With gold reaching five-month highs, it does appear that it is time to take another look at gold shares – specifically this gold mining stock favorite of ours.

Shares of companies that mine – and more importantly own – supplies of new gold do well when gold and other precious metals are on the move higher.

Shares of companies that mine – and more importantly own – supplies of new gold do well when gold and other precious metals are on the move higher.

Production expands to meet new, higher demand and profits rise, as well.

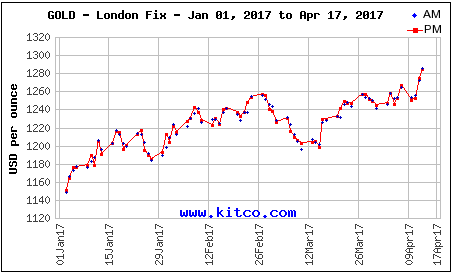

Indeed, gold is now trading more than 14% above its November 2016 low of $1,124.30 per troy ounce.

Putting that into context, it also means that gold has already reclaimed half of its losses suffered from last year’s peak. That is a market on the move!

There are many factors influencing the price of gold.

They include inflation, the trend in interest rates, and the strength in competing assets such as stocks.

[ad#Google Adsense 336×280-IA]Gold is often used as a safe haven to protect investors from times of market volatility and rising interest rates such as we see right now.

Most buyers treat gold as a long-term hedge rather than a short-term profit opportunity.

After all, when interest rates move higher, businesses tend to borrow less and expansion is scaled back.

Stocks that are priced to perfection become vulnerable to declines, and bonds, because they move in the opposite direction to interest rates, lose value.

Where is an investor to hide? Cash under the mattress still pays virtually nothing, as the Fed is still only beginning to raise short-term rates. The interest rate on risk-free, short-term U.S. Treasury Bills is barely above .5%. That is one half of one percent! That does not even cover the current U.S. inflation rate at 2.5%.

While gold does not pay interest or a dividend, it does not lose value as inflation and interest rates rise. In fact, inflation makes gold look more attractive, and that means investor demand for gold will rise.

That’s good for gold mining stocks.

The question is which gold mining stocks are the best.

Money Morning Executive Editor Bill Patalon – whose Private Briefing investment service regularly serves up new double- and triple-digit gainers – answered that question for readers recently.

Why This Is Our Favorite Gold Mining Stock

He thinks Canadian heavyweight Goldcorp Inc. (NYSE: GG) is well positioned to profit.

Patalon believes that the company is doing all the right things to facilitate strong growth.

Last July, Goldcorp grabbed Kaminak Gold Corp. for $373 million.

And then in March, Goldcorp completed a $4.75 million “private placement” deal with Triumph Gold Corp. (CVE: TIG), which gives Goldcorp 19.9% of Triumph.

And it partnered with another Canadian gold mining heavyweight, Barrick Gold Corp. (NYSE: ABX), in a gold and copper deposit in Chile.

To be sure, the deal with Barrick is a complex affair and the market did not respond – at least not yet. Patalon sees this as a long-term plan to slash costs and, over the long haul, generate a better return.

As you can see, Goldcorp is being aggressive and thinking long term.

While Goldcorp’s stock price seems to be on hold this year, there are interesting clues generated by the market itself why the $14-$16 level is a price floor. Stocks, as with anything people buy, are influenced by supply and demand. Investors might analyze the company and decide it is cheap. Their actions create demand, and when demand exceeds supply – shares for sale, in this case – prices tend to rise.

Over the past two decades, Goldcorp, along with the gold mining sector and the broad market itself, has seen its share of ups and downs. Yet, one fact remains – when the price falls to the $14-$16 area, buying interest picks up.

We saw it in 2004-2005 just before the stock tripled in price.

We saw it in 2008 after the commodities meltdown. That time the stock nearly quadrupled.

And now after years of general weakness in gold mining stocks, it seems as if Goldcorp is once again finding buyers at this price level.

Analysts right now have a $28 target price on the stock – nearly double what it’s currently trading for. Looking for a triple or quadruple in price this time seems overly optimistic, but a double is still pretty good.

Grabbing a stake in Goldcorp at this level is a good deal. But Patalon advises investors hold back some cash. If U.S. stocks keep advancing (before any “bad surprises” try to wreck our landing), you may get to add to your stake at lower levels – averaging down to lower your overall purchase price.

— Money Morning Staff

[ad#mmpress]

Source: Money Morning