Penny stock investing is notoriously risky, which is why many investors are right to worry about penny stock scams. Without knowing what traps to look for, these penny stock scam companies can steal your hard-earned money.

Today, we’ve done the research for you so you can avoid these scams and safely invest in penny stocks.

You see, penny stocks are attractive because they can offer double-digit or even triple-digit returns in a very short time. For example, Cleveland BioLabs Inc. (Nasdaq: CBLI) skyrocketed from $1.56 at the Thursday, April 13, close to $5.10 on Wednesday, April 19.

[ad#Google Adsense 336×280-IA]That’s a stunning 227% return in just three sessions (the markets were closed that Friday).

And penny stock scammers try to take advantage of investors looking for those quick gains.

If they succeed, you could be left with huge losses.

This deceptive financial behavior is much more widespread than you may think.

A July 2014 report from The Wall Street Journal noted how the U.S. Securities and Exchange Commission (SEC) suspended trading for over 1,300 companies between 2012 and 2014 in an effort to crack down on penny stock fraud.

That’s why we’re going to show you three of the most egregious penny stock scams in recent years. While some of these investigations are still ongoing, the perpetrators of these scams are suspected of using shady tactics to manipulate stocks and cheat investors out of their hard-earned cash.

Here’s our list…

Exposed Penny Stock Scams No. 3: Cynk Technology Corp. (OTCMKTS: CYNK)

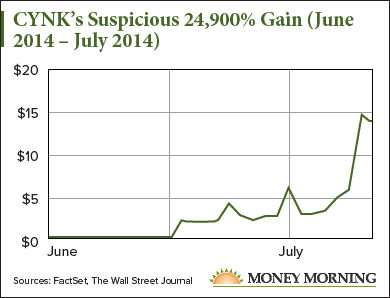

On June 17, 2014, shares of a social network company called Cynk Technology Corp. (OTCMKTS: CYNK) shot up 3,650% from $0.06 to $2.25. The price then rocketed another 567% to just under $15 a share by early July of that year. That gave it a total gain of roughly 24,900% from $0.06 to $15.

On June 17, 2014, shares of a social network company called Cynk Technology Corp. (OTCMKTS: CYNK) shot up 3,650% from $0.06 to $2.25. The price then rocketed another 567% to just under $15 a share by early July of that year. That gave it a total gain of roughly 24,900% from $0.06 to $15.

The meteoric rally gave the company a $6 billion valuation, which instantly put it on the radar of both the Justice Department and the SEC. After all, it’s highly unusual for a social network that no one’s heard of to suddenly be valued at more than $6 billion.

But by Sept. 11, 2014, shares had crashed to just $0.20. That was less than 1/100th of the peak $21.95 price in mid-July.

The probes into the penny stock’s dramatic rise and fall found that Cynk was essentially a shell company – it had zero revenue, zero assets, and only one official employee on record. It was used to orchestrate a $300 million pump-and-dump scheme that involved at least 100 investors.

The investigation was centered in Belize, where Cynk said it was headquartered. U.S. prosecutors conducted a sting operation in the country that led to the arrest of six Belizean residents. This group as well as one Canadian citizen were among those responsible for the penny stock scheme.

But the leader of the whole scheme was Gregg Mullholland, a California stock promoter who was arrested in June 2015. He allegedly set up the network of corrupt brokers in Belize to manipulate the value of CYNK stock for his own profits, which would then be wired to banks in the country. In May 2016, Mullholland pleaded guilty to money laundering conspiracy.

Penny stocks are known for posting monster returns. However, it always looks suspicious if a stock that doesn’t trade on an SEC-regulated exchange posts a one-month gain bigger than the S&P 500’s entire historical return of 2,315%.

Exposed Penny Stock Scams No. 2: Neuromama Ltd. (OTCMKTS: NERO)

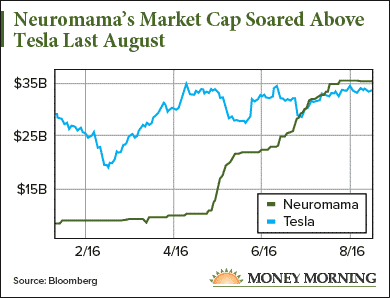

If the market cap of an obscure company with an unclear product suddenly zooms past that of Tesla Inc. (Nasdaq: TSLA), something shady is clearly going on.

If the market cap of an obscure company with an unclear product suddenly zooms past that of Tesla Inc. (Nasdaq: TSLA), something shady is clearly going on.

Shares of Neuromama Ltd. (OTCMKTS: NERO), which claims to make some sort of neural network-based search engine, soared 254% from $15.90 in April 2016 to $56.25 in August 2016.

While that price range technically disqualifies it as a “penny stock,” the big concern was the company’s explosive market cap. At $56.25 a share, Neuromama had a roughly $35.4 billion market cap – about 4.7% larger than Tesla’s then $33.8 billion market cap.

This was an obvious red flag for the SEC, which suspended trading for NERO stock on Aug. 15, 2016. The agency cited concerns over “potentially manipulative transactions” and the “identity of the persons in control” as reasons for the suspension.

