I will cut right to it today…

The last time we saw this setup, emerging market stocks soared 400%, crushing the returns on U.S. stocks.

[ad#Google Adsense 336×280-IA]Now, we’re seeing this setup again.

And I expect history will repeat – and emerging market stocks will dramatically outperform U.S. stocks in the next few years.

Let me explain what’s going on…

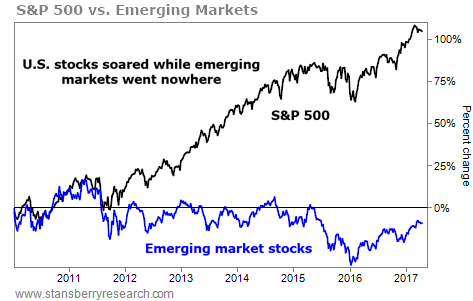

Emerging market stocks have massively underperformed U.S. stocks – for a very long time…

Stocks in the U.S. have soared in the last seven years.

Meanwhile, stocks in emerging markets have literally gone nowhere.

Look at the chart below, and you’ll see what I mean:

In seven years, U.S. stocks have more than doubled… while emerging markets stayed flat.

In seven years, U.S. stocks have more than doubled… while emerging markets stayed flat.

We’ve seen this type of dramatic underperformance before. The last time emerging markets underperformed for at least four consecutive years was 1995 through 1998. You can guess what happened next…

Emerging markets went up 64% in 1999. They went on to soar by more than 400% during the mid-2000s… And they outperformed the U.S. market for 10 of the next 12 years.

Could we see a similar path today? Absolutely. It’s already happening…

Emerging market stocks have outperformed U.S. stocks by 11 percentage points since their January 2016 bottom.

That outperformance over the last year isn’t a full reversal of the past five-plus years… But it’s a start.

That outperformance over the last year isn’t a full reversal of the past five-plus years… But it’s a start.

If you’re a longtime reader, then you know that’s exactly what I want to see – the start of an uptrend.

In short, buying emerging markets after years of underperformance has led to incredible returns in the past. I expect we will see incredible returns from emerging markets again, starting right now…

I urge you to take advantage of it!

Good investing,

Steve

[ad#stansberry-ps]

Source: Daily Wealth