For decades, AT&T (NYSE: T) has been known as a stock that’s suitable for widows and orphans.

[ad#Google Adsense 336×280-IA]In other words, it’s a safe stock to hold for people who can’t afford to lose any money.

A little more than a year ago, I wrote about how AT&T received an upgrade by SafetyNet Pro.

Since several readers have asked about Ma Bell’s dividend safety, let’s take a look and see if it’s still as safe as it was last year…

After a dip in free cash flow in 2014, AT&T has boosted cash flow in each of the past two years. And cash flow is expected to grow sharply again this year.

For 2017, free cash flow is forecast to grow 9%, a meaningful amount for such a giant company.

Not only is AT&T generating more cash, but also it very comfortably covers the dividend.

Last year, it paid out $11.8 billion in dividends for a payout ratio of 70% – well within my comfort zone. I prefer payout ratios to be 75% or less. As a refresher, the payout ratio is the percentage of earnings or cash flow (I use cash flow) that is paid out in dividends.

Living up to its widows and orphans reputation, the company has never cut its dividend. In fact, it’s a Perpetual Dividend Raiser (a stock that has an established track record of increasing its dividend).

Living up to its widows and orphans reputation, the company has never cut its dividend. In fact, it’s a Perpetual Dividend Raiser (a stock that has an established track record of increasing its dividend).

AT&T has raised the dividend every year since it began paying one 33 years ago.

The company and its stock have had their ups and downs. But one thing that has never been down is its dividend.

AT&T is as rock solid a dividend payer as any you’ll find.

And with a juicy 5% yield, widows and orphans shouldn’t be the only ones looking at the stock.

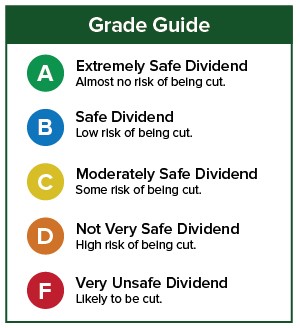

Dividend Safety Rating: A

Good investing,

Marc

[ad#agora]

Source: Wealthy Retirement