.

What I want you to understand for purposes of today’s conversation is that simple mathematics related to income can give you a tremendous advantage in widely varied market conditions.

This applies to situations as varied as a World War, multiple regional conflicts, expansion, contraction, recessions, and more.

Which brings me back to REITs…

Most REITs are publicly traded entities that make money through their investments in real estate that are usually a combination of income-producing properties. Think shopping centers, retail strip malls, offices, warehouses… all the usual stuff. They can be private or non-listed, too.

Originally created by Congress in 1960, REITs are intended to provide a structure that, for all intents and purposes, is similar to a mutual fund. They’re typically broken up into two groups – so-called equity REITS and mortgage REITs. At the start of 2016, there were more than 200 REITs in the U.S. that trade on a major stock exchange – most of them found in the NYSE.

REITs have to return 90% of their profits back to shareholders in the form of dividend income which is, of course, why they are so popular during low-rate regimes, and why so many people mistakenly believe they’re going to tank as rates rise.

Not All REITs Are Created Equal

Mortgage-based REITs – that is those investing mainly in agency-backed securities – are going to come under the most pressure when rates rise. That’s because the value of the fixed income investments they hold will decrease as rates go up. The reason is that yields of existing holdings will match or be inferior to newly issued alternatives with higher coupon rates. In addition, many of these portfolios are based on residential property so there’s also indirect consumer exposure to contend with.

Equity-based REITs – those investing in income-producing properties – are less sensitive to increasing rates. That’s because there’s usually plenty of cash flow AND appreciation to offset any price drop associated with higher rates.

Outlook for Competitors

This isn’t always the case, mind you, but enough that it’s a good rule of thumb and an important distinction.

Well-managed REITs that have a good handle on their debt won’t necessarily face higher interest costs like many people believe. Moreover, they may also be able to grow their revenues faster because of their ability to increase rent for the right tenants even in a rising rate environment.

A bond’s coupon rate, by comparison, can never change. That’s why bonds fall in value when rates rise like they are now.

However, tap into one of more of our Unstoppable Trends and what I’m talking about takes on an entirely new dimension.

Let me explain…

Take Alexandria Real Estate Equities Inc. (NYSE:ARE), for example.

The company deals heavily in tech real estate in New York, San Francisco, and Boston (among other places).

I recommended it to Money Map Report subscribers in December 2014 as a way to play the Silicon Valley boom while avoiding the risk of flashy startups.

More importantly, the fund taps into the explosive Unstoppable Trend we call Technology using a very innovative “cluster model” that groups investments immediately adjacent to world class academic, medical, and technology institutions.

The model exploits the logical strength associated with the world’s most sophisticated biotech companies, medical researchers, product development, and even biofuels – all of which are highly secure lessees, not the fly-by-night, perennially unprofitable tenants – like Sears Holding Corp. (NasdaqGS:SHLD) and other so-called “anchor retail chains” associated with lesser quality REITs.

ARE has delivered a total return of 46% since we recommended it to Money Map Report subscribers at a time when REITs were largely on the decline. More importantly, though, it’s hiked its dividend payout by 12% (from $0.74 to $0.83) since I initially recommended it.

Or, consider Omega Healthcare Investors Inc. (NYSE:OHI).

The Maryland-based company invests heavily in hospital properties and health care facilities, with a special emphasis on nursing facilities. In fact, it recently acquired Aviv REIT, another significant player in assisted-living.

OHI’s nursing home concentration dovetails nicely with two other Unstoppable Trends we follow: Medicine and Demographics, at a time when an estimated 10,000+ baby boomers retire each day in America.

Like ARE, OHI has high-quality tenants representing a fraction of the risk associated with traditional office, residential, or commercial shopping tenants. And like ARE, OHI recently raised its dividend, resulting in a mouth-watering current yield of 7.38%, according to Yahoo!Finance.

Moreover, it’s one of those special REITs with the wherewithal and management acumen needed to raise its dividends to shareholders quarter after quarter, not just once a year.

OHI is cheap after the haircut so many REITs have seen in 2016, and it currently trades at a PE ratio of just 16.24, which strikes me as great value for a company that’s expanding its holdings -and with recent quarterly earnings growing by 88% year-over year at a time when so many companies are still fighting to emerge from the six-quarter earnings recession.

In closing, I hope I’ve made my point – the “right” REITs are not the investing zombies many investors think when it comes to rising rates if you understand the composition of the holdings driving them.

Moreover, some, like the two I’ve recommended may even be superstars because they line up with our Unstoppable Trends.

Until next time,

Keith

[ad#mmpress]

Source: Total Wealth Research