Last week, I reviewed a real estate investment trust with a modest 3.4% yield and declared its dividend unsafe.

I was a bit surprised when I first looked at the company. REITs typically have higher yields than regular stocks. Often, a REIT with a lower yield suggests safety.

[ad#Google Adsense 336×280-IA]However, due to deteriorating cash flow and a recent dividend cut, the company garnered an F rating.

While low yields typically suggest safety, extremely high yields usually mean the dividend is likely unsustainable.

But that’s not so with the subject of this week’s Safety Net column.

New Residential Investment Corp. (NYSE: NRZ) is a mortgage REIT.

It borrows money in the short term and invests in longer-term mortgages.

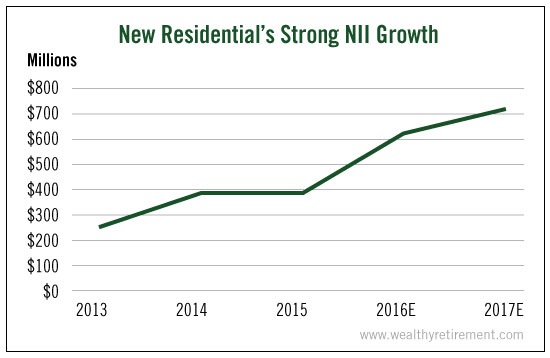

The key metric used to evaluate a mortgage REIT’s performance is net interest income (NII). It’s the difference between the interest it pays and the interest it takes in.

And New Residential’s NII growth has been terrific. Its NII more than doubled between 2013 and 2016.

This year, the company is expected to pay out just 59% of its NII in the form of dividends.

This year, the company is expected to pay out just 59% of its NII in the form of dividends.

This gives us a buffer against down years in the future. If NII were to fall and dividends do not make up a large percentage of NII, the company should be able to sustain the dividend without a cut.

New Residential Investment has a short but strong track record of paying dividends. On a yearly basis, it hasn’t lowered its payout.

I emphasize yearly because when it first started paying dividends in 2013 and early 2014, it paid a higher dividend in two quarters and a lower dividend in the next two.

I emphasize yearly because when it first started paying dividends in 2013 and early 2014, it paid a higher dividend in two quarters and a lower dividend in the next two.

However, it abandoned that policy for a more consistent dividend, which (on a yearly basis) has not declined.

The company pays an 11.5% yield. And with its rising NII, a low percentage being paid back to shareholders and a solid track record, I see no reason why investors should be overly concerned about the safety of New Residential Investment’s dividend.

The only reason the company doesn’t get SafetyNet Pro’s highest rating is because its track record is too short.

Dividend Safety Rating: B

Good investing,

Marc

[ad#wyatt-income]

Source: Wealthy Retirement