It’s no surprise right now that the brick and mortar stores are on their last legs – all you have to do is follow the endless stream of upcoming store closures to know that.

[ad#Google Adsense 336×280-IA]The real problem is that the media heads are scaring everyone into thinking they need to dump their retail stocks.

But not all retailers are suffering…

Now last month, I told you why home improvement stores are faring better than others. I also told you that Home Depot (HD) is the best home improvement stock to buy.

And today, I’m going to show you exactly how you can make an easy 100% on this stock – no matter how bad the rest of the sector gets.

Using the Fastest-Growing Moneymaker in the World to Play Home Depot

The Consumer Discret Sel Sect SPDR ETF (XLY) is often the go-to ETF to measure how retail and related consumer stocks are performing. This means that home builders are lumped into it, even though they aren’t the heaviest weighted stocks. But although the retail sector is bearish overall, retailers of home improvement goods are actually doing quite well. And as I mentioned, Home Depot (HD) is doing particularly well.

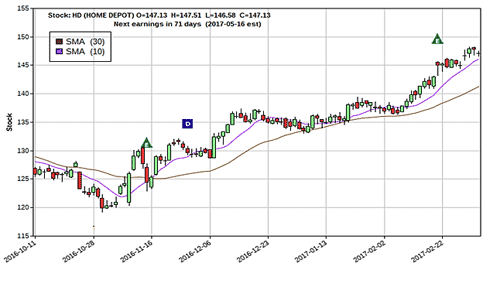

HD already reported strong earnings per share (eps) and revenue numbers, with its latest eps at $1.44 on revenue of $22.2 billion (consensus estimates were for an eps of $1.33 on a revenue of $21.7 billion). Take a look at its steady upward price movement since last October:

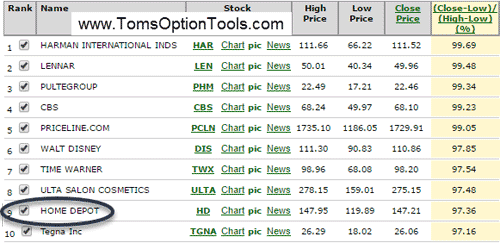

And now, it’s among the top 10 consumer discretionary stocks near their 52-week highs…

Now when it comes to capturing profits, long calls or debit call spreads is the quickets and easiest way to go.

Based on the price patterns I’m seeing, HD typically moves higher heading into May, as spring cleaning and home improvement projects take front and center with many people. Therefore at-the-money call spreads, with May expirations could be your best bet right now (such as the HD May $145-$150 call spread). Not only is the cost low to get in – it’s also currently priced in a way that could deliver you an easy double.

To your continued success…

Tom Gentile

[ad#mmpress]

Source: Power Profit Trades