But it was the business practices, or lack thereof, that were the biggest concern. The company had not reported any financials on its search product during the three years leading up to the trading halt. Even stranger was the company’s reported movement of operations from southwest Siberia to a town near Tijuana, Mexico.

According to a Fortune report, the leader behind the Neuromama stock manipulation was a man named Vladislav “Steven” Zubkis. The Ukraine native went by Steven Schwartzbard at Neuromama and controlled the shell companies that served as Neuromama’s financiers and advisory board.

But Zubkis’ history of deception extends back more than 20 years. In 1993, he was investigated by the National Association of Securities Dealers for brokering a firm called Jutland Enterprises. This firm owned two New York sandwich shops but was reportedly losing money at a rapid pace. However, Zubkis and other brokers said Jutland “was comparable to McDonald’s” and that the Jutland stock price would skyrocket.

While the investigation into Neuromama is still ongoing, it’s clear the scheme was the brainchild of a very experienced con man.

Exposed Penny Stock Scams No. 1: “Trump Magazine” and Premier Stock (OTCBB: PPBL)

President Trump was indirectly tied to a pump-and-dump penny stock scam that involved a short-lived publication bearing his name: “Trump Magazine.”

President Trump was indirectly tied to a pump-and-dump penny stock scam that involved a short-lived publication bearing his name: “Trump Magazine.”

In 2005, a company called Premiere Publishing Group was created to publish Trump Magazine.

The company paid over $850,000 in licensing fees to Donald Trump for producing the upscale men’s magazine originally meant to circulate only at Trump’s real estate properties.

However, Premiere CEO Michael Jacobson pushed for newsstands to sell it and eventually boosted quarterly circulation to 200,000.

Many people who worked for the magazine early on commented about Premiere Publishing’s financial troubles. Carey Purcell, who was hired in 2006 as a receptionist at the Trump Magazine offices, wrote in Politico about how many of her paychecks didn’t clear her bank. Premiere’s losses mounted due to the firm having to raise its licensing payments to Trump from $120,000 per issue in 2005 to $135,000 in 2006.

On Aug. 9, 2006, Premiere held an IPO and listed the stock on an over-the-counter exchange. Shares were sold to the public through several misleading practices meant to artificially raise the stock price. These included cold-calling and distributing newsletters falsely asserting that Premiere was readying a deal with Disney to produce a Trump cartoon. According to Fusion, one newsletter that hyped Premiere stock touted returns of “500% or even more.”

The first day of trading saw Premiere Publishing Group (OTCBB: PPBL) trade around $1 per share. By September 2006, the share price was nearly half that. The firm’s first quarterly filing in July 2007 showed that the company only had $735 in cash reserves. That sent the stock price crashing to mere pennies.

By August 2007, Trump ended his licensing agreement. Premiere then went bankrupt and had reportedly lost $7 million during its one year on the market. Meanwhile, any private investor who bought shares of the company lost big.

“[A very friendly broker] said he had something that was very good,” Wade Cartwright, a then 77-year-old doctor from California who bought $100,000 worth of stock after talking to a promoter, told Fusion. “I lost every cent.”

Despite these horror stories, not every cheaply traded company is a penny stock scam. There are several strategies for finding safe penny stocks that can hand you strong returns. And here at Money Morning, we’re dedicated to making sure you know how to spot unsafe investments and two-bit con artists.

That’s why we’ve developed these two rules that can help any investor figure out if a penny stock is fraudulent or trustworthy…

2 Rules You Must Follow to Find Safe Penny Stocks to Buy

Rule No. 1: Analyze the Executive Compensation Section of the 10-K Filing

One tip for penny stock investing is not placing faith in a company if the management doesn’t. And the easiest way to figure out if the higher-ups aren’t optimistic about the firm’s future performance is by reviewing the 10-K.

A 10-K report is an annual summary of a company’s financial performance. It includes the firm’s financial history, outstanding shares, organizational structure, and earnings per share.

But the most important aspect of a penny stock’s 10-K is the executive compensation. If you see that the CEO and other board members are paid with cash and don’t own any stock options, it suggests they’re trying to make as much money as possible before the company inevitably goes bankrupt.

Seeing how the company operates is paramount to determining if it’s worth your money. All you have to do is dig through the 10-K for answers.

Rule No. 2: Stay Away from Companies with Paid Promotions

Another huge sign that a penny stock is unsafe is its use of paid promotions like we saw with the Premier stock scandal. These deceptive advertisements can range from a brochure in the mail to a simple phone call to your house.

You see, promoters typically work in collusion with corporate insiders in “pump and dump” scams. That’s when they use slick and convincing copywriting to encourage unknowing investors to buy shares of the penny stock.

After the stock price soars, these promoters and insiders sell their shares at the inflated price. That gives them quick profits and causes the victims to lose most – if not all – of their investment.

A modern example of a pump-and-dump is the “misdialed” call scam. It’s when a stranger leaves a “hot” investment tip for a friend on their answering machine. The voicemail is meant to sound as if the speaker didn’t realize he or she called the wrong number. However, these strangers intentionally call the wrong number because they’re being paid to leave the messages.

If you follow these two rules, you’ll be on the right track to making safe and profitable investments in the penny stock sector.

— Alex McGuire

[ad#mmpress]

Source: Money Morning