Amazon.com (AMZN) is eating everything retail alive – including most retail REITs.

As a result, the entire sector is selling at fire prices – leaving us with a select handful of underappreciated bargains.

[ad#Google Adsense 336×280-IA]Why the panic?

Amazon has completely transformed retail over the past decade or so, starting with books, but expanding into just about every corner of the traditional retail market – clothes, electronics, home goods and even staples like toilet paper and laundry detergent.

The company gobbled up $98 billion in “electronics and other general merchandise” sales across all of 2016 – an expansion of nearly 30% that shows Amazon’s growth in e-tailing is still rampant.

So, as you sell your retail-related dividends, don’t forget to ditch their landlords. As more storefronts shut down, REITs that lease retail space are getting clobbered.

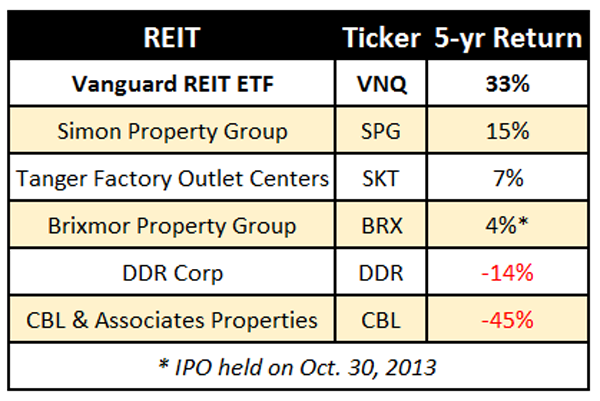

The Vanguard REIT ETF (VNQ) – a broad collection of REITs that spans commercial, residential, industrial, healthcare and other types of real estate – has advanced 33% in the past year or so (excluding dividends). Compare that to some of the bigger names in retail real estate:

But this panic has created a few select bargains. Not all retail space will be gobbled up by Jeff Bezos & Co, after all – but all retail REITs are trading like their days are numbered. Here are three “Amazon-proof” firms that will continue growing their dividends in the years ahead.

Realty Income (O)

Dividend Yield: 4.1%

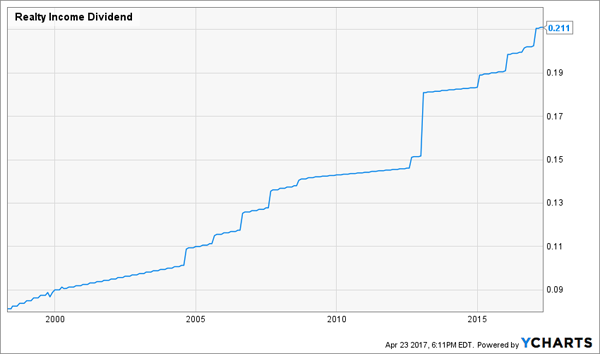

We all know Realty Income (O) as the self-proclaimed “Monthly Dividend Company” – a moniker it deserves given its 561-month streak of uninterrupted dividends and 78 consecutive quarterly payout increases.

While most retail REITs have mostly been pounded into the dirt over the past few years, Realty Income has remained a low-risk winner. Even after a pronounced dip in late 2016, O shares have advanced nearly 60% — roughly double the VNQ – without even factoring in its monthly dividends.

The key to Realty Income’s resilience is its portfolio. Realty Income boasts more than 4,900 commercial properties across more than 30 retail industries, as well as non-retail industries including healthcare, machinery and packaging. It’s geographically diverse, too, with no one state delivering 10% or more of the company’s total revenues. And its top tenants include plenty of retailers that have nothing to fear from Amazon – drugstores like Walgreens (WBA) and CVS Health (CVS), theaters like Regal Cinemas (RGC) and AMC Theaters (AMC), and even gyms like LA Fitness and Life Time Fitness.

For as bad as the retail environment is, Realty Income still boasts 98%-plus occupancy. O shares are and will continue to be a solid performer, regardless of Amazon.

The “Monthly Dividend Company” Is a Relentless Dividend Raiser

Getty Realty (GTY)

Dividend Yield: 4.2%

Getty Realty (GTY) owns convenience store and gas station properties, and leases them out to a host of operators including BP (BP) and Exxon Mobil (XOM). And it’s a survivor.

Back in 2011, one of its biggest customers – Getty Petroleum – went bankrupt amid mounting oil cleanup costs, forcing GTY to suspend its dividend amid a great deal of uncertainty. However, Getty Realty repossessed the gas stations it leased out to Getty Petroleum, then began to lease those out to several other operators. Since then, the company has been transforming and expanding, now spanning 829 properties across 23 states and Washington, D.C.

