It’s tough to like anything about the government these days.

Bureaucrats squander our money and get on their soapboxes about their fake morals… It’s enough to make anyone scream.

But there is one good thing about the government…

[ad#Google Adsense 336×280-IA]It generally pays its bills.

And that’s good news for Government Properties Income Trust (Nasdaq: GOV), a real estate investment trust that rents office space to federal, state and local governments.

It’s a popular stock thanks to its 8%-plus yield.

I last looked at it in August of 2015, and at that time, it received a B for dividend safety.

The company’s first dividend was $0.50 per share in November 2009. Its next dividend was $0.40 per share.

After that, it raised its payout by a penny per share three times. And it’s paid a $0.43 per share quarterly dividend since 2012.

Unlike its renters, Government Properties Income Trust is responsible with other people’s money. It doesn’t spend more than it can afford.

In 2016, the company paid $1.72 per share in dividends. Funds from operations (FFO), a measure of cash flow for REITs, was $2.35.

This year, FFO is projected to dip to $2.30 per share, still more than enough to pay the $1.72 in dividends.

SafetyNet Pro penalizes companies when cash flow is projected to drop.

SafetyNet Pro penalizes companies when cash flow is projected to drop.

But that’s the only ding on this company’s dividend safety record.

Its 74% payout ratio is low enough that I’m comfortable a dividend cut isn’t coming.

Its 74% payout ratio is low enough that I’m comfortable a dividend cut isn’t coming.

But if its FFO dips below $2.30, its payout ratio will be more than 75%, and the stock will be downgraded.

If FFO falls again next year, that’d be another problem.

The stock could see a big downgrade and its dividend considered unsafe.

But given its track record of a stable dividend and FFO growth, it likely has a year until its dividend safety grade will be reconsidered.

For now, there’s a low chance of a cut in the near future.

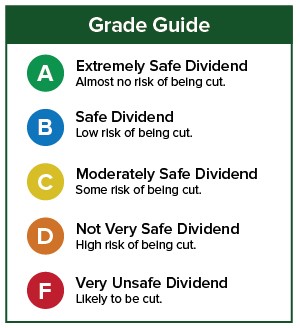

Dividend Safety Rating: B

Good investing,

Marc

[ad#wyatt-income]

Source: Wealthy Retirement