A few weeks ago, I told you about my strategy that has beaten the market by 689% over the last 20 years. And why the hedge fund I worked for didn’t care.

[ad#Google Adsense 336×280-IA]Today, I’ll tell you why its loss is your gain.

My strategy focuses on dividend initiations.

It’s pretty simple, really.

When companies start paying dividends, they outperform the market… often by a lot.

Let’s look at a few recent examples…

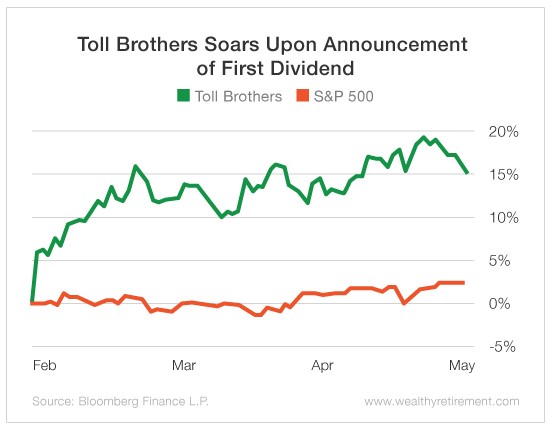

Homebuilder Toll Brothers (NYSE: TOL) announced its first dividend on February 21.

Investors were thrilled.

Since then, the stock is up 15.29%.

During the same period, the S&P 500 is up only 2.39%.

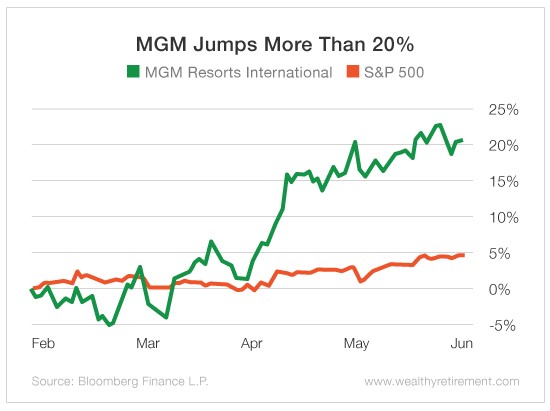

MGM Resorts International (NYSE: MGM) is one of the world’s largest casino operators. It said it would begin paying dividends on February 16.

Since the announcement, MGM’s stock has returned 20.65%. The S&P 500 has returned just 4.51%.

To find even bigger market outperformance, we have to look back further. But not too far…

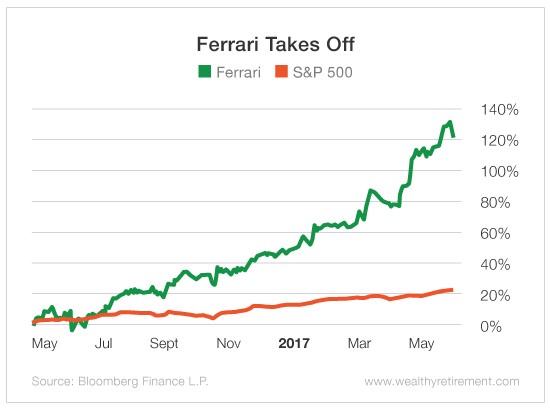

Ferrari (NYSE: RACE) went public in October 2015. Its market debut started out rocky. Within a week, Ferrari shares traded below their IPO price.

But six months later, the stock turned around.

On May 19, 2016, the luxury car company declared its first dividend. That’s when Ferrari’s stock price really started to rev up.

In just the last 13 months, Ferrari’s stock has returned 121%.

That’s nearly six times the return of the S&P 500!

So why do these “dividend pioneers” outperform year after year?

It all boils down to good old common sense.

A dividend initiation sends investors a loud and clear message.

It tells them a lot about present and future cash flow, and it signals that a company is doing well. A dividend initiation usually means that the company is throwing off more cash than it needs to cover the dividend. And it expects to make enough money to pay it in the years to come.

You see, dividends are more than just checks. They are public commitments to shareholders.

If a company decides to pay a dividend today, investors will expect it to pay another one tomorrow. And most investors will expect the dividend to grow.

Breaking that promise has disastrous implications for share prices.

For example, Frontier Communications (Nasdaq: FTR) found this out the hard way. The stock is down more than 30% since the company slashed its dividend by 62% last month.

Dividends also keep spending in check.

When companies commit to paying dividends, they keep less money on the balance sheet. So companies are less likely to overpay executives or overpay for acquisitions.

They spend wiser.

A dividend initiation tells you a lot about the prospects for a stock. And it is a great way to take a company’s financial temperature. Best of all, it can help ramp up a company’s stock returns.

So keep an eye on new dividend payers. They could be tomorrow’s biggest winners.

Good investing,

Kristin

[ad#wyatt-income]

Source: Wealthy Retirement