At first blush, Getty might seem exactly like the kind of REIT Amazon would eat away at indirectly. After all, if more people are shopping online, fewer people are going out, so there’s less need for gas … and Getty’s tenants would suffer.

But it hasn’t played out that way at all. Low gas prices have not only attracted drivers, but driven up sales in their convenience-store operations, which boast far better margins than fuel sales. Meanwhile, Getty has provided a solid string of top- and bottom-line growth that has pushed shares more than 70% higher over the past five years.

GTY might not be the best play if oil prices skyrocket once more, but it has very little to fear from Amazon.

Getty Realty (GTY) Has Recovered, And Now It’s Roaring!

EPR Properties (EPR)

Dividend Yield: 5.4%

EPR Properties (EPR) is an expert in Amazon dodgeball because it simply doesn’t go head-to-head with any of Amazon’s current retail operations. Instead, it owns a number of entertainment-, recreation- and even education-centric properties.

EPR has a brilliant property mix that includes 149 megaplex theaters, 25 “golf entertainment complexes” – through partner TopGolf, which revolutionized driving ranges by incorporating skill games and upscale bars – and 67 public charter schools (which should benefit under Trump education pick Betsy DeVos). The company refers to itself as a “diversified specialist,” and it’s right.

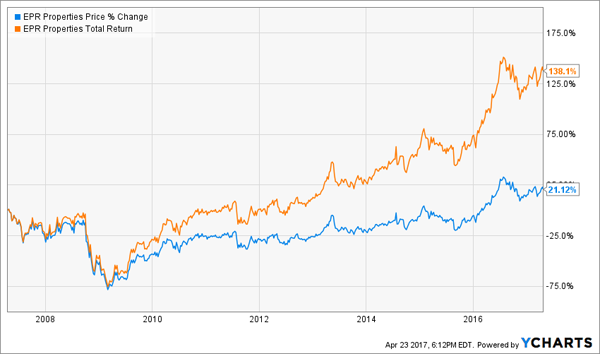

As a result, EPR has grown like a weed. Shares are up 60% over the past five years, thanks in large part to a 30% bottom-line expansion since 2013 alone – and a similar boost to the monthly payout over the same time! Add in the fact that EPR’s tenants aren’t even on Amazon’s radar, and you have one of the best plays in retail real estate.

EPR Properties (EPR) Doesn’t Look Like a Stock With Amazon Problems

— Brett Owens

The Retirement Portfolio You NEVER Have to “Sell” for Money [sponsor]

I only have one issue with these Amazon-proof stocks: They don’t yield enough right now.

When you’re investing for retirement, you need the capital-gains potential and dividend growth of these three stocks, but you also need big, absolute yield. In short, you need the kinds of “triple-threat” dividend stocks you’ll find in my “No Withdrawal” retirement portfolio.

These stocks weren’t easy to discover. In fact, I had to spend months researching hundreds of REITs, BDCs and other stocks looking for ultimate dividend plays that deliver everything we need to build a successful retirement portfolio … and I had to weed out numerous yield traps and value traps. But the effort was worth it, because it resulted in this can’t miss portfolio featuring:

- No-doubt 6%, 7% even 8% yields – and in a couple of cases, double-digit dividends!

- The potential for 7% to 15% in annual capital gains

- Robust dividend growth that will keep up with (and beat) inflation

All of these elements are critical for retirement holdings, because it allows you to live off income alone while actually growing your nest egg.

Most pundits that talk about so-called “retirement stocks” will point you in the direction of no-growth blue chips that yield 3%, maybe 4% if you’re lucky. But if you do the math, you won’t like what you see. Think about it: Even if you’ve saved up $500,000 for retirement, 4% annually is just $20,000 a year. You and I both know that even with Social Security tucked in there, that’s not a comfortable retirement.

The 8% average yield on my “No Withdrawal” portfolio – as well as the dividend growth that will yield to double-digit yields on cost over time – will ensure you have all the income you need to pay the bills (and then some). Meanwhile, the growth potential of these picks will help grow your nest egg in retirement, which is essential should you ever need to pay for a big one-time expense, whether it’s an emergency or just buying a vacation home.

This all-star portfolio features the very best of several high-income assets, from preferred stocks to REITs to closed-end funds and more. That means diversification and continued payouts regardless of how volatile or bearish the stock market becomes.

Don’t let mediocre yields from uninspired, lazy stock picks ruin the retirement you’ve worked so hard to build. You deserve substantial, regular dividend checks that will let you see the world and live in comfort for the rest of your post-career life.

Let me show you the path to a no-worry retirement. Click here and I’ll provide you with THREE special reports that show you the path to building a “No Withdrawal” portfolio. You’ll get the names, tickers, buy prices and full analysis of their wealth-building potential!

Source: Contrarian Outlook