Income investors often ignore the technology sector. That’s a shame, because tech stocks have been one of the best sources of dividend growth over the past few years.

[ad#Google Adsense 336×280-IA]Plus, some familiar names now pay substantial yields. In fact, in just a minute, I’ll introduce you to seven tech stocks that offer payouts into the mid-double digits!

But first, let’s talk about the biggest income mistake that countless investors are making right now.

Most first-level thinkers pile into “defensive” stocks like consumer staples and utilities.

Unfortunately, while most of these companies do offer secure dividends, they don’t offer much upside.

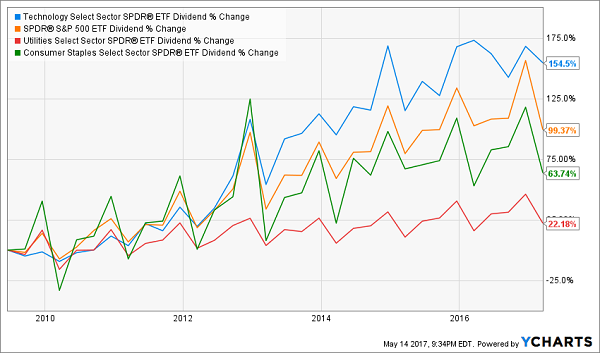

And investors who “don’t care because they’re in it for the dividends” end up with payout raises that severely lag those lavished upon tech investors:

Utilities and Staples: Two “Safe” Ways to Underperform

Since this time 2009, the Technology Select Sector SPDR (XLK) has seen its nominal dividend well more than double – a nearly 155% increase that not only dwarfs dividend mainstays like utilities (XLU) and consumer staples (XLP), but trumps the S&P 500 itself by half!

Since this time 2009, the Technology Select Sector SPDR (XLK) has seen its nominal dividend well more than double – a nearly 155% increase that not only dwarfs dividend mainstays like utilities (XLU) and consumer staples (XLP), but trumps the S&P 500 itself by half!

And you don’t have to choose between dividends today or payout growth tomorrow – you can secure both if you choose your tech dividends wisely. Here are seven big payers to consider.

Rogers Communications (RCI)

Dividend: 3.1%

U.S. telecoms like AT&T (T) and Verizon Communications (VZ) have taught us to tolerate the slow growth of wireless communications and cable business as a means of gobbling up substantial dividends and relentless dividend growth over time.

Canada’s premier telecom, Rogers Communications (RCI), doesn’t quite fit that bill.

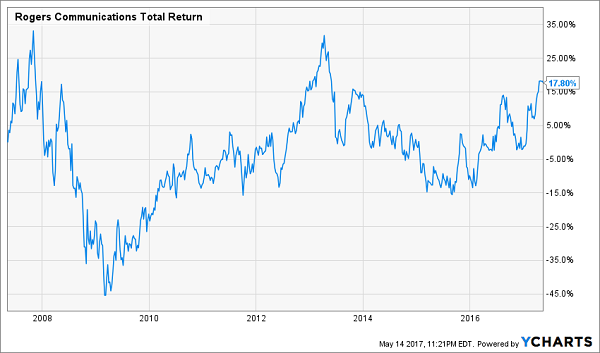

Yes, RCI is in the midst of a 20% year-to-date run, but shares are still below 2013 levels. Meanwhile, while the company is still posting modest growth in its wireless segment, cord cutting continues to neutralize the cable business, and its business solutions business is merely treading water, too.

That kind of operational performance would be tolerable, if not for the income. Rogers’ 3% yield is well above your average tech stock, but it’s middling compared to other telcos. But the real dealbreaker is the fact that Rogers hasn’t improved the dividend since early 2015; the company’s debt situation was so bad that in 2016, it made the decision to dig out of its IOUs instead of its regular payout hike.

Prudent fiscal management? Sure. A tempting dividend play? Nope. Let’s move on to a more promising play.

