Another day, another bearish article. It’s impossible nowadays to read the news without someone telling us that a crash is coming and we need to sell our stocks now!

If you’re seeing these same people urging you to liquidate your retirement accounts, you’re not alone. In fact, these stories seem to be everywhere in the mainstream financial press.

[ad#Google Adsense 336×280-IA]It’s all nonsense, written to grab your attention with fear-based headlines.

And if you don’t take a critical look at these stories (and here I mean going by raw numbers, not emotional appeals), you risk missing a terrific wealth-building opportunity—or worse.

Here’s the truth: behind the alarming headlines, there’s another, far more boring story: American companies are absolutely crushing it.

Don’t believe me? Let’s review the evidence.

Exhibit 1: Negative Forecasts Get No Traction

At the end of March, I wrote about how the market was still ready to soar, and the SPDR S&P 500 ETF (SPY) has gained 3% since. If you listened to the permabears who told you to sell and hide in things like gold or the SPDR Gold Shares (GLD), you’ve been leaving money on the table:

Stocks Still Winning

Why are stocks outperforming? Profits are soaring.

Why are stocks outperforming? Profits are soaring.

Look at what happened in the first quarter of 2017:

- 75% of S&P 500 companies beat earnings estimates.

- Earnings rose 13.9% from the first quarter of 2016.

- Earnings growth for the S&P 500 was at its highest since the third quarter of 2011.

These are amazing stats in any kind of economy. What they mean is that companies are getting richer, giving them more cash to pay out in dividends (including some nice recent hikes at three Dividend Aristocrats my colleague Brett Owens singled out on June 2).

That gives us more reason to buy shares in the first place. It’s no wonder stocks are up nearly 10% in 2017 alone.

And it’s going to continue, thanks to this:

Exhibit 2: Positive Earnings Surprises

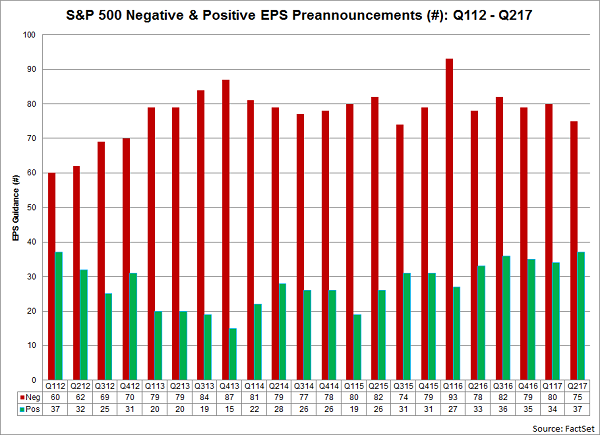

The first-quarter earnings bonanza wasn’t a one-off. So far for the second quarter, we’ve seen more positive earnings per share (EPS) pre-announcements (37 of the S&P 500) than for any quarter since 2012. Not only that, but the number of companies with negative EPS pre-announcements (75) is the second lowest since 2012, and this is expected to go even lower.

Companies Getting More Optimistic

Why is this important? Two reasons: positive pre-announcements indicate companies’ confidence in their earnings potential. Negative pre-announcements are typically more common, as you can see from the chart above, because management likes to play it safe. But when they look at demand for their products and their customers’ behavior, they have good reason to be optimistic about the future.

Why is this important? Two reasons: positive pre-announcements indicate companies’ confidence in their earnings potential. Negative pre-announcements are typically more common, as you can see from the chart above, because management likes to play it safe. But when they look at demand for their products and their customers’ behavior, they have good reason to be optimistic about the future.

And that’s great news for shareholders.

Exhibit 3: GDP Growth

GDP growth is important because it measures the overall rise in the American economy. Negative growth means a recession, which is pretty much always bad for everyone. Low growth isn’t always bad for stocks (especially if corporate expansion is at the root), and high growth is almost always great for stocks because it means corporate profits are going up, individual incomes are rising and the average American is more comfortable buying goods and services.

That’s why things look great for stocks now. According to the Federal Reserve’s GDPNow, a data-driven tool maintained by the Atlanta Fed, the second quarter will see 3% growth on a seasonally adjusted basis. That’s a sharp jump from 1.2% in the first quarter, when company profits soared almost 14%.

Does that mean corporate profits will grow again in the second quarter? Absolutely. Thomson Reuters expects an 8.3% increase in earnings, with only utilities seeing a decline, while technology, financials and energy post huge growth.

The bottom line: America’s economy is going gangbusters; American companies are still making a lot of money, and they’re positioned to make a lot more soon. Why would any of that be bad for stocks?

The simple answer: it isn’t, and the hysterical mainstream press is wrong.

Exhibit 4: A Better Labor Market

Ultimately, the US economy is driven by workers, who make money in the economy, then use that cash to buy things. So how are American workers faring?

Despite the hysteria, they’re doing well. The working-age labor force has been growing, which usually indicates higher productivity is around the corner. Job openings had skyrocketed to 6 million by the end of April, the highest number ever counted. The unemployment rate is 4.3%, which is extremely low by historical standards.

Most importantly, Americans are richer: wages are rising—average hourly earnings jumped 2.5%, to $26.22, in the last Bureau of Labor Statistics study, released earlier this month.

This is all good for the market, despite the doom and gloom the press wants to feed us.

— Michael Foster

How to Ride the Rebound and Collect a 7.5% Yield [sponsor]

A rising stock market is great, but if you’re relying on your portfolio for income, there’s a big problem: those same rising share prices are crushing dividend yields.

So if you’re looking for new income stocks to put your cash into … you’re running out of options!

Consider your average S&P 500 stock, which pays a pathetic 1.9%, so once you account for inflation, you’re basically pocketing nothing here.

If we want to fund the retirement we want, we need to do better

That’s where closed-end funds (CEFs) come in. They’re a too-often-ignored investment that lets you invest in the same blue chip stocks you love with one big exception: you’ll be collecting massive dividends on the side.

In fact, my 4 favorite names are throwing off safe 7.5% average payouts now, and unlike your typical Dividend Aristocrat, they’re cheap, trading at big discounts to their net asset value (or the value of their underlying holdings).

That means we can expect easy 20% upside here, on top of that gaudy 7.5% average payout!

I know that sounds crazy, but I assure you it’s real. And these CEFs are easy to buy: it’s really just a matter of swapping over the ETFs or regular stocks you already hold in your portfolio.

All you need to do is click right here and I’ll tell you exactly how these incredible funds work and give you their names, tickers, buy prices and much more.

Source: Contrarian Outlook