Inflation is classically defined as an increase in the money supply, but today, even most economists use the term to describe the effect of inflation: a general rise in prices.

On that basis, it’s becoming impossible to deny that inflation, an insidious tax on your wealth, is back… bigly.

In fact, the U.S. government is telegraphing, loud and clear, massive spikes in inflation ahead.

[ad#Google Adsense 336×280-IA]As you’ll see in a moment, there’s likely no stopping it, but you don’t have to take it lying down, either – not with the “stock-and-a-kicker” play I’m going to recommend…

This Could Make QE 1, 2, and 3 Look Like Peanuts

Trump has promised to cut taxes, in his words, “massively.”

On his first full day on the job, he told 12 executives from America’s largest businesses that tax rates would tumble from 35% down to 15% to 20%.

That’s not all. He’s promised to cut taxes for the middle class, all while simplifying the tax code.

But what he hasn’t said is how he’ll make up for that considerable lost revenue.

Treasury Secretary Mnuchin recently confirmed that Trump’s first budget would not bring cuts to big entitlement programs like Social Security, Medicare, or Medicaid.

And true to his unconventional form, the president has talked down the U.S. dollar, saying it was not in America’s interest to have such a strong currency.

So, you don’t have to be a Nobel prize-winning economist to conclude that Trump has just three options to pay for a growing deficit: printing, printing, and more printing.

The money supply is all but totally certain to get a huge boost from the “Gutenberg,” and so inflation is all but inevitable.

And it has been for some time now.

As soon as Trump was declared victor in November 2016, inflation expectations spiked. Five-year forward inflation zoomed from 1.85% to 2.05% virtually overnight. Trump’s promises to create or bring back American jobs by dropping trade agreements, slapping tariffs on imports, and calling out China as a currency manipulator “did the job.”

It’s clear those promises resonated with voters; producing more stuff “at home” sounds warm and fuzzy, and it’s supposed to mean more jobs.

But this is the 21st century. A lot of domestic production just can’t compete with lower wages and cheap-to-nonexistent benefits offshore. So even if that helps create jobs, the stuff they make is going to cost more.

Then let’s see how easily the newly employed can afford what they produce.

As for imports, slapping duties and tariffs on them is also going to boost their prices, perhaps as much as 35% on Mexican imports and 45% on Chinese imports.

It’s going to take a lot more than a (quasi-mythical) manufacturing job to make up the difference.

Signs of inflation are moving forward on all fronts, in some of the world’s biggest, most important economies.

Worldwide Price Spikes Are at Consistent, Multiyear Highs

Producer price indices (PPIs) of some of the world’s largest producing economies have jumped over the last several months.

Those include the United States, China, Germany, Japan, and South Korea. Their PPIs have been trending distinctly higher. The key takeaway from this is that PPIs are leading indicators which typically signal the direction of consumer prices.

In Germany, consumer price inflation was up more than double from November to December, providing the largest monthly increase ever recorded. Across the European Union, consumer prices have been coming in higher than expected, in fact the highest in four years.

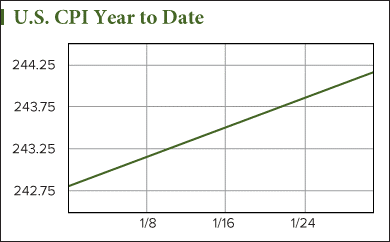

In the United States, we’re getting similar data, of course. The Consumer Price Index (CPI) was ahead 0.6% in January, providing the largest monthly increase in almost four years. U.S. CPI inflation has reached an annualized 2.5%, the highest since 2012.

In the United States, we’re getting similar data, of course. The Consumer Price Index (CPI) was ahead 0.6% in January, providing the largest monthly increase in almost four years. U.S. CPI inflation has reached an annualized 2.5%, the highest since 2012.

We know the Fed tracks a similar indicator called the Personal Consumption Expenditures (PCE) index, which despite its lag to the CPI, does follow it closely. The PCE popped by 0.4% in January, now printing at 1.9% annually.

The market is now setting odds of March rate hike at or close to 100%. The rate hike is priced in, but we should read this as confirmation that inflation is heating up.

And the best inflation hedge out there is largely doing the opposite of what the crowd expected… and that’s extremely bullish.

Gold Has a Strong Basis for Running (Much) Higher

The Fed raised rates in December 2015, and gold went up. The Fed raised rates again in December 2016, and gold went up again.

Despite some recent weakness, which seems to be abating as of the end of last week, it’s undeniable that, by and large, gold’s been rising in the face of rising interest rates and a rising dollar. The dollar’s been rising as well, thanks in part to a bullish market outlook on the economy in the wake of Trump’s pro-business stance. Of course expected rate hikes are also bolstering the greenback.

That’s as bullish as it gets.

What’s more, I don’t think the Fed can continue to raise rates in a sustained way; of course it won’t risk jeopardizing an economy that finally seems to be turning around.

And the U.S. Dollar Index (DXY) might be steady at close to 102, but I don’t think it has a proverbial “snowball’s chance” of staying that high with Trump bound and determined to devalue it and then debase it.

This is all the support gold needs to run considerably higher.

Here’s a low-risk, high-upside, income-paying way to play it…

This “Un-Miner” Should Lap Inflation in 2017

Franco Nevada Corp. (NYSE: FNV) is a leading gold-focused royalty and streaming company. Based in Toronto, the company has 340 mining properties which are in varying stages of production.

Thanks to its business model, Franco Nevada bears no operational risks related to exploration, permitting, development, or mining. Instead, the company funds miners in return for a stream of their future output at a highly discounted price.

So Franco – and anyone savvy enough to own it – gets to ride all the upside of the sector with limited risk.

In fact, the company’s costs are so low, it can remain profitable even in a falling metals price environment. Revenue sources are about 66% gold, 21% silver, 7% platinum group metals, 5% oil and gas, and 1% other.

Debt-free Franco Nevada has about $1.4 billion of available capital that can be put to work in opportunities management identifies. The $11 billion company has been consistently paying dividends and has faithfully increased those for nine consecutive years since going public.

As of today, that dividend is a respectable 1.39%.

But folks who buy by the ex-dividend date of March 14 get put on the record books by March 16, so they’ll be in line to collect 1.43% – $0.22 per share – on March 30.

That alone puts the stock well on track to beat inflation this year, but it gets better.

Though it’s not the main reason to buy Franco, the stock also has strong upside potential thanks to its exposure to exploration and expansion. Discoveries and eventual production on properties in which Franco has an interest can boost future revenue considerably.

In the meantime, by owning Franco-Nevada, you get great exposure to gold’s inflation-busting benefits, a large and growing dividend, and a possible kicker as precious metals move deeper into their secular bull market.

— Peter Krauth

[ad#mmpress]

Source: Money Morning