Less Than 20% in Total Returns in 10 Years? You Can Do Better Than RCI

DuPont Fabros Technology (DFT)

DuPont Fabros Technology (DFT)

Dividend: 3.8%

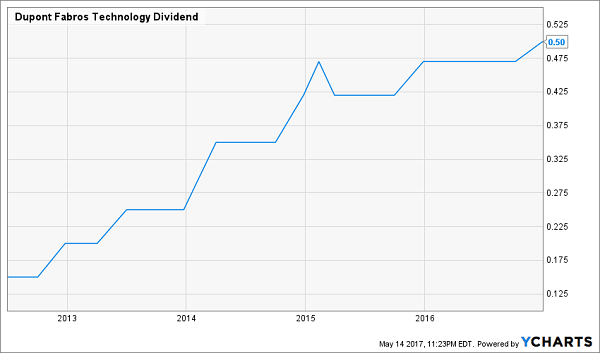

Income investors have a much more favorable prospect in Dupont Fabros Technology (DFT), one of a handful of real estate investment trusts (REITs) that specialize in datacenter operations.

It’s not cheap to house a datacenter – you need security monitoring, electricity, the ability to properly cool all that hardware. Many businesses can’t or simply find it cost-inefficient, and instead choose to put their storage needs in the hands of companies like DFT. DuPont Fabros serves both U.S. coasts and everything in between, and sports Canadian operations, too. And its services are heavily in demand, with the REIT boasting 99% occupancy as of its most recent quarter.

Revenues have shot up 40% in the past three years, and the company’s recent Q1 report included some explosive results – EPS were up 25% YOY, and adjusted FFO jumped by a whopping 40%!

The only thing more impressive than that is the company’s dividend growth; DuPont Fabros has more than tripled its payout in the past five years.

Dupont Fabros (DFT) Is a Dividend-Hiking Machine

Cogent Communications (CCOI)

Cogent Communications (CCOI)

Dividend: 4.4%

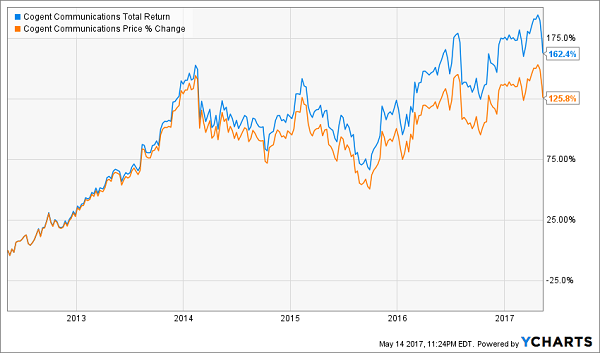

While DFT’s dividend growth is impressive, it – nor any other stock on this list – touches the payout expansion of Cogent Communications (CCOI), which has boosted its quarterly check by 320% since it initiated payments in Q3 2012.

In fact, DFT has upped the ante every single quarter since then, including its most recent announcement – a roughly 5% uptick to 44 cents per share for the second-quarter payment.

Cogent provides internet, ethernet and colocation services in nearly 200 markets in 41 countries, and the business has been steadily growing for years. The top line is up 40% since 2012, and operating income has more than doubled, helping to propel CCOI to multiyear highs. Cash flows continue to rise, too, helping fund a never ending string of dividend improvements.

Cogent Communications (CCOI) Is Becoming a Two-Headed Giant

AT&T (T)

AT&T (T)

Dividend: 5%

The business case for AT&T (T) couldn’t be simpler. AT&T and Verizon (VZ) essentially share a duopoly in U.S. telecom – a service so vital for Americans that it has essentially become a utility. T-Mobile (TMUS) and Sprint (S) might one day join up to create a competitive third player, but for now, they’re also-rans that have to cut deep for any chance of pulling customers away from AT&T and Verizon.

Meanwhile, AT&T is still making a few swipes at growth. AT&T bid $48.5 billion for DirecTV in 2014 to better compete in the cable/satellite TV market, then anted up $85.4 billion for Time Warner (TWX) in 2016 in a deal that ultimately should go through sometime this year. That puts AT&T smack-dab into content with properties such as HBO, CNN and Warner Bros.

And unlike Rogers, AT&T boasts a substantial yield of 5%, plus it has earned the title of Dividend Aristocrat thanks to 33 years of uninterrupted dividend hikes.

AT&T (T): A Little Growth, A Whole Lotta Income

CenturyLink (CTL)

CenturyLink (CTL)

Dividend: 8.7%

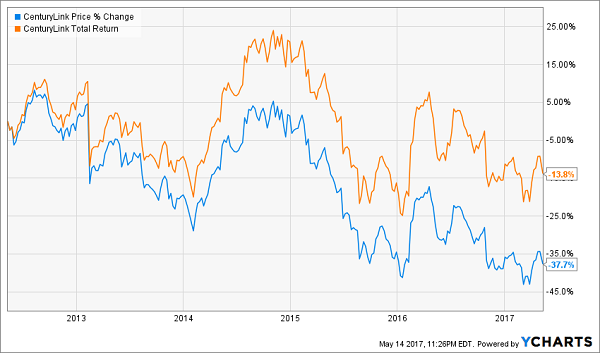

CenturyLink (CTL) is one of a number of more regional communications companies that simply don’t have the scale to compete with the likes of AT&T and Verizon, but have piled up a mountain of debt trying to. After a few acquisitions in the late aughts and early tens, CTL finally cried “uncle” in 2013 and slashed its dividend by roughly a quarter, from 72.5 cents to 54 cents – exactly where the payout stands today.

CenturyLink’s high dividend at this point is mostly the result of battered shares that have plunged more than 40% in the past five years or so. The top line is eroding, profits are stagnant and the dividends eat up a huge chunk of its cash, cramping the company’s financial flexibility and leaving it mostly unable to continue acquiring its way to scale.

If you want 8%-9% dividends, there are much better, safer ways to get them than CTL.

CenturyLink (CTL) Proves That Even Enormous Dividends Don’t Solve Everything

— Brett Owens

The Retirement Portfolio You NEVER Have to Touch! [sponsor]

Two other high-yield communications plays in the same vein as CenturyLink are Frontier Communications (FTR) and Windstream (WIN), which yield roughly 13% and 14%, respectively. Those yields have been inflated by respective 80% and 55% losses over the past two years alone! Worse still, you might remember that back in April, I warned about a potential cut to Frontier’s dividend … and that’s what we got a few weeks later, when FTR reduced its dividend by 62%! The fact Frontier still yields 13% shows you just how badly this stock has been hammered.

Dividend traps like these will destroy your returns over time. Yes, you absolutely need big headline yields – but when they’re backed by poor businesses, a 14% annual yield can easily turn into a 4% annual return … or 2%, or 0%, or worse. Those kinds of performances can literally set back your retirement timetable by years!

If you want to retire comfortably, you need a multi-tooled portfolio that not only offers big headline yield, but also dividend growth and the potential for capital gains, too!

And you can find these kinds of “triple threat” stocks in my “No Withdrawal” retirement portfolio.

I’ve spent months researching high-yield stocks looking for the ultimate dividend plays that deliver everything we need to build a successful retirement portfolio. I had to weed out numerous yield traps like some of the losers we mentioned above, but it was worth it, because it resulted in this can’t-miss portfolio featuring:

- No-doubt 6%, 7% even 8% yields – and in a couple of cases, double-digit dividends!

- The potential for 7% to 15% in annual capital gains

- Robust dividend growth that will keep up with (and beat) inflation

These are the three most critical elements for any retirement portfolio, because achieving all three allows you to live off income alone while actually growing your nest egg.

Most pundits that talk about so-called “retirement stocks” will point you in the direction of no-growth blue chips that yield 3%, maybe 4% if you’re lucky. But if you do the math, you won’t like what you see. Think about it: Even if you’ve saved up $500,000 for retirement, 4% annually is just $20,000 a year. You and I both know that even with Social Security tucked in there, that’s not a comfortable retirement.

My “No Withdrawal” portfolio averages 8% across the board right now, but also offers dividend growth that will result in double-digit “yields on cost” over time. That will ensure you have every cent of income so you can pay the bills and have plenty left over to enjoy life. Meanwhile, the growth potential of these picks will help grow your nest egg in retirement, which is essential should you ever need to pay for a big one-time expense, whether it’s an emergency or just buying a vacation home.

This all-star portfolio features the absolute best of several high-income assets, from preferred stocks to REITs to closed-end funds and more. That means diversification and continued payouts regardless of how volatile or bearish the stock market becomes.

Don’t let mediocre yields from uninspired, lazy stock picks ruin the retirement you’ve worked so hard to build. You deserve substantial, regular dividend checks that will let you see the world and live in comfort for the rest of your post-career life.

Let me show you the path to a no-worry retirement. Click here and I’ll provide you with THREE special reports that show you the path to building a “No Withdrawal” portfolio. You’ll get the names, tickers, buy prices and full analysis of their wealth-building potential!

Source: Contrarian Outlook