Business Development Companies (BDCs) have a lot in common with closed-end funds, or CEFs. However, investors need to take a very different approach to the basic evaluation of these two types of high-yield investments. While a share price discount to net asset value (NAV) can be a positive with a quality CEF, when you see a BDC trading at a discount to NAV, view that as a very strong negative and a reason to avoid or sell the stock.

Business development companies make up a small stock market sector operating under a highly specific structure and tax rules. The business development company type was created by Congress to facilitate the availability of debt and equity capital for growing small to mid-size corporations.

[ad#Google Adsense 336×280-IA]To stay within its legal limits, a BDC will only provide capital to corporations that are too small to be able to tap into the public debt and equity markets.

The large majority of BDC business is making loans to client companies.

A BDC may also get a small equity stake in those clients, but you can view the BDC sector as a group of commercial lenders.

The biggest problem with the BDC business structure and the BDC rules is that one of these companies is not allowed to set aside bad loan reserves.

By rules, a BDC must pay out over 90% of net income as dividends to investors.

A regular bank can retain earnings against loans that don’t get paid back; where as a BDC cannot.

This problem is compounded by the fact that BDCs make riskier loans. Their clients are the companies that cannot get regular commercial loans from banks. The facts of riskier loans and no loan loss reserves leads to the unavoidable fact that a BDC will have an unavoidable book value or NAV erosion from the percentage of loans that don’t get repaid. On average 4% to 5% of the lending amount in the BDC universe will end up in default. In a recession, that percentage will go significantly higher.

A BDC counteracts the inevitable NAV erosion by steadily growing its book of loans. A BDC can never stand still. If it is not trying to grow, it will have a shrinking portfolio. That growth requires additional capital.

Another BDC rule limits the amount of debt a company can carry to be no more than one times the equity. This rule means that to fund growth, a BDC must regularly issue new shares of common stock. This is where the market share price vs. NAV becomes an issue.

If the stock price of a BDC is trading at a discount, it will receive less money if new shares are issued.

If the stock price of a BDC is trading at a discount, it will receive less money if new shares are issued.

In fact, the charters of many BDCs do not allow management to sell shares at a discount.

This could keep a BDC from growing, and we now know that if it’s not growing it will be fading away, continuing to lose book value and the share price will fall even farther.

On the flip side, if a BDC stock is trading at a premium to book value, the company gets an automatic NAV boost when new shares are sold.

For example, if the stock is at a 20% premium to NAV, the company would get $1.2 million in cash when it sells $1 million in NAV of new shares.

Here are three popular BDCs that currently trade at significant discounts to their NAVs. Avoid or sell these stocks:

• Medley Capital Corp(NYSE: MCC) has a market cap of $416 million and currently yields 11.4%. The MCC share price is trading at an 18% discount to NAV.

• PennantPark Investment Corp.(Nasdaq: PNNT) has a market value of $580 million and yields 8.9%. PNNT trades at an 11% discount to NAV.

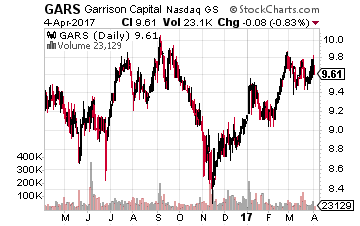

• Small cap BDC Garrison Capital Inc. (Nasdaq: GARS) yields 11.5%. This company has a market cap of $150 million. The GARS market price currently is worth 21% less than the NAV per share.

These discounted BDCs have small market values due to the fact the businesses are just shrinking away. If you want to own some BDC shares for the attractive dividend yields consider these three which all trade at premiums to the per share NAVs.

• Triangle Capital Corporation (NYSE: TCAP) yields 9.5% and has a $760 million market value. The TCAP share price is at a 26% premium to NAV.

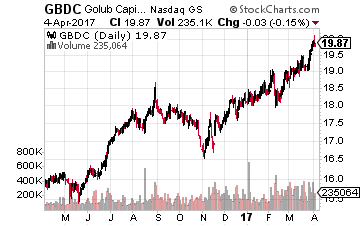

• Golub Capital BDC Inc. (Nasdaq: GBDC) has a $1.1 billion market value and yields 6.5%. GBDC shares are also worth a 26% premium to NAV.

• Hercules Capital, Inc. (Nasdaq: THTGC) yields 8.2% and has a $1.25 billion market value. HTGC is currently trading at a 53% premium to its per share NAV.

Owning high-yield stocks with secure cash flow streams like the three BDCs above allows me and my subscribers to stop worrying about the daily gyrations of the stock market because we earn consistent returns, paid in the form of cash.

Owning high-yield stocks with secure cash flow streams like the three BDCs above allows me and my subscribers to stop worrying about the daily gyrations of the stock market because we earn consistent returns, paid in the form of cash.

It’s so easy, all you have to do is buy shares in the stocks that I recommend and research and watch as they deposit money into your brokerage account multiple times a year.

— Tim Plaehn

Sponsored Link: My subscribers and I regularly collect big dividend payments that give us financial certainty in an uncertain world, and only the most financially secure high-yield income stocks make it onto the recommendation list for my newsletter, The Dividend Hunter.

Right now, there are over 20 high-yield stocks available through my Monthly Dividend Paycheck Calendar, a system for generating a recurring monthly income stream from the market’s most stable high-yield stocks.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 6 paychecks every month and in some months up to 14 paychecks from reliable high-yield stocks built to last a lifetime.

This unique tool will set you up to receive a more predictable dividend stock income stream that you can count on every month instead of just once a quarter like most other investors. Joining my calendar by Friday, April 14th will give you the opportunity to claim an extra $1,671 in dividend payouts by April 28th.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you can make from these low-risk, buy and hold stocks paying upwards of 12%, 13%, even 18%. I’ve done all the research and hard work, you just have to pick the stocks and how much you want to get paid.

The next critical date is Friday, April 14th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $1,671 in payouts by April 28th, but only if you’re on the list before April 14th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Source: Investors